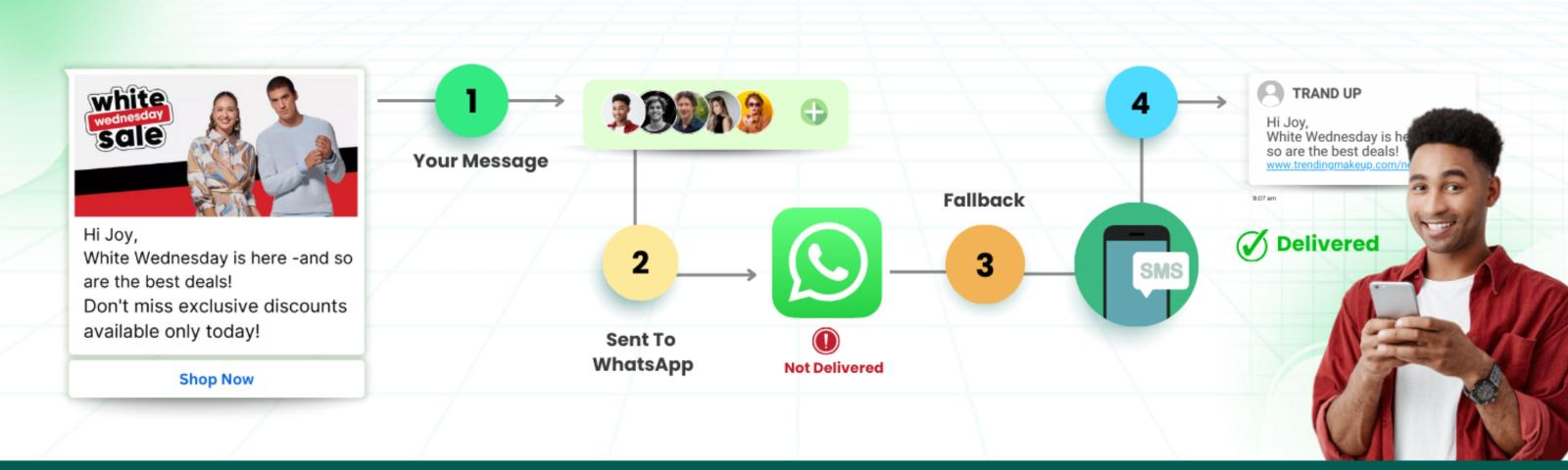

With banks, FinTech companies, and new-age digital banking firms rolling out their services in a tech-savvy world, attention to user security, risk communication, and other real-time user measures is crucial. Customer care via transactional SMS messaging has now become a security staple during sensitive customer engagements, starting from login OTPs to balance queries. Transactional SMS today renders instant, secure, and important information transmission.

Let’s analyze further how banks and other financial service providers have adopted transactional bulk SMS as part of their business strategies, and how their unique communications infrastructure relates to enabling security and flexible reliability.

Importance of Bulk SMS in the Financial Sector

Transactional SMS stands for automated broadcasts sent to subscribers where certain criteria have been met. For banks and FinTechs, these SMS messages may stimulate:

Login and transaction OTPs (One-Time Passwords)

Confirmation messages for completed transactions

Notifications regarding the balance in a given account

Alerts pertaining to the detection of fraud

Reminders concerning loans or overdue EMIs

Updates relating to registration of the account or revised Know Your Customer (KYC) details

These messages are critical to the customer and as such need to be delivered right away without delay, spam filtering, or DND filter. Hence, most banks prefer transactional bulk SMS over any other channels of communication.

Use Cases: Make Alerts Secure for Every Action

Here are practical instances of how banks and FinTechs use transactional SMS for real-time communication:

1. OTP Authentication

Banking systems hinge on security. An OTP is sent via SMS every time a user logs in, resets a password, or makes a payment. A specific action can only be completed by the rightful owner. That’s why reliable OTP sender services play a vital role in customer verification.

2. Real-Time Transaction Alerts

Customers get SMS notifications for every debit and credit transaction. This helps in detecting fraud sooner, increasing customer trust, and preserving confidence in digital banking.

3. Loan and EMI Alerts

Banks use bulk SMS to remind customers about due payments, which minimizes the chances of missed EMIs or financial penalties.

4. New Accounts or Credit Card Activation

From account opening to credit card activation, every action is notified through instant SMS updates, enhancing transparency and customer experience.

Why Shree Tripada is the Preferred Choice for Transactional SMS Services

For reliable and scalable bulk SMS services, Shree Tripada Infomedia India Pvt. Ltd. is a trusted name. We offer transactional bulk SMS at the cheapest rate in the market—without compromising on quality or delivery time.

Our robust infrastructure ensures messages are delivered instantly, even during peak hours. One of our most popular services is OTP bulk SMS, highly appreciated by banks and FinTech companies for its speed and security. If you’re looking to buy OTP SMS solutions that are trusted and timely, Shree Tripada has the answer.

We also provide custom SMS APIs for seamless integration, making our service perfect for both startups and large financial institutions.

Final Thoughts

As the banking sector continues to evolve with cutting-edge digital solutions, the need for fast and secure communication becomes more important than ever. Transactional SMS strengthens user trust, enhances real-time interaction, and ensures better customer service.

If you're looking to scale your communication with secure bulk SMS, dependable OTP sender, or need to buy OTP SMS solutions for your business, Shree Tripada delivers cost-effective, fast, and reliable services you can count on.