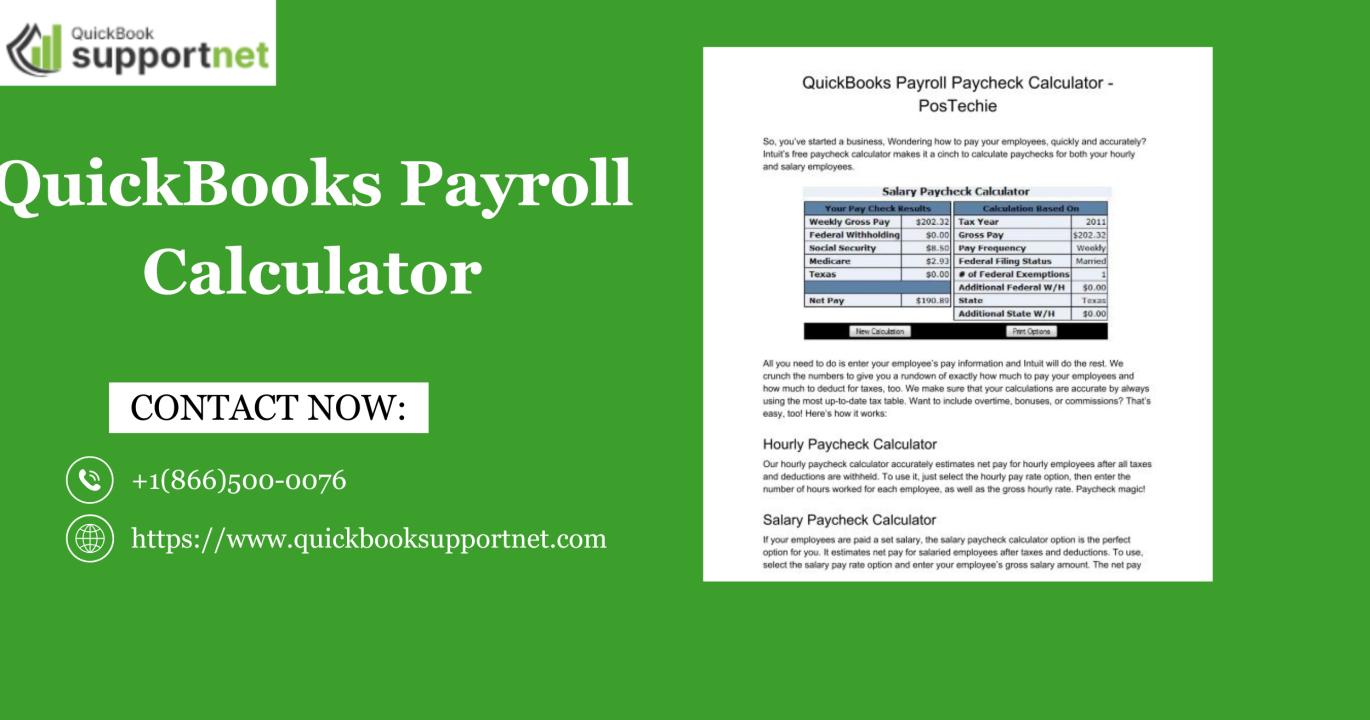

Managing payroll can feel overwhelming, but with the QuickBooks Payroll Calculator (also known as the quickbooks paycheck calculator or payroll calculator quickbooks), you can simplify the process. Whether you’re calculating employee wages, deductions, or taxes, the quickbooks free payroll calculator ensures accuracy and saves time. In this guide, we’ll walk you through how to use the intuit quickbooks payroll calculator step by step, so you can handle payroll like a pro.

Master QuickBooks Payroll Calculator in 7 steps. Learn paycheck, tax & salary calculations. Call +1(866)500-0076 today.

Why Use the QuickBooks Payroll Calculator?

The quickbooks payroll tax calculator is designed to help small businesses and accountants streamline payroll tasks. Here’s why it’s a game-changer:

Accuracy: Eliminates manual errors in paycheck calculations.

Efficiency: Saves hours of work by automating payroll.

Compliance: Keeps you aligned with tax regulations.

Flexibility: Works for hourly, salaried, and contract employees.

Whether you’re using the quickbooks online payroll calculator or the QB payroll calculator, the tool ensures every paycheck is correct.

Step-by-Step Guide to Using the QuickBooks Payroll Calculator

Step 1: Access the Calculator

Log in to QuickBooks Online.

Navigate to the payroll section.

Select paycheck calculator quickbooks or quickbooks salary paycheck calculator depending on your needs.

Step 2: Enter Employee Information

Input employee name and pay schedule.

Choose whether they are hourly or salaried.

For contractors, use the payroll calculator in QB option.

Step 3: Add Pay Details

Enter hours worked or salary amount.

Include overtime, bonuses, or commissions.

The intuit quickbooks paycheck calculator automatically adjusts totals.

Step 4: Apply Deductions

Add health insurance, retirement contributions, or other deductions.

The quickbooks payroll tax calculator ensures taxes are calculated correctly.

Step 5: Review Tax Withholdings

Federal, state, and local taxes are calculated automatically.

Verify accuracy using the quickbooks free payroll calculator.

Step 6: Preview Paycheck

The paycheck calculator quickbooks displays net pay after deductions.

Review for accuracy before finalizing.

Step 7: Save or Print

Save the paycheck in QuickBooks.

Print or email pay stubs directly to employees.

Benefits of QuickBooks Payroll Calculator

Time-Saving: Automates repetitive payroll tasks.

Error-Free: Reduces mistakes compared to manual calculations.

Scalable: Works for small businesses and growing teams.

Accessible: Available online as the quickbooks online payroll calculator.

Pro Tips for Using QuickBooks Payroll Calculator

Always double-check employee tax information.

Use the QB payroll calculator regularly to stay compliant.

Keep employee records updated for accurate calculations.

Take advantage of the quickbooks salary paycheck calculator for salaried staff.

Conclusion

The QuickBooks Payroll Calculator is more than just a tool—it’s a payroll solution that ensures accuracy, compliance, and efficiency. Whether you’re using the intuit quickbooks payroll calculator or the quickbooks online payroll calculator, following these steps will help you manage payroll seamlessly.

If you need additional QuickBooks services, such as Change Primary Admin in QuickBooks Online, professional support is available at +1(866)500-0076.

FAQs

Q1: Is the QuickBooks Payroll Calculator free to use?

Yes, the quickbooks free payroll calculator is available online for basic paycheck calculations.

Q2: Can I calculate taxes with QuickBooks Payroll Calculator?

Absolutely. The quickbooks payroll tax calculator automatically applies federal, state, and local taxes.

Q3: Does QuickBooks Payroll Calculator work for contractors?

Yes, you can use the payroll calculator in QB for contractors and freelancers.

Q4: How accurate is the QuickBooks Paycheck Calculator?

The intuit quickbooks paycheck calculator is highly accurate, provided employee details are entered correctly.

Q5: Can I access QuickBooks Payroll Calculator on mobile?

Yes, the quickbooks online payroll calculator is accessible via mobile devices.

Read Also:- QuickBooks 1099 Forms