The Life Insurance Corporation of India (LIC) is one of the most trusted and established names in the Indian insurance industry. Since its inception in 1956, LIC has built a legacy of reliability, long-term investment options, and comprehensive insurance coverage for millions of Indians. But before you invest your hard-earned money in an LIC policy, it’s important to understand what makes Life Insurance Corporation of India unique—and what you should consider as a potential policyholder.

Whether you’re buying life insurance for the first time or switching from another provider, here are the top 10 things you should know about LIC before you make your decision.

1. LIC is Government-Owned and Backed

One of the biggest reasons people trust LIC is that it's owned by the Government of India. This provides a strong sense of security, as government backing reduces the risk of default. In times of financial uncertainty, this backing can give you peace of mind that your investments are safe.

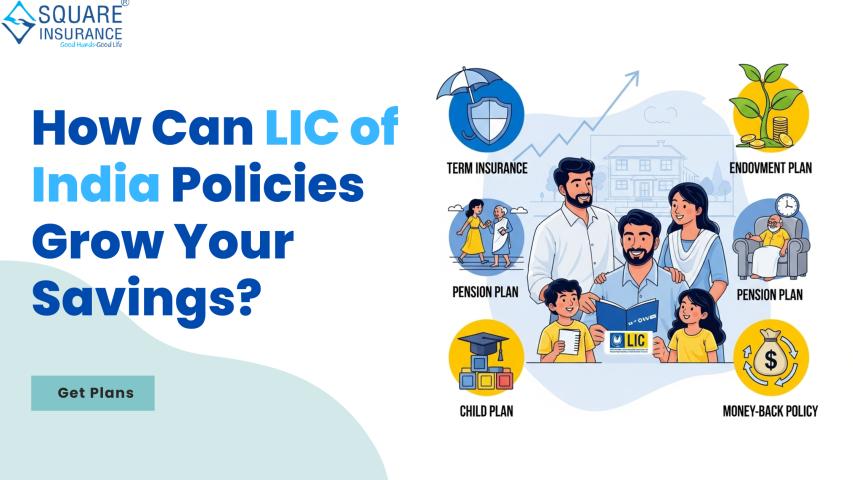

2. LIC Offers a Wide Range of Insurance Plans

LIC is not a one-size-fits-all insurer. It offers a variety of plans to suit different needs, including:

- Term Insurance Plans

- Endowment Policies

- Whole Life Insurance

- Money Back Policies

- Pension and Retirement Plans

- Child Education & Future Plans

- Unit Linked Insurance Plans (ULIPs)

No matter what stage of life you’re in, there’s likely an LIC plan that fits your goals.

3. LIC Has a High Claim Settlement Ratio

Before buying any insurance policy, it’s crucial to check the company’s Claim Settlement Ratio (CSR). LIC consistently maintains a high CSR (above 95%), which means most claims filed by customers are successfully settled. This is an important indicator of the company's trustworthiness and service quality.

4. LIC Policies Include Bonus Benefits

Many LIC policies offer bonuses—a share of LIC’s yearly profits that are distributed among policyholders. These bonuses are added to your policy's sum assured and are payable at maturity or death, increasing the overall return on your investment. This is one of the major features that sets LIC apart from many private insurers.

5. Premium Payment is Flexible and Convenient

LIC provides multiple channels to pay your policy premiums:

This flexibility ensures that you can pay your premiums on time, in a way that’s convenient for you.

6. LIC Offers Both Offline and Online Services

While LIC has a strong network of over 2,000 branches and lakhs of agents, it also offers robust online services. You can:

- Online payment through LIC’s website or app

- Auto-debit through bank or credit card

- Payment via LIC’s customer portal or mobile app

- Offline payment at LIC branches or through agents

All of this can be done via the LIC e-Services portal or the LIC Customer App.

7. You May Be Eligible for Tax Benefits

Under Section 80C of the Income Tax Act, LIC policyholders can claim deductions of up to ₹1.5 lakh annually on premium payments. Additionally, maturity amounts are generally tax-free under Section 10(10D), subject to conditions.

So apart from insurance coverage, LIC policies can also help with tax savings.

8. LIC Policies Can Be Used for Loans and Collateral

Most traditional LIC policies, after a few years of consistent premium payment, are eligible for loans. This means you can borrow against your policy in case of financial emergencies, without needing a credit score check. Some banks also accept LIC policies as collateral for loans.

9. You Can Track Your Policy Anytime

LIC makes it easy for customers to track their policy status and details using multiple channels:

- LIC e-Services portal

- LIC Mobile App

- Toll-free customer support

- LIC agents and merchants

This helps you stay updated on premium due dates, policy status, and accrued bonuses.

10. Policy Revival and Portability Options Exist

If your policy has lapsed due to missed payments, LIC offers policy revival options within a defined period (usually 2–5 years). They also provide options to change nominee details, update address, or transfer servicing branches easily, making it a user-friendly choice for long-term investments.

Get Expert Help at Squareinsurance.in

If you’re unsure which LIC policy is right for you, or you need help with premium comparisons, tax benefits, or policy selection.

It’s a trusted insurance platform that helps you explore LIC plans, compare features, and get expert assistance to make the right choice—completely hassle-free.

Conclusion

Choosing a life insurance policy is one of the most important financial decisions you can make. With a stellar reputation, government backing, and customer-friendly features, the Life Insurance Corporation of India continues to be the top choice for millions of Indians.

Before buying, make sure to compare plans, understand your goals (protection, savings, retirement, etc.), and select a policy that fits your needs. With LIC, you're not just buying insurance—you’re building a secure future for yourself and your loved ones. visit Squareinsurance.in.