The global casino gaming equipment market is expanding steadily as technological innovations, rising consumer spending, and more casino establishments fuel demand. Casino gaming equipment includes a range of machines and accessories used in casinos, shopping malls, and entertainment venues for gambling and recreation. This market has witnessed significant transformation driven by modernization with advanced slot machines, electronic gaming tables, and immersive gaming experiences enabled by virtual reality (VR) and augmented reality (AR).

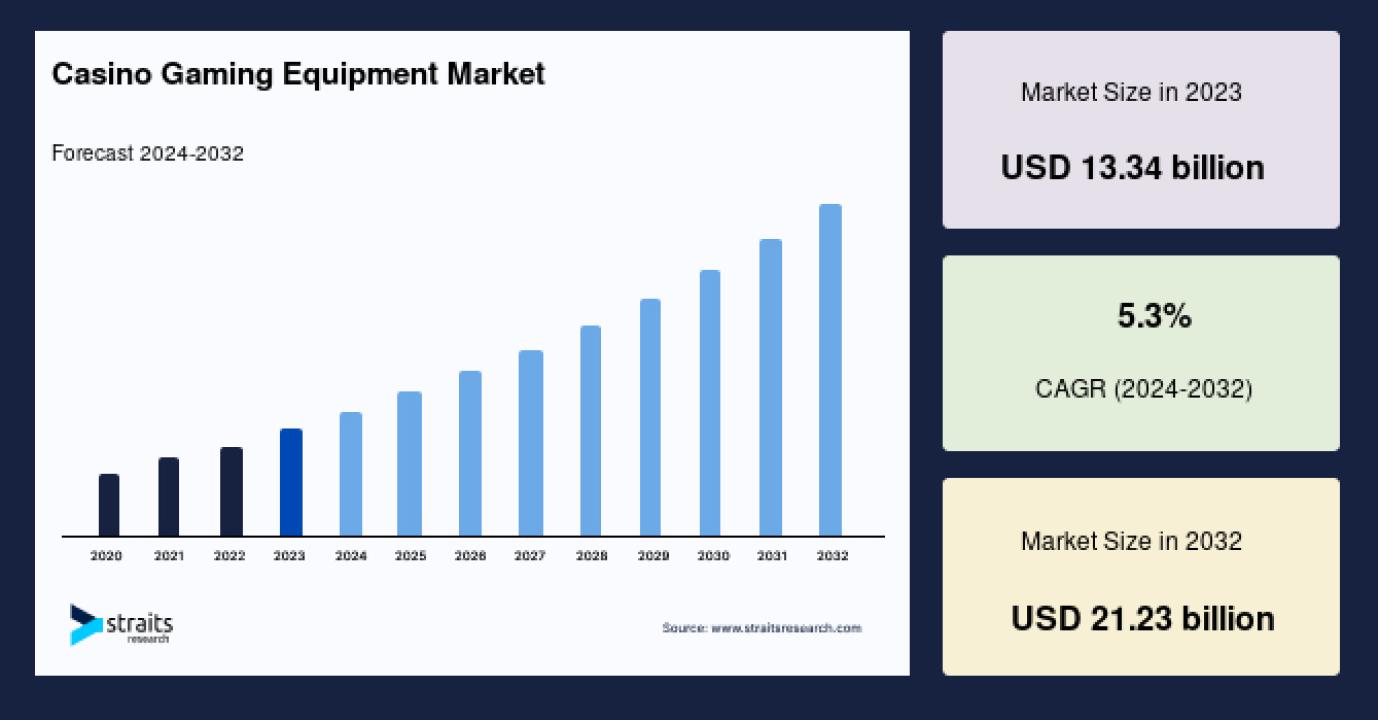

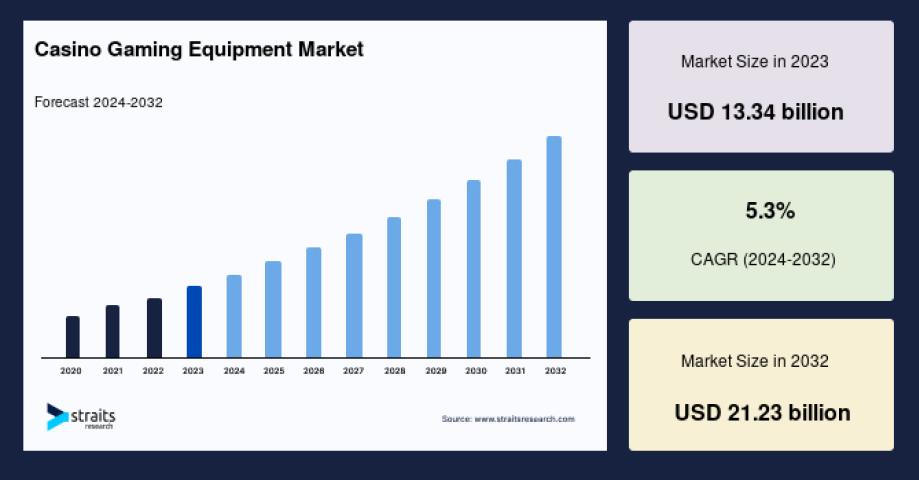

Market Size 2023 – USD 13.34 billion

Market Size 2032 – USD 21.23 billion

CAGR (2024-2032) – 5.3%

For a detailed market data and insights download free sample here: Request Sample – https://straitsresearch.com/report/casino-gaming-equipment-market/request-sample

Market Drivers

Technological innovation is the primary growth catalyst in the casino gaming equipment market. Modern slot machines now feature ultra-high-definition screens, immersive sound systems, and touchscreen controls, vastly enhancing player engagement. The transition from mechanical to electronic gaming tables increases operational efficiency by reducing dealer-related costs and enabling higher games per hour rates. Electronic gaming systems also allow casinos to customize and configure gaming floors more flexibly while maintaining appealing aesthetics.

Furthermore, the legalization and expansion of gambling-related activities worldwide boost industry growth by increasing the number of casinos and, in turn, the demand for gaming equipment. Enhanced consumer spending on entertainment and gambling activities also drives higher footfall in casinos globally. Integration of AI-driven analytics and player card systems boosts personalized player experiences, encouraging longer engagement and higher revenue.

Market Challenges

Despite numerous growth opportunities, the market faces challenges. Strict regulatory compliance and varied gambling laws across countries demand constant adaptations from manufacturers. High costs linked to sophisticated gaming technologies can be barriers, especially for smaller casino operators. Additionally, the growing popularity of online gambling diverts some market share from physical casinos, challenging traditional gaming equipment manufacturers to innovate and stay relevant.

The COVID-19 pandemic also affected land-based casinos due to social distancing restrictions, pushing many players towards online platforms, although recovery is underway with reopening and technological upgrades in physical casinos.

Market Segmentation

By Product Type

Slot Machines: The largest segment with steady growth. Slot machines have evolved from mechanical reels to highly digitalized systems with virtual reality elements, creating powerful user experiences.

Video Lottery Terminals (VLTs): Electronic gambling machines regulated by lottery agencies and located at bars, restaurants, and licensed locations. Popular games on VLTs include bingo and scratch cards.

Video Poker Machines: Known for security, transparency, and flexibility, these machines combine traditional poker game features with electronic interfaces.

Others: Including electronic table games and related gaming accessories.

By Installation

Installed Inside Casinos: Accounts for the largest revenue share due to casinos’ large gaming floor spaces and diversified game offerings.

Installed Outside Casinos: Found in venues like malls, entertainment complexes, and resorts. This segment is growing rapidly as regional casinos expand into nontraditional locations.

By Mode of Operation

Floor Mounted: Most widely used casino gaming equipment, directly attached to the floor, traditional and stable in use.

Portable: Lightweight and compact machines that are easy to relocate. With recent innovations, portable systems are increasingly demanded for flexibility and smaller gaming areas.

To purchase the full report visit: Buy Now this report – https://straitsresearch.com/buy-now/casino-gaming-equipment-market

Regional Insights

North America dominates the global casino gaming equipment market, driven by the U.S.'s immense casino industry, high consumer spending, and early adoption of technology, including AR and VR in gaming. The region is projected to maintain leadership due to consistent investment and strong market demand.

Europe presents the fastest growth opportunity, propelled by countries such as the U.K., France, Germany, and Spain implementing regulations favorable to online and land-based gambling. The online gambling market holds a significant share, enhancing demand for electronic casino equipment.

Asia-Pacific is emerging rapidly, led by iconic casino resorts in Singapore and Macau. Legalization and rising disposable incomes in China, Japan, and India are fueling growth. The market benefits from increasing tourism and fresh gambling licenses.

Latin America, the Middle East, and Africa (LAMEA) hold smaller shares, primarily due to comparatively low consumer spending but growing interest in gambling activities in countries like Brazil and Peru.

Top Players Analysis

Key players in the casino gaming equipment market, based on Straits Research, include:

International Game Technology PLC (IGT): A global leader providing innovative gaming solutions spanning slot machines and lottery terminals.

Scientific Games Corporation: Focused on high-tech gaming systems, lottery technologies, and virtual sports betting.

Aristocrat Technologies, Inc.: Known for advanced gaming machines and electronic table games.

Konami Holdings Corporation: Offers gaming machines combined with entertainment content and online gaming platforms.

Bally Technologies (a Scientific Games company): Specializes in slot machines and casino management systems.

Everi Holdings Inc.: Provides slot machines, electronic table games, and financial technology solutions to casinos.

Ainsworth Game Technology Ltd.: Producer of innovative slot and gaming machines, targeting various global markets.

Merkur Gaming: Manufacturer of slot machines and gaming cabinets with a strong presence in Europe.

Novo Gaming: Focused on casino games software and electronic table solutions.

Playtech PLC: Offers unified gaming software platforms and virtual gaming services enhancing player experience.

These players focus on developing technologically advanced, engaging, and flexible gaming solutions to capture market share amid evolving consumer preferences and regulatory landscapes.

Conclusion and About Us

The global casino gaming equipment market presents promising growth led by continuous innovation, expanding gambling legalization, and rising entertainment spending. Technological advancements drive enhanced player engagement, while new casino openings globally broaden demand. Challenges like online gaming competition and regulatory hurdles exist, but evolving market dynamics position the sector for steady expansion through 2032.

Straits Research is a market intelligence company providing global business information reports and services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insight for thousands of decision-makers. Straits Research Pvt. Ltd. provides actionable market research data, especially designed and presented for decision making and ROI.

FAQs

What is the global casino gaming equipment market size in 2023?

USD 13.34 billion

What is the expected market size by 2032?

USD 21.23 billion

What is the CAGR of the market between 2024 and 2032?

5.3%

Which product segment dominates the market?

Slot machines dominate the market share.

Which region holds the largest market share?

North America leads the market share globally.

What role does technology play in this market?

Technological innovations such as electronic gaming tables, VR, and AR enhance player experience and drive market growth.