The financial services sector is undergoing a rapid transformation, driven by the convergence of blockchain technology and decentralized finance (DeFi). As traditional systems face challenges related to transparency, security, and accessibility, emerging blockchain-based solutions are offering a compelling alternative. From reimagining payment systems to reshaping lending, asset management, and insurance, blockchain is no longer a future concept—it's a present-day disruptor.

Blockchain in Fintech: Beyond the Buzz

Blockchain is playing a pivotal role in modernizing fintech infrastructure by enabling faster, more secure, and tamper-proof transactions. Unlike conventional financial systems that rely on intermediaries and centralized controls, blockchain operates on distributed ledger technology (DLT), ensuring every transaction is traceable, immutable, and auditable.

Oodles fintech services have empowered financial institutions and startups to build scalable, secure, and regulation-ready platforms for digital payments, KYC/AML compliance, digital identity management, and cross-border remittances.

DeFi: Redefining Access to Finance

At the heart of blockchain’s fintech revolution lies DeFi—a movement focused on creating open, permissionless financial systems using smart contracts. These decentralized protocols remove intermediaries from processes such as borrowing, lending, trading, and staking, giving users full control over their assets and data.

For a deeper dive into how DeFi is reshaping global finance, Oodles’ comprehensive blog on decentralized finance outlines core use cases, benefits, and the underlying architecture.

Some key innovations include:

-

Decentralized Lending & Borrowing: Platforms like Aave and Compound allow users to lend and borrow crypto without traditional credit checks.

-

Decentralized Exchanges (DEXs): Uniswap and SushiSwap enable peer-to-peer token swaps with high liquidity.

-

Synthetic Assets: Protocols like Synthetix create blockchain-based representations of real-world assets.

Laying the Foundation: Introduction to DeFi Principles

Before integrating DeFi into fintech strategies, understanding its foundational components is essential. Smart contracts, or self-executing agreements, are the backbone of DeFi ecosystems. They enable automated, trustless interactions between participants while minimizing operational risks.

In Oodles’ introduction to defi, readers can explore how these principles work in real-world applications and how developers can begin architecting secure DeFi protocols.

Real-World Applications and Use Cases

-

Neobanking: Blockchain-driven digital banks offer fast onboarding, low-fee transactions, and global accessibility.

-

Cross-Border Payments: With blockchain, international money transfers can be completed within minutes—without intermediaries.

-

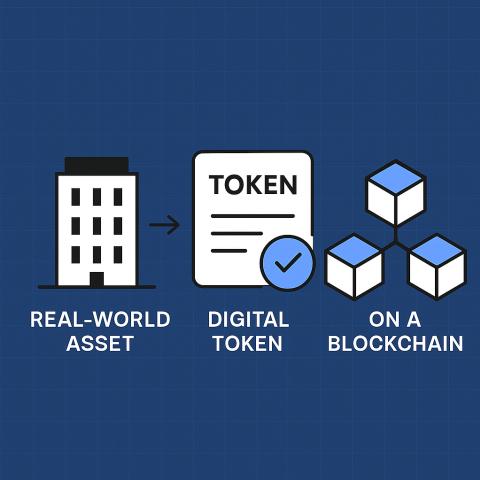

Tokenized Assets: Real estate, equity, and commodities are increasingly being tokenized to enable fractional ownership and broader investor access.

-

RegTech Integration: Automated compliance solutions leveraging blockchain improve transparency in auditing and regulatory reporting.

The Road Ahead: Merging DeFi with Traditional Finance

While DeFi poses disruption, its full potential lies in synergy with traditional finance. Regulatory frameworks, institutional-grade custody, and interoperability standards will play a crucial role in bridging this gap.

Forward-looking financial institutions are already exploring hybrid models that incorporate the best of both worlds—transparency and speed from DeFi, and compliance and trust from conventional systems.

Conclusion

Blockchain and DeFi are not merely trends; they represent the next wave of financial innovation. As fintech platforms continue to evolve, integrating decentralized technologies will become a strategic imperative rather than a competitive advantage.

Organizations looking to stay ahead must invest in robust blockchain infrastructure, embrace open finance principles, and stay informed through trusted resources like those offered by Oodles.