Cryptocurrency continues to reshape global finance by enabling decentralized transactions and unlocking new financial opportunities. For entrepreneurs and businesses, this evolution presents exciting prospects—from launching a crypto exchange platform to integrating cryptocurrency payments. However, succeeding in this space requires more than enthusiasm; it demands careful planning, technical excellence, and a strong market strategy.

In this comprehensive guide, we’ll explore key aspects of building a cryptocurrency exchange, effective marketing techniques to attract users, and the considerations businesses should weigh before accepting cryptocurrencies. The insights are supported by authoritative resources from Oodles Blockchain.

1. Cryptocurrency Exchange Development: Building a Robust Foundation

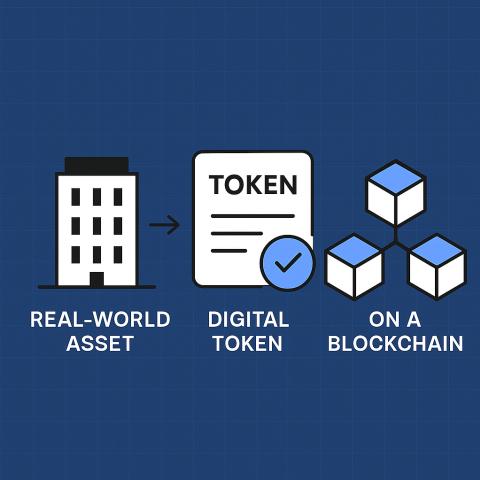

Launching a cryptocurrency exchange is a complex undertaking that blends fintech innovation with strict security and regulatory requirements. At its core, an exchange is a marketplace connecting buyers and sellers of digital assets like Bitcoin, Ethereum, and thousands of altcoins. To ensure success, your platform must deliver:

-

Scalability: The ability to handle growing numbers of users and trades without performance degradation.

-

Security: Advanced measures to protect user funds and personal data from hacking and fraud.

-

Compliance: Adherence to Know Your Customer (KYC), Anti-Money Laundering (AML), and other regulatory frameworks.

-

User Experience: Intuitive interface and seamless trading workflows to attract and retain traders.

Oodles Blockchain offers specialized Cryptocurrency Exchange Development services that encompass everything from order matching engines, wallet integrations, liquidity management, to backend infrastructure. With the right technology partner, businesses can accelerate time-to-market while maintaining flexibility for future enhancements.

Key Features to Consider During Development

-

Multi-currency support: Enable users to trade a variety of cryptocurrencies.

-

Advanced order types: Support for market, limit, stop-loss, and other trading orders.

-

Real-time analytics: Provide users with market data, charts, and portfolio tracking.

-

Mobile-friendly design: Cater to traders on-the-go with responsive or native mobile apps.

-

API integrations: Allow third-party developers or institutional traders to access exchange functionality.

2. Effective Marketing Strategies for Crypto Exchanges

Even the most sophisticated exchange will struggle without a solid marketing plan. The crypto space is highly competitive with many established players and emerging startups competing for attention. To stand out, it’s essential to build a brand, foster trust, and engage communities.

The article on Crypto Exchange Marketing details best practices, which include:

Community Building and Social Proof

Creating an engaged community on platforms like Telegram, Discord, and Twitter helps build loyal user bases. Regular AMA (Ask Me Anything) sessions, updates, and transparent communication foster trust.

Influencer Partnerships

Collaborate with crypto influencers who have credibility within niche audiences. Their endorsements can amplify your reach and credibility.

Content Marketing and Education

Publish blogs, tutorials, webinars, and videos explaining how to use your exchange, market insights, and crypto basics. This positions your platform as a knowledgeable, user-friendly destination.

Paid Advertising and SEO

Targeted ads on Google, crypto forums, and social media drive initial traffic. Simultaneously, optimizing for search engines ensures sustainable organic growth.

Incentives and Referral Programs

Reward users for onboarding friends or reaching trading milestones to accelerate user acquisition.

3. Should Your Business Accept Cryptocurrencies? Assessing the Opportunity

Beyond exchange development, many traditional businesses consider whether to accept cryptocurrencies as payment. This decision carries strategic implications.

Benefits of Accepting Cryptocurrencies

-

Access to New Customers: Crypto holders tend to be early adopters and tech-savvy consumers. Accepting crypto can attract this niche demographic.

-

Faster, Lower-Cost Transactions: Digital currency payments can be processed quicker than traditional cross-border transfers, often with lower fees.

-

Enhanced Security: Blockchain transactions reduce risks of chargebacks and fraud.

-

Brand Innovation: Being crypto-friendly enhances your business’s image as modern and forward-thinking.

Challenges to Consider

-

Price Volatility: Cryptocurrencies are known for rapid price swings, which may affect revenue stability.

-

Regulatory Uncertainty: Compliance requirements vary by jurisdiction and can be complex.

-

Integration Complexity: Incorporating crypto payments requires compatible point-of-sale systems or ecommerce plugins.

-

Tax and Accounting: Businesses must adapt to new tax reporting and accounting practices.

For a deeper dive into these factors, the article Should Your Business Accept Cryptocurrencies? offers guidance on evaluating readiness and selecting appropriate payment solutions.

Final Thoughts: Aligning Technology, Marketing, and Business Strategy

The journey into cryptocurrencies—whether building an exchange or adopting crypto payments—demands holistic consideration. Technical robustness ensures reliability and security, while effective marketing drives user acquisition and retention. Meanwhile, business leaders must assess operational impacts, regulatory compliance, and customer expectations.

Partnering with experienced blockchain development providers like Oodles Blockchain can ease this complexity by delivering turnkey solutions aligned with your strategic goals.