Payroll compliance is one of the most critical tasks for businesses at the start of every year. If you use QuickBooks for payroll, understanding how to Print Your W-2 and W-3 Forms in QuickBooks correctly can save you time, money, and compliance headaches.

Learn how to print W-2 & W-3 forms in QuickBooks 2026 easily. Step-by-step guide for Desktop & Online. Call +1(866)500-0076 for help.

In this 2026 guide, we’ll walk you through everything you need to know—from preparation to printing—covering both Desktop and Online versions. Whether you’re a small business owner or an accountant, this guide ensures smooth and accurate filing.

What Are W-2 and W-3 Forms?

Before jumping into steps, let’s quickly clarify their purpose:

- W-2 Form: Reports wages paid to employees and the taxes withheld during the year.

- W-3 Form: A summary form that totals all W-2 forms and is submitted to the Social Security Administration (SSA).

QuickBooks simplifies this process, making it easy to Print Your W-2 and W-3 Forms without manual calculations.

Why Print W-2 & W-3 Forms in QuickBooks 2026?

Using QuickBooks for payroll forms offers several advantages:

- Automatic tax calculations

- Reduced data entry errors

- Easy access to employee payroll records

- Compliance with updated 2026 payroll rules

Most importantly, you can Print Your W-2 and W-3 Forms in QuickBooks directly, ensuring accurate and professional results.

Before You Print: Important Checklist

Before printing, make sure you’ve completed these steps:

- Verify employee names, SSNs, and addresses

- Confirm company EIN and business address

- Ensure payroll is updated for 2026

- Reconcile payroll accounts

- Install the latest QuickBooks updates

Completing this checklist prevents errors when you Print Your W-2 and W-3 Forms in QuickBooks Desktop or Online.

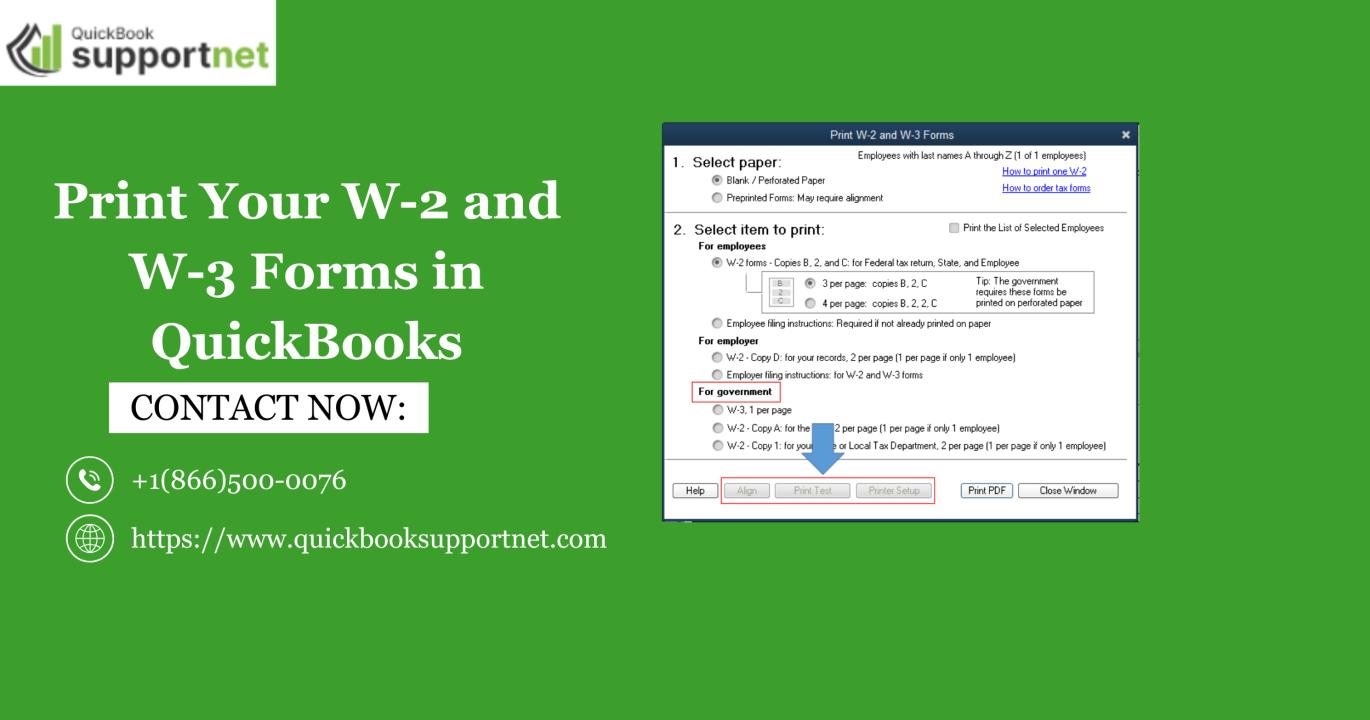

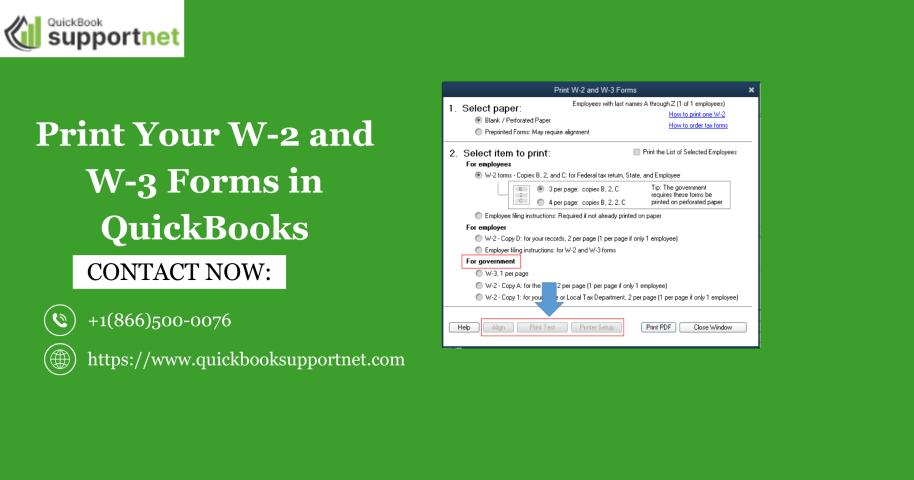

How to Print W-2 & W-3 Forms in QuickBooks Desktop (2026)

Follow these steps to Print Your W-2 and W-3 Forms in QuickBooks Desktop:

Step-by-Step Instructions

- Open QuickBooks Desktop

- Go to Employees > Payroll Tax Forms & W-2s

- Select Process Payroll Forms

- Choose Annual Form W-2/W-3 – Wage and Tax Statement

- Click Create Form

- Review employee details carefully

- Select Print Forms

- Choose paper type (pre-printed or blank)

- Click Print

QuickBooks automatically generates the W-3 summary when you print W-2 forms.

How to Print W-2 & W-3 Forms in QuickBooks Online (2026)

If you’re using QuickBooks Online, the process is slightly different. Here’s how to Print Your W-2 and W-3 Forms in QuickBooks Online:

Printing Steps

- Sign in to QuickBooks Online

- Go to Payroll > Taxes

- Select Forms

- Choose Annual Forms

- Click W-2s

- Select View or Print

- Download the PDF and print

For businesses asking how to print w3 form quickbooks online, note that W-3 is included automatically when filing or printing W-2s.

Desktop vs Online: Which Is Better for Printing Forms?

| Feature | Desktop | Online |

|---|---|---|

| Manual control | Yes | Limited |

| PDF download | Optional | Yes |

| Printing flexibility | High | Moderate |

| Auto updates | Manual | Automatic |

Both versions allow you to Print Your W-2 and W-3 Forms, but Desktop offers more customization, while Online is simpler and cloud-based.

Common Errors to Avoid When Printing W-2 & W-3

Avoid these mistakes to ensure accurate filing:

- Incorrect employee SSNs

- Wrong tax year selected

- Using outdated QuickBooks versions

- Printing on incorrect paper type

- Missing employer identification details

Double-check everything before you Print Your W-2 and W-3 Forms in QuickBooks to prevent penalties.

Tips for Accurate W-2 & W-3 Printing in 2026

- Always preview forms before printing

- Use blank paper for flexibility

- Keep digital copies for records

- File electronically if possible

- Contact QuickBooks support if errors appear

For expert assistance, you can also call +1(866)500-0076.

Conclusion

Printing payroll forms doesn’t have to be complicated. With the right preparation and steps, you can confidently Print Your W-2 and W-3 Forms in QuickBooks for 2026. Whether you use Desktop or Online, QuickBooks streamlines payroll compliance and saves valuable time.

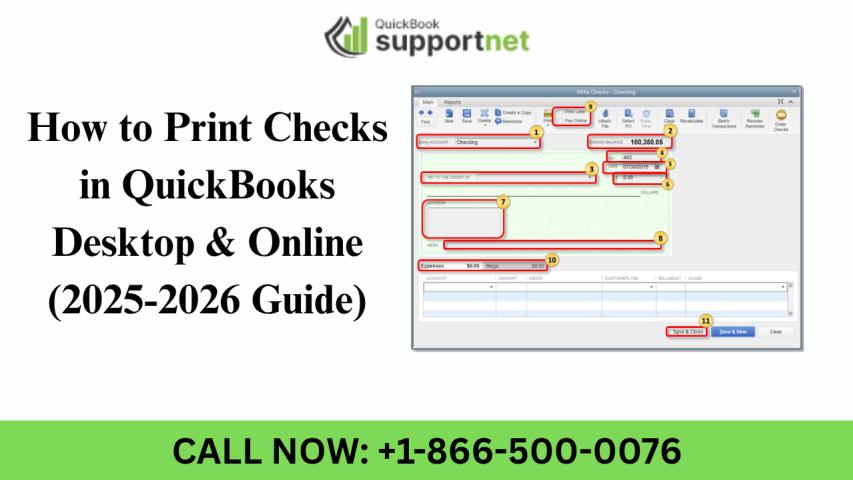

In addition to W-2 and W-3 forms, QuickBooks also supports other essential filings such as QuickBooks Form 940, making it a complete payroll solution for businesses of all sizes.

FAQs

1. Can I reprint W-2 and W-3 forms in QuickBooks?

Yes, QuickBooks allows you to reprint forms anytime from the Payroll Forms section.

2. Does QuickBooks Online include the W-3 form?

Yes, when you print or file W-2s, the W-3 summary is automatically included.

3. What paper should I use to print W-2 forms?

You can use either IRS-approved pre-printed forms or blank paper, depending on your setup.

4. Is e-filing better than printing W-2 & W-3 forms?

E-filing is faster and reduces errors, but printing is still acceptable if done correctly.

5. Who can help if I face issues printing payroll forms?

For expert QuickBooks payroll assistance, contact support at +1(866)500-0076.