Managing finances manually is time-consuming and prone to errors. In 2026, automation is no longer optional—it’s essential. When you connect bank and credit card accounts to QuickBooks Online, you unlock real-time financial visibility, faster reconciliation, and stress-free bookkeeping. This guide explains everything you need to know, step by step, to connect your accounts securely and correctly in QuickBooks Online 2026.

Learn how to connect bank and credit card accounts to QuickBooks Online 2026 for faster bookkeeping and error-free tracking. Call +1(866)500-0076

Whether you are a small business owner, accountant, or startup founder, this blog will help you set up bank feeds the right way and avoid common mistakes that slow down your accounting workflow.

Why You Should Connect Bank and Credit Card Accounts to QuickBooks Online

QuickBooks Online 2026 is designed to automate daily accounting tasks. By linking your bank and credit card accounts, you gain several powerful benefits:

- Automatic transaction downloads updated daily

- Reduced data entry errors and manual work

- Faster bank reconciliation

- Accurate cash flow tracking

- Real-time financial reports

When you connect bank and credit card accounts to QuickBooks Online, your books stay updated without constant manual intervention.

What You Need Before Connecting Accounts

Before you start, make sure you have the following ready:

- Active QuickBooks Online 2026 subscription

- Online banking login credentials

- Stable internet connection

- Admin or master admin access in QuickBooks

Having these prepared will make the setup smooth and error-free.

Step-by-Step: Connect Bank & Credit Cards to QuickBooks Online 2026

Follow these simple steps to link your financial accounts:

Step 1: Log in to QuickBooks Online

Sign in using your admin credentials.

Step 2: Go to Banking Menu

- Click Transactions

- Select Banking or Bank Transactions

Step 3: Add Your Bank or Credit Card

- Click Link account

- Search for your bank or credit card provider

- Choose the correct institution

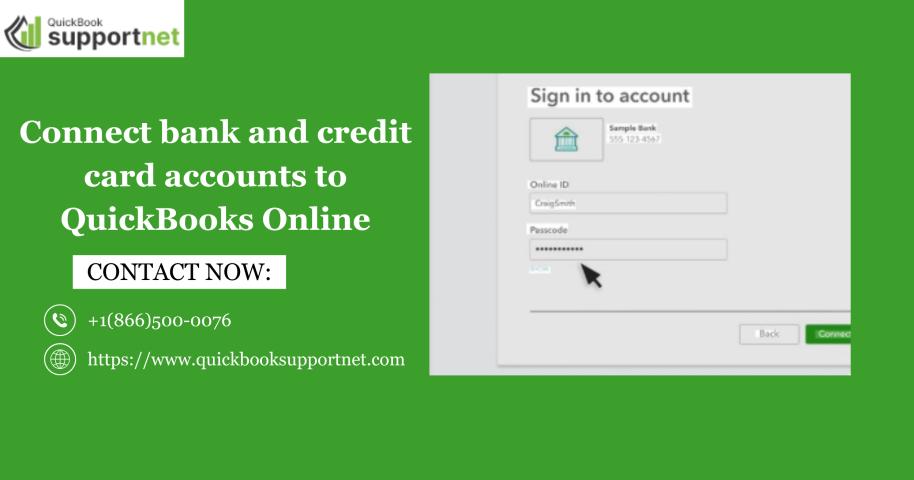

Step 4: Enter Banking Credentials

Use the same username and password you use for online banking.

Step 5: Select Accounts

- Choose the bank or credit card account

- Match it with the correct QuickBooks account

- Select the date range for transactions

Step 6: Click Connect

QuickBooks will securely connect and start importing transactions automatically.

That’s it. You’ve successfully completed the process to connect bank and credit card accounts to QuickBooks Online in 2026.

How QuickBooks Handles Imported Transactions

Once connected, QuickBooks automatically:

- Downloads new transactions daily

- Applies bank rules to categorize entries

- Suggests matches for existing records

- Flags duplicates to prevent errors

You can review, approve, or modify transactions before adding them to your books.

Best Practices for Accurate Bank Feeds

To get the most out of your connected accounts, follow these best practices:

- Create bank rules for recurring expenses

- Review transactions weekly, not monthly

- Reconcile accounts regularly

- Match transactions carefully to avoid duplicates

- Disconnect unused accounts to keep data clean

Midway through your bookkeeping process, regularly checking how you connect bank and credit card accounts to QuickBooks Online ensures long-term accuracy.

Common Errors and How to Fix Them

Even with automation, users may face issues. Here are common problems and solutions:

Bank Not Connecting

- Double-check login credentials

- Ensure your bank supports QuickBooks

- Try connecting in incognito mode

Duplicate Transactions

- Avoid manual entry for connected accounts

- Use the match feature during reconciliation

Missing Transactions

- Check the selected date range

- Refresh bank feeds

- Reconnect the account if needed

Security & Data Protection in QuickBooks Online 2026

QuickBooks Online uses advanced encryption and secure connections to protect your financial data. When you connect bank and credit card accounts:

- Credentials are encrypted

- Data is read-only

- Transactions are securely imported

- No one can move money through QuickBooks

This makes QuickBooks Online 2026 a trusted platform for modern businesses.

Who Should Use Bank & Credit Card Integration

This feature is ideal for:

- Small and medium businesses

- Freelancers and consultants

- Ecommerce sellers

- Accountants and bookkeepers

- Startups tracking cash flow

If accuracy, speed, and compliance matter to you, account integration is a must.

Conclusion

Connecting your bank and credit card accounts to QuickBooks Online 2026 is one of the smartest steps you can take toward efficient financial management. It saves time, minimizes errors, and gives you real-time insights into your business performance.

Beyond bank feeds, businesses often need expert help with advanced services like Set up Chart of Accounts in QuickBooks and managing a QuickBooks Payroll Subscription to ensure full compliance and scalability. With the right setup, QuickBooks becomes a powerful financial command center for your business.

FAQs

1. Is it safe to connect bank and credit card accounts to QuickBooks Online?

Yes, QuickBooks uses bank-level encryption and read-only access to ensure complete security.

2. How often does QuickBooks update bank transactions?

Most banks update transactions automatically every 24 hours.

3. Can I connect multiple bank and credit card accounts?

Yes, QuickBooks Online 2026 allows you to connect multiple accounts without limits.

4. What if my bank is not listed in QuickBooks?

You can upload transactions manually using CSV files as an alternative.

5. Do I need an accountant to connect my accounts?

No, the process is user-friendly, but professional help can ensure correct setup and categorization.