Explore why stablecoin development in 2026 depends on decentralized identity. Learn how privacy and scalable architecture shape trust and long-term adoption. For detailed insights, read the complete blog :-https://www.antiersolutions.com/blogs/why-stablecoin-development-needs-decentralized-identity-for-privacy-in-2026/

A guide for merchants and fintechs on building a stablecoin payment platform. Understand architecture, settlement, compliance, and stablecoin remittance. Catch every detail in the full article — read more at:..

Learn how the stablecoin supercycle is transforming finance and how a leading stablecoin development company can help institutions modernize settlement. See what this shift really means — keep reading. Visit:..

See how Stablecoin Development Services guide the full journey from rules and structure to checks, audits, and scale in payment and remittance markets. Want to learn more? Explore the full..

Discover why global banks are accelerating stablecoin remittance adoption, cutting costs and settlement times while unlocking next-gen cross-border efficiency. Catch every detail in the full article — read more at:https://www.antiersolutions.com/blogs/why-are-the-biggest-banks-rushing-into-stablecoin-remittance-right-now/

Discover why 90% of financial institutions will build stablecoin remittance platforms by 2026. Learn how payment rails are redefining cross-border transactions. Catch every detail in the full article — read..

Discover how fintech leaders are combining stablecoin remittance & decentralized digital identity to enable instant, compliant, & trusted cross-border payments. Want to learn more? Explore the full article for detailed..

Understand why stablecoins matter to governments & how stablecoin development enables secure, interoperable, and policy-aligned digital finance ecosystems. Want to learn more? Explore the full article for detailed insights visit:..

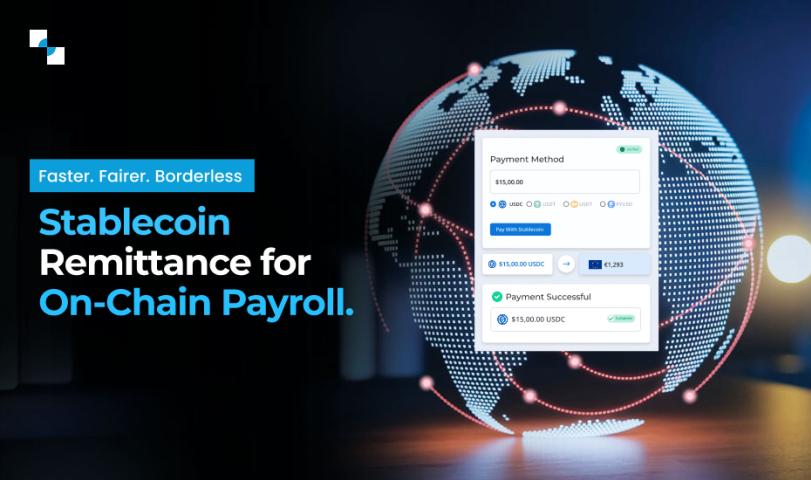

Explore how advanced stablecoin remittance platforms streamline global payroll, reduce costs, ensure compliance, and boost efficiency for enterprises. Continue reading for full insights — visit: https://www.antiersolutions.com/blogs/can-stablecoin-remittance-fix-cross-border-payroll-pain-points/

Build a stablecoin payment system for gig workers, creators, & freelancers. Learn the features and compliance steps to launch a global payout platform. For comprehensive insights, please visit: https://www.antiersolutions.com/blogs/how-to-build-a-stablecoin-payment-system-for-gig-workers-creators-freelancers/

Discover why global banks are accelerating stablecoin remittance adoption, cutting costs and settlement times while unlocking next-gen cross-border efficiency. Catch every detail in the full article — read more at:https://www.antiersolutions.com/blogs/why-are-the-biggest-banks-rushing-into-stablecoin-remittance-right-now/

Discover how fintech leaders are combining stablecoin remittance & decentralized digital identity to enable instant, compliant, & trusted cross-border payments. Want to learn more? Explore the full article for detailed..

Explore how advanced stablecoin remittance platforms streamline global payroll, reduce costs, ensure compliance, and boost efficiency for enterprises. Continue reading for full insights — visit: https://www.antiersolutions.com/blogs/can-stablecoin-remittance-fix-cross-border-payroll-pain-points/

Discover how AI stablecoin payment platforms cut fees and boost compliance. Create custom, scalable solutions for fast, secure global payments today! Discover the full insights in our detailed article —..

Discover the rise of white label stablecoin remittance platforms in 2025. Learn how banks, fintechs, and global enterprises are cutting costs and gaining speed with programmable, compliant payment rails. Uncover..

Get insights into the global rise of stablecoin remittance. Explore the technology, regulation, and top countries shaping stablecoin remittance platform development in today’s digital economy. Don’t miss the details —..

When value moves without clarity, trust collapses. Antier helps you develop a stablecoin transaction platform that makes every transfer verifiable, fast, and failproof. We bake in compliance. Why wait? Set..

Cross-border remittance platforms have evolved drastically over the years, and one such evolution is alternative payment methods. APMs can do wonders that your customers could not even imagine. Yes, APMs..