The global duty-free and travel retail market is experiencing robust expansion driven by the resurgence of international travel, rising consumer demand for luxury goods, and advancements in digital retailing. This unique retail format serves travelers by offering products free from local taxes and duties, predominantly in airports, seaports, and border shops worldwide. It plays a crucial role in economic development through infrastructure improvement and job creation, while also acting as a major channel for brands to capture international buyers.

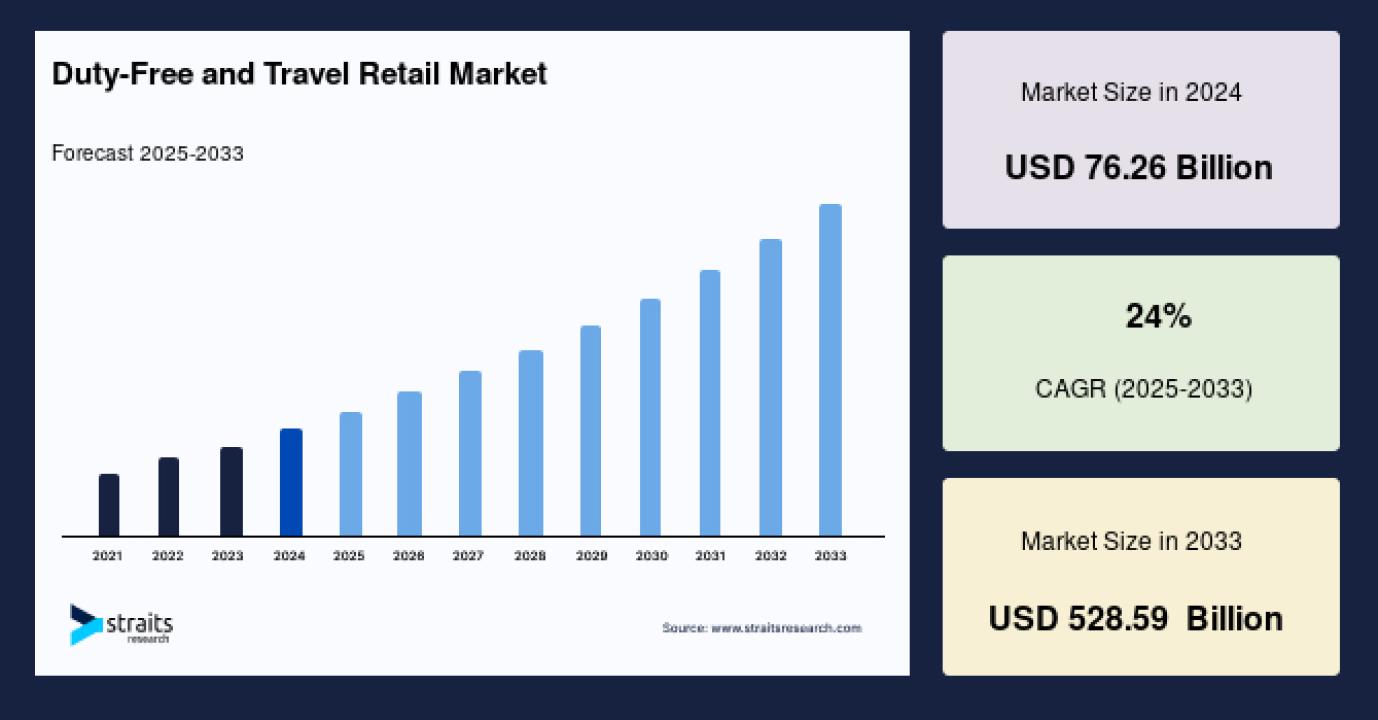

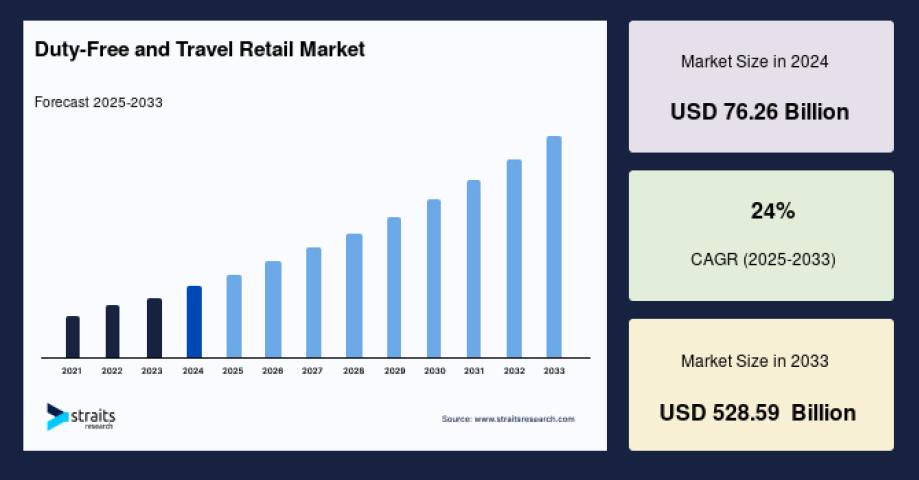

Market Size 2024 – USD 76.26 billion

Market Size 2025 – USD 94.57 billion

Market Size 2033 – USD 528.59 billion

CAGR (2025-2033) – 24%

For detailed market data and insights, download the free sample report: Request Sample – https://straitsresearch.com/report/duty-free-and-travel-retail-market/request-sample

Market Drivers

The surge in global tourism and travel is a key driver boosting duty-free and travel retail sales, fueled by increased affordability of air travel and expanding middle-class consumer bases, especially in developing regions like Asia-Pacific. Travelers enjoy the experience of shopping international brands at duty-free zones post-security checks, where luxury and premium goods are prominently featured. The growing popularity of digitizing the retail experience is enhancing consumer engagement and optimizing sales through online platforms, click-and-collect services, and personalized marketing.

Urbanization, infrastructure development, and the proliferation of new airports and seaports worldwide contribute to higher footfall and increased retail space availability. Rising incomes and life>

Market Challenges

The duty-free and travel retail industry faces several challenges that hamper growth. Complex security protocols and screening procedures for products, especially liquids, create operational difficulties and affect customer experience. Retailers contend with unique supply chain and logistical constraints, including strict delivery schedules, limited on-site storage, and difficulties in processing returns due to location restrictions.

Extended store operating hours demand flexible staffing, often requiring multilingual employees with additional onboarding complexities and security clearances specific to airport environments. Changing consumer behaviors, such as deliberate purchasing and increased online spending, are pressuring traditional impulse buy-focused duty-free retail models. Additionally, the pandemic accelerated digital transformation expectations, forcing retailers to adapt quickly to remain competitive.

Market Segmentation

By Product Category

Beauty and Personal Care: Dominates the market with strong growth in cosmetics and perfumes, driven by rising demand for natural and organic products supported by augmented reality (AR) technologies for virtual try-ons.

Fashion Accessories and Hard Luxury: The second-largest segment, focusing on premium brands that emphasize high-quality customer experiences and exclusive products.

Electronics: Includes gadgets, headphones, and travel accessories that appeal to tech-savvy travelers.

Food and Beverages: Popular items such as chocolates, alcohol, tobacco, and confectionery often buying impulse-driven.

By Channel

Airport Retail: Commands the largest market share, contributing about 50% of international airport revenues. Innovations like reserve-and-collect services cater to changing traveler preferences.

Downtown Duty-Free Stores: Increasingly popular for allowing shoppers to purchase anytime during their journey, not just at airports.

Seaport and Border Shops: Serve passengers on cruises and cross-border travelers, offering a tailored product portfolio relevant to their journeys.

By Region

Asia-Pacific: Largest market, driven by China’s outbound travel boom, infrastructure investments, and rising middle-class spending.

Europe: Second largest and growing rapidly with a CAGR of 22.3%. The region features a mature travel retail ecosystem supported by thriving tourism.

North America: Third largest, characterized by diverse traveler demographics and regional variations such as high spending in Latin America and the Caribbean compared to the U.S.

To purchase the full report: Buy Now this report – https://straitsresearch.com/buy-now/duty-free-and-travel-retail-market

Top Players Analysis

Leading companies dominate the duty-free and travel retail market with diverse strategies encompassing retail network expansion, digital innovation, and luxury brand partnerships:

DFS Group – Strong footprint in Asia-Pacific and luxury brand collaborations.

Dufry AG – Global leader with operations in over 65 countries and multiple retail formats including airports and downtown locations.

Lagardère Travel Retail – Extensive global presence and strong digital retail experiences.

The Shilla Duty Free – Key player in Asian markets, especially South Korea, with luxury and beauty focus.

Aer Rianta International – Operating in major European and Middle Eastern airports.

King Power International – Thailand’s dominant travel retailer focused on luxury and local products.

Lotte Duty Free – Major Korean retailer expanding internationally.

Heinemann Group – Focused on high-end and specialty goods in airports.

China Duty Free Group – Leading market share in China’s outbound travel segment.

Gebr. Heinemann SE & Co. KG – Key European operator notable for digital transformation initiatives.

These companies leverage omnichannel retail, customer loyalty programs, and strategic partnerships with luxury brands to retain market leadership.

Conclusion and About Us

The duty-free and travel retail market is set for exponential growth resulting from increasing global travel, evolving shopping behaviors, and technological enhancements. While navigating operational complexities and adapting to digital demands, industry players are creating innovative, consumer-centric experiences to capitalize on growing product demand across luxury, beauty, and electronics segments.

Straits Research is a market intelligence company providing global business information reports and services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insight for thousands of decision-makers. Straits Research Pvt. Ltd. delivers actionable market research data, especially designed for strategic decision making and ROI.

FAQs

What is the global duty-free and travel retail market size in 2024?

USD 76.26 billion.

What will be the market size by 2033?

Projected to reach USD 528.59 billion.

What is the CAGR during 2025-2033?

24%.

Which region holds the largest market share?

Asia-Pacific, led by China’s outbound travel sector.

What are the top product segments in duty-free retail?

Beauty and personal care dominate, followed by fashion accessories and hard luxury.

What key challenges impact the market?

Security screening, supply chain constraints, and evolving consumer purchase behaviors.

Who are the major players in duty-free and travel retail?

DFS Group, Dufry AG, Lagardère Travel Retail, The Shilla Duty Free, Aer Rianta International, King Power International, Lotte Duty Free, Heinemann Group, China Duty Free Group, Gebr. Heinemann SE & Co. KG.