The Life Insurance Corporation of India (LIC) is among the most respected brands in the insurance sector. For decades, the Life Insurance Corporation of India has been helping people protect their families’ future, save money, and enjoy financial security. Whether you’re looking for life cover, investment opportunities, or retirement planning, LIC has a variety of plans to suit different needs.

In this blog, we will explore the key benefits that LIC of India offers in simple, easy-to-understand language.

Financial Protection for Your Family

The most important benefit of LIC is life coverage. In case something happens to you, your family will receive a sum assured to help them manage daily expenses, repay loans, and maintain their life>

Why it matters:

• Ensures your family’s financial stability

• Protects them from unexpected hardships

• Works as a safety net during tough times

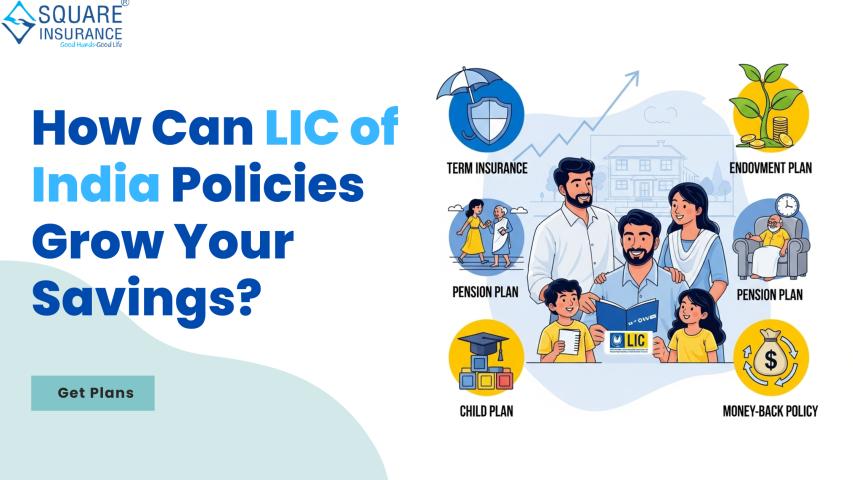

Wide Range of Insurance Plans

LIC offers different types of plans, such as:

• Term Insurance: Complete protection packages with reasonable rates

• Endowment Plans – Insurance plus savings

• Money-Back Plans: Consistent payments for the duration of the policy

• Pension Plans – Retirement income security

• Child Plans – Securing your child’s future needs

With so many options, you can choose a plan that matches your goals and budget.

Savings and Investment Opportunities

LIC is not just about insurance; it also helps you grow your money. Many LIC policies provide bonuses and returns at maturity. This means you get life cover while also building a financial corpus over time.

Benefits include:

• Long-term wealth creation

• Safe and reliable returns

• Tax benefits on premiums and maturity amounts

Affordable Premiums

LIC has plans that fit every budget. You can choose how much you want to pay, monthly, quarterly, half-yearly, or yearly. This flexibility makes it easier for people from all walks of life to get insured.

Loan Facility Against Policy

One of the practical benefits of LIC policies is that you can take a loan against your policy in case of urgent financial needs. The loan amount depends on the policy value and is available at a reasonable interest rate.

Tax Benefits

Under the Income Tax Act, Section 80C, you can claim deductions on the premium you pay for your LIC policy. Additionally, maturity proceeds are often tax-free under Section 10(10D), subject to certain conditions.

Bonus and Additional Benefits

Policyholders receive bonuses from LIC, which distributes a portion of its profits to them. These bonuses are added to your sum assured and paid at maturity or in case of a claim, increasing the total payout.

High Claim Settlement Ratio

In the insurance sector, LIC has one of the highest claim settlement ratios. This means that most claims are honored promptly, giving customers peace of mind that their loved ones will not face difficulties during claim processing.

Easy Access and Service

With LIC’s large network of branches, agents, and its online customer portal, you can easily pay premiums, check policy details, or update information without hassle.

Plans for All Life Stages

Whether you are:

• Starting your career and need basic life cover

• Married and want to secure your spouse’s future

• A parent planning for your child’s education

• Near retirement and looking for pension options

LIC has a policy tailored for your stage in life.

Tips for Choosing the Right LIC Plan

• Assess your financial goals (protection, savings, retirement)

• Decide your budget for premiums

• Consider the policy term that suits you best

• Compare benefits before finalizing

Conclusion

The Life Insurance Corporation of India offers more than just insurance; it provides peace of mind, financial security, and a safe way to grow your wealth. With a variety of plans, affordable premiums, tax benefits, and a trusted track record, LIC continues to be a top choice for millions of Indians.

If you are looking for professional guidance in choosing the right LIC plan for your needs, Square Insurance can help you compare options, understand benefits, and select the most suitable policy. With expert advice and a customer-first approach, Square Insurance makes the process of securing your family’s future simple and stress-free.