Keeping payroll accurate and compliant is one of the most critical responsibilities for any business. With changing tax laws and annual updates, payroll software must stay current to avoid calculation errors and penalties. Many businesses rely on QuickBooks to manage payroll efficiently, but missing updates can lead to costly mistakes. That’s why understanding the QuickBooks Payroll Tax Table Update Download process is essential for 2026 and beyond.

QuickBooks Payroll Tax Table Update Download guide for 2026. Step-by-step instructions, common fixes, and payroll update solutions. Call +1-866-500-0076.

What Are QuickBooks Payroll Tax Tables?

QuickBooks payroll tax tables contain up-to-date federal, state, and local tax rates used to calculate employee withholdings. These tables include Social Security, Medicare, federal income tax, and state-specific deductions.

When Intuit releases changes, businesses must install the QuickBooks payroll tax table update download to ensure payroll calculations remain accurate. Without these updates, paychecks may reflect outdated tax rates, creating compliance risks.

QuickBooks payroll tax tables are updated regularly, sometimes multiple times a year, depending on legislative changes.

Why Payroll Tax Table Updates Matter in 2026

Tax regulations evolve frequently, especially with inflation adjustments, state-level changes, and federal policy updates. Using the latest payroll update QuickBooks desktop version ensures:

Accurate employee paychecks

Correct employer tax liabilities

Compliance with IRS and state agencies

Reduced risk of penalties and amended filings

Ignoring updates may result in incorrect payroll reports, mismatched tax filings, and unnecessary audits.

How to Check the Current QuickBooks Tax Table Version

Before downloading updates, it’s important to verify your existing version.

Steps to Check Tax Table Version:

Open QuickBooks Desktop

Go to Employees > Payroll Center

Select Payroll Updates

Check the displayed current QuickBooks tax table version

Comparing your version with the latest release ensures you know whether an update is required.

QuickBooks Payroll Tax Table Update Download: Step-by-Step

Follow these steps to complete the update successfully:

Step 1: Verify Payroll Subscription

Ensure your payroll subscription is active. Expired subscriptions often cause the QuickBooks payroll tax table not updating issue.

Step 2: Backup Company File

Always back up your data before installing updates to prevent data loss.

Step 3: Download the Update

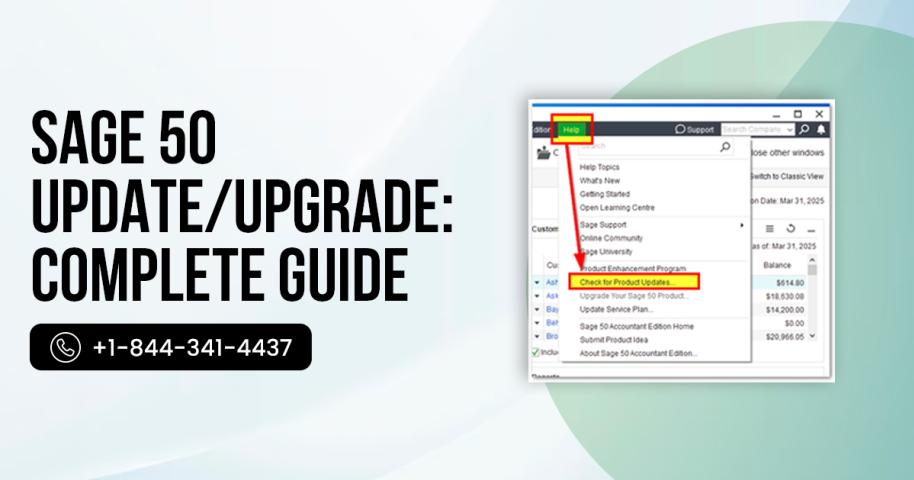

Open QuickBooks Desktop

Navigate to Employees > Get Payroll Updates

Check Download Entire Update

Click Download Latest Update

Once completed, QuickBooks will confirm successful installation.

QuickBooks Desktop Payroll Tax Table Update Tips

When performing a QuickBooks desktop payroll tax table update, ensure:

QuickBooks is updated to the latest release

Windows firewall allows QuickBooks access

Internet connection is stable

These precautions help prevent installation failures and incomplete downloads.

Common Payroll Update Errors and Fixes

Many users experience issues such as QuickBooks payroll tax table update not working or partial downloads. Below are common causes and solutions.

1. QuickBooks Payroll Tax Table Not Updating

Possible causes:

Expired payroll subscription

Corrupt update files

Outdated QuickBooks version

Solution: Update QuickBooks Desktop first, then retry the payroll update.

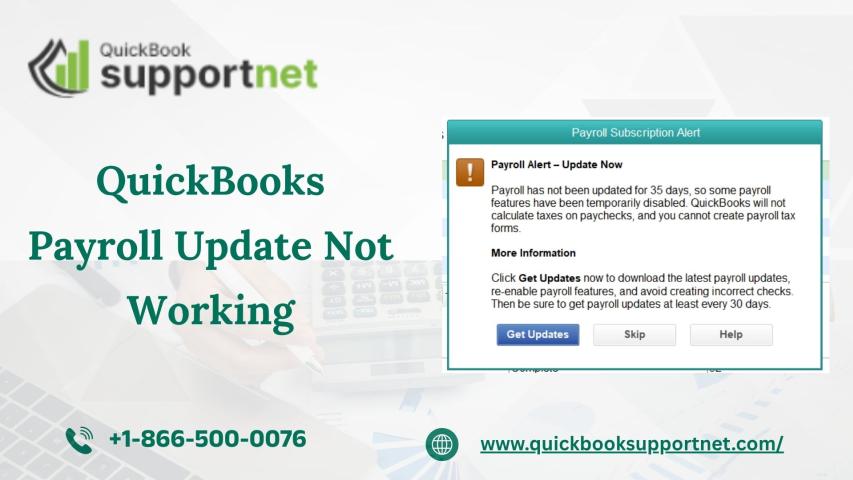

2. QuickBooks Payroll Update Not Working

This issue may occur due to security software blocking the update.

Fix: Temporarily disable antivirus/firewall and reattempt the update.

3. QuickBooks Tax Table Not Updating Error

Run QuickBooks as an administrator and verify company file integrity using the Verify Data tool.

These steps resolve most QuickBooks payroll update problems without advanced troubleshooting.

Troubleshooting Advanced Payroll Update Problems

If errors persist after basic fixes:

Use the QuickBooks Tool Hub

Repair QuickBooks installation

Manually install payroll updates

Re-register QuickBooks payroll files

Persistent errors may require professional assistance to avoid payroll disruptions. For immediate help, call +1-866-500-0076 to speak with certified QuickBooks payroll experts.

Manual Payroll Tax Table Update Method

In rare cases, a manual installation is required.

Manual Update Steps:

Close QuickBooks

Download payroll update file from Intuit

Save it to your desktop

Open QuickBooks and install manually

Manual updates are especially useful when internet restrictions prevent automatic downloads.

Best Practices for Managing Payroll Updates

To avoid recurring payroll update issues:

Schedule regular update checks

Enable automatic updates

Maintain active payroll subscription

Perform updates outside payroll processing hours

Proactive management reduces last-minute payroll delays and errors.

Beyond payroll updates, businesses often need help with year-end reporting. If you’re preparing contractor filings, you may find this guide helpful: Print form 1099 and 1096 in QuickBooks Deskop This resource walks you through accurate tax form printing and compliance.

Staying Compliant Throughout 2026

With evolving tax laws, consistent updates are non-negotiable. Ensuring your QuickBooks Payroll Tax Table Update is current protects your business from fines and compliance errors. Regular updates also improve system performance and payroll accuracy.

If you encounter complex issues or need expert guidance, trusted professionals are available at +1-866-500-0076 to assist with payroll setup, updates, and troubleshooting.

Conclusion

Successfully managing payroll in 2026 requires attention to detail and timely updates. Completing the QuickBooks Payroll Tax Table Update Download ensures accurate tax calculations, compliant filings, and smooth payroll operations. From checking your current QuickBooks tax table version to resolving update errors, following the steps outlined in this guide will help you avoid common pitfalls.

For ongoing support, advanced troubleshooting, or professional payroll assistance, call +1-866-500-0076 to connect with experienced QuickBooks specialists who can keep your payroll running smoothly year-round.

Read Also: QuickBooks Form 941 Explained: Common Errors and Easy Solutions