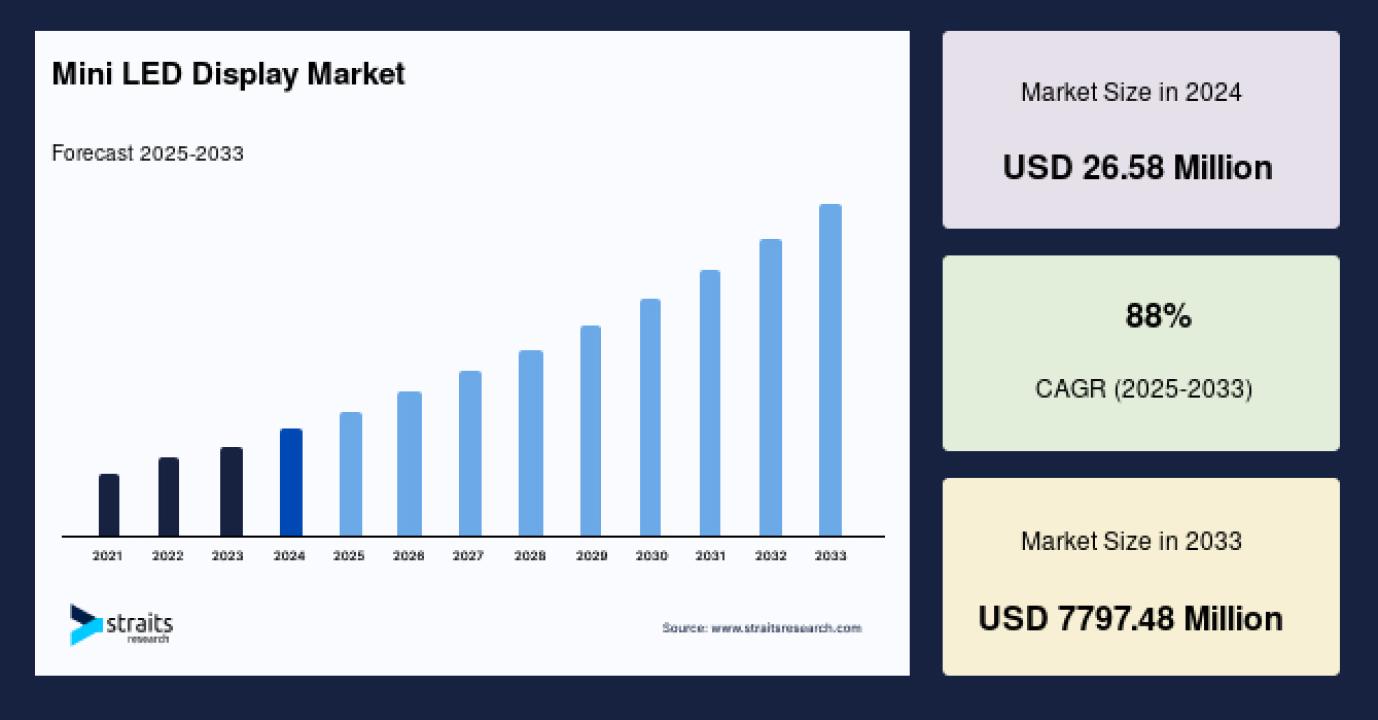

The global mini LED display market is experiencing exponential growth driven by advances in display technology and increasing demand across automotive, consumer electronics, and television segments. Mini LED technology, characterized by thousands of tiny LEDs used as backlights in LCD panels, offers superior local dimming, higher brightness, and better color accuracy compared to traditional display methods. This breakthrough is revolutionizing devices ranging from high-end televisions and monitors to smartphones and automotive displays.

Market Size 2024 – USD 26.58 million

Market Size 2025 – USD 49.97 million

Market Size 2033 – USD 7,797.48 million

CAGR (2025-2033) – 88%

For those interested in a detailed market report, download the free sample here: Request Sample – https://straitsresearch.com/report/mini-led-display-market/request-sample

Market Drivers

Key factors fueling the mini LED display market include the growing need for advanced backlighting technologies in consumer electronics. Major manufacturers like LG, Samsung, and AUO are incorporating mini LED backlights in various devices to enhance display quality. The superior brightness, color precision, energy efficiency, and longevity of mini LED displays compared to OLED or traditional LCDs make them attractive for a broad range of applications.

The surge in smartphone adoption and the expansion of feature-rich mobile devices are accelerating mini LED integration in smaller displays. The automotive sector is also adopting mini LED technology for dashboards, HUDs, and infotainment systems, driven by its advantages in brightness and durability in varying light conditions.

Investment in mini LED manufacturing is increasing, with companies like Dicolor, Focus Lightings, and Epistar boosting production capacity through significant capital expenditure. This scale-up is expected to reduce costs and increase market penetration.

Market Challenges

Despite rapid growth, the high cost of mini LED components, including LED chips, PCB backplanes, and driver ICs, remains a challenge. Complex manufacturing processes such as testing, sorting, and surface-mount technology (SMT) increase production expenses compared to traditional LCD and OLED displays, potentially restraining growth.

Technical challenges also include the requirement for precise quality control to maintain display uniformity and reliability. Moreover, competition from OLED and emerging Micro-LED technologies may impact mini LED adoption depending on cost, performance, and innovation pace.

Market Segmentation

By Product Type

Automotive Displays: Mini LED technology improves dashboard visibility and infotainment quality, driving demand in the automotive sector.

Television: The largest segment, mini LED TVs surpass OLEDs in brightness and color richness, appealing to consumers seeking premium viewing experiences.

Smartphones: While OLED dominates high-end phones, mini LED gains ground in mid-size displays due to energy efficiency and cost benefits.

By End User

Consumer Electronics: Holds the largest market share and is expected to grow rapidly, driven by rising electronic consumption in emerging economies.

Automotive: Increasing adoption of mini LED in in-car displays and digital interfaces fuels growth in this vertical.

By Region

Asia-Pacific: The largest regional market with the highest manufacturing capabilities, supported by a large population and strong tech industry.

Europe: Fastest-growing region with strong investments and adoption in smart TV manufacturing and automotive displays. Germany is a key market leader.

North America: Significant revenues from US and Canadian markets driven by innovation, high consumer spending, and energy efficiency regulations.

LAMEA: Emerging market with growing interest in display technologies but hampered by skilled labor shortages.

To purchase the full report, visit: Buy Now this report – https://straitsresearch.com/buy-now/mini-led-display-market

Top Players Analysis

Leading companies investing heavily in mini LED display technology include:

AU Optronics (AUO) – Diversified product lines including large monitors and automotive displays.

LG Display – Major innovator in mini LED TVs with strong global presence.

Samsung Electronics – Integrates mini LED in premium TV and smartphone models.

Epistar – Taiwan’s top LED chip manufacturer enhancing production capacity.

Dicolor – Invested USD 146.28 million in mini LED production expansion.

Focus Lightings – Planned USD 511.99 million investment for mini LED chip capacity growth.

BOE Technology Group – Significant player in China focusing on mini LED backlights.

Innolux Corporation – Focused on LCD and mini LED panel manufacturing.

TCL Technology – Expanding mini LED product offerings in televisions.

Sony Corporation – Leveraging mini LED for next-gen display technology.

These companies leverage capital investments and strategic partnerships to increase production, reduce costs, and introduce innovative products, driving market growth.

Conclusion and About Us

The mini LED display market is on a swift growth path owing to technological advantages, rising consumer demand, and strong investments from top manufacturers. While cost and competition present challenges, ongoing innovation and scale efficiencies point to a robust market outlook through 2033. Asia-Pacific’s manufacturing dominance coupled with Europe’s rapid adoption underscores the global scope of this market revolution.

Straits Research is a market intelligence company providing global business information reports and services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insight for thousands of decision-makers. Straits Research Pvt. Ltd. provides actionable market research data, especially designed and presented for decision making and ROI.

FAQs

What is the market size of the global mini LED display market in 2024?

USD 26.58 million.

What is the forecast market size in 2033?

Expected to reach USD 7,797.48 million.

What is the CAGR between 2025 and 2033?

88%.

Which product segment holds the largest share?

Television segment leads due to premium display adoption.

What are the key challenges for the mini LED display market?

High component and manufacturing costs, plus competition from OLED and Micro-LED.

Which regions dominate the market?

Asia-Pacific is the largest, Europe is the fastest growing, followed by North America.

Who are the top companies in this market?

AUO, LG Display, Samsung, Epistar, Dicolor, Focus Lightings, BOE, Innolux, TCL, and Sony.