Money management has always been a major aspect in our daily lives, yet the instruments with which we manage our money have evolved significantly over the last few years. With Fintech, or Financial Technology, people can now save, spend and invest their money in a smarter, faster and more convenient way. Budgeting apps, mobile payment systems, and other technologies are transforming the way individuals engage with their finances and making financial management more accessible than ever before, the Fintech industry is changing the way people interact with their money.

What Is Fintech?

It is necessary to know what is fintech before delving into its effects. Fintech is a portmanteau of financial and technology. In straightforward terms, Fintech meaning is the application of technology to provide financial services in a more effective way.

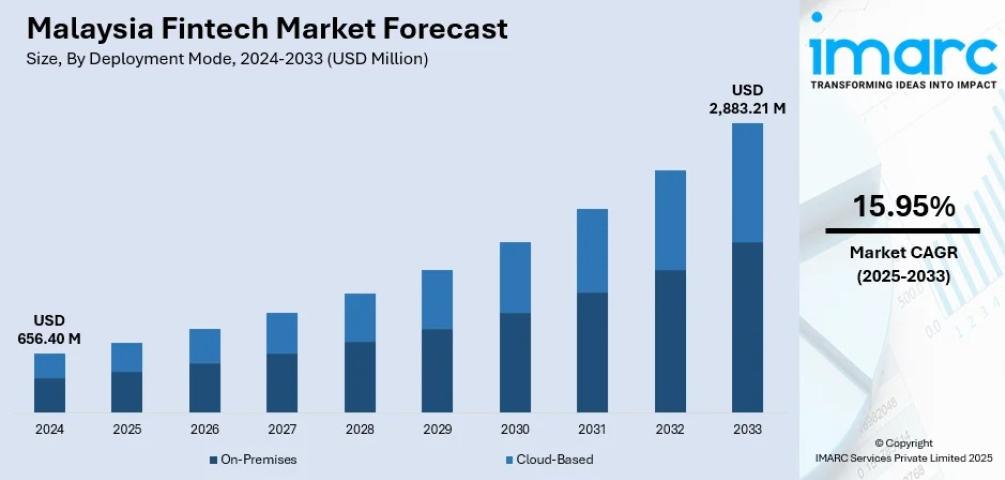

It can be a banking application on your phone, an online investment platform, or a peer-to-peer lending platform, all of them are FinTech solutions. The Fintech sector has expanded at a high rate over the past ten years due to consumer preference of convenience and the necessity of businesses to be digitized.

The Future of Fintech in the Management of Personal Finance.

The emergence of Financial Technology solutions has transformed the manner in which people handle their money entirely. The following are some of the most important ways it is making an impact:

1. Expense Tracking and Budgeting.

Long gone are the days of manual spreadsheets and guesswork. Fintech applications have become the way to automatically track expenses, group spending, and build personalized budgets. Applications such as Mint, YNAB (You Need a Budget), and others can point out spending patterns on the fly.

This gives people the strength to make wiser financial decisions and not to spend on unnecessary things. Financial awareness is not the preserve of accountants or experts anymore with the FinTech solutions, it is accessible to all.

2. Mobile Payments and Digital Wallets.

Payments have been transformed by the Fintech industry. Consumers are able to pay immediately using mobile wallets such as Apple Pay, Google Pay, or PayPal instead of using cash or cards.

This convenience does not only accelerate transactions but also simplifies the management of day to day costs. Digital wallets tend to offer transaction history, rewards, and even budgeting features, and they fit perfectly into personal finance management.

3. Simple Savings and Investments.

In the past, investment involved employing brokers or going to a bank. Fintech companies today provide convenient platforms that enable anyone to begin investing with as little as a few dollars. Robo-advisors such as Betterment or Wealthfront offer automated investment plans, and apps such as Acorns round up purchases and invest the spare change.

The solutions of Financial Technology have democratized the process of investing and now beginners can become rich without having to possess a lot of financial knowledge.

4. Improved Access to Credit

One of the key benefits of Fintech is that it provides loans and credit more quickly than the old banks. Microloan providers and peer-to-peer lending platforms use alternative data, including spending habits and digital activity, to determine creditworthiness.

This implies that individuals who might not be eligible to take bank loans can now access Fintech companies. This has led to an increase in financial inclusion particularly in the developing economies.

5. Increased Security and Transparency.

Security is the issue of finance that has always been a priority. Financial Technology is now safer with the assistance of AI, blockchain, and advanced encryption. A lot of apps are designed with biometric authentication (fingerprint or facial recognition) which minimizes the chances of fraud.

Another important advantage is transparency, as users can access transaction information in real-time, and it is easier to track accounts and notice suspicious behavior.

The Fintech Trends that are influencing Personal Finance.

In the future, a number of Fintech trends will keep changing personal finance:

AI-Powered Advisor: Artificial intelligence-driven personalized financial advice.

Blockchain-Based Payments: Cross-border payments are faster, cheaper and more secure.

Open Banking: Providing customers with increased access to their data and financial options.

Green Fintech: Apps that promote sustainable investments and environmentally conscious spending.

FinTech Insights state that these innovations are not only defining the future of finance but also making financial literacy and management more accessible in the world.

The reason why Fintech Companies are spearheading this change.

All the big Fintech firms have one similar aim: to simplify and customerize finance. Fintech companies are fast, innovative, and user-friendly unlike traditional banks that are slow and bureaucratic.

Their emphasis on mobile-first designs, smooth interfaces and data-driven personalization have earned them the trust of millions of users around the world. This flexibility will make the Fintech industry remain at the forefront of personal finance in the future.

Conclusion

The role of Fintech in the management of personal finances cannot be overestimated. Financial Technology solutions are providing people with greater control over their finances than ever before, whether it is through budgeting apps and mobile wallets, investment platforms and digital lending.

It is no longer a choice to know what is fintech and adopt FinTech solutions, but rather a necessity to anyone who wants to handle his or her finances in the current digital economy. With the trends in Fintech constantly shifting, with the help of such experts and websites as FinTech Insights, personal finance can only get smoother, safer, and more empowering.