Life Insurance Corporation of India (LIC) has been a cornerstone of

financial security for millions of Indians. With the rise of digital platforms,

LIC has made it easier for policyholders to manage their policies online

through the LIC Customer Portal Login. This portal allows

users to view policy details, pay premiums, track claims, and access other

services from the comfort of their homes. In this comprehensive guide, we cover

everything you need to know about logging in, features, benefits, and tips to

make the most of the LIC online portal.

What is the LIC Customer Portal?

The LIC Customer Portal is an official online platform

provided by LIC to policyholders, enabling digital access to various insurance

services. The portal is designed to simplify policy management and reduce the

need for in-person visits to LIC branches. With a secure login, users can

manage policies, premiums, and claims efficiently.

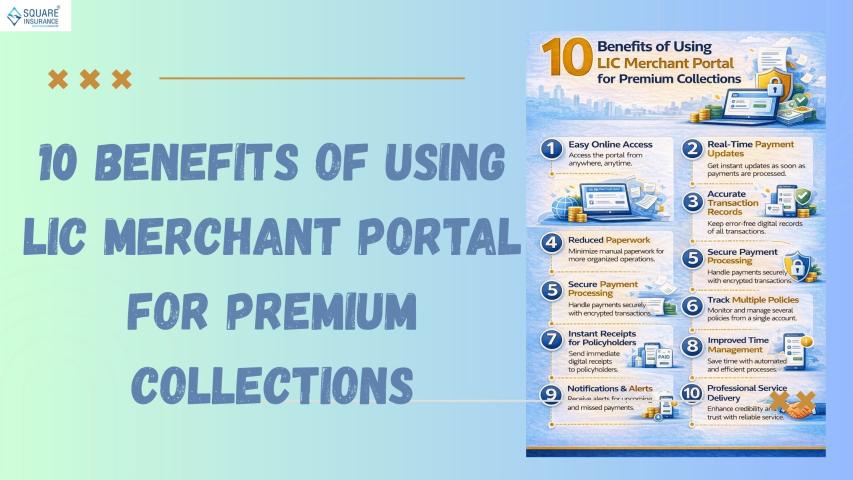

Benefits of Using the LIC Customer Portal

1. Easy Policy Management

Through the portal, policyholders can view their policy details, including

maturity dates, sum assured, premium status, and coverage details.

2. Online Premium Payments

The LIC portal allows for hassle-free premium payment using multiple

options, such as net banking, debit/credit cards, or UPI. Timely payments help

avoid policy lapses and maintain continuous coverage.

3. Track Claims and Maturity Benefits

Users can track the status of claims and maturity benefits, ensuring

transparency and reducing dependency on branch visits.

4. Access Policy Documents

The portal provides easy access to digital copies of policy documents,

premium receipts, and other relevant certificates, eliminating the need for

physical paperwork.

5. Notifications and Alerts

Policyholders receive timely reminders about premium due dates, policy

renewals, and other important updates, helping maintain uninterrupted coverage.

How to Register for LIC Customer Portal Login

Step 1: Visit the LIC Portal

Open the official LIC website and navigate to the customer login section.

Step 2: New User Registration

Click on the “New User? Register” option. Enter your policy number, date of

birth, and premium details as required.

Step 3: Create User ID and Password

After validating your policy details, create a unique User ID and password

for your account. Ensure that your password is strong and secure.

Step 4: Verification

LIC may send an OTP to your registered mobile number or email for

verification. Enter the OTP to complete the registration process.

Step 5: Login

Once registered, enter your User ID and password to access your LIC Customer

Portal account.

Key Features of LIC Online Portal

1. Policy

Summary – Quick view of all active policies and key details.

2. Premium

Payment – Pay online and download receipts instantly.

3. Claims

Status – Track ongoing claims or maturity claims easily.

4. Nominee

Updates – Update nominee details online without visiting a branch.

5. Policy

Servicing Requests – Raise requests for address change, payment mode

change, or policy endorsement.

6. Digital

Documents – Access premium receipts, policy contracts, and

endorsements.

7. Renewals

& Installments – Renew policies and manage installment payments.

Security Measures on LIC Customer Portal

LIC ensures that all transactions and account details on the portal are

secure. Some of the security measures include:

·

OTP verification for login and key actions

·

Two-factor authentication for sensitive

transactions

·

Secure encryption protocols for payment and data

storage

·

Regular monitoring and alerts for suspicious

activities

Policyholders are advised to never share login credentials and to use

official channels only.

Tips for Using the LIC Customer Portal Effectively

1. Keep

your registered mobile number and email updated for OTPs and notifications.

2. Regularly

check your policy details and payment status to avoid lapses.

3. Use

strong and unique passwords for the portal.

4. Download

and store policy documents digitally for future reference.

5. Use

the portal to raise service requests before visiting the branch, saving time

and effort.

Common Issues and Troubleshooting

·

Forgot Password: Use the

“Forgot Password” link to reset your password using your registered mobile or

email.

·

Login Failure: Ensure you are

entering the correct User ID, password, and captcha. Clear browser cache if

needed.

·

Policy Not Found: Check that

you have entered the correct policy number and date of birth. Contact LIC

support if the issue persists.

·

Payment Issues: Verify payment

method details and retry; if the problem continues, contact the LIC helpdesk.

Conclusion

The LIC Customer Portal Login is a game-changer for

policyholders seeking convenience, transparency, and efficiency in managing

their life insurance policies. By using the portal, policyholders can monitor

their policies, pay premiums, track claims, and access important documents with

ease. For personalized guidance on policy management, premium payments, or

financial planning, Square Insurance offers expert solutions

to help you make informed decisions and protect your financial future.

Frequently Asked Questions

Q1. What is the LIC Customer Portal Login?

The LIC Customer Portal is an official online platform for policyholders to

manage policies, pay premiums, and track claims digitally.

Q2. How do I register on the LIC Customer Portal?

Visit the official LIC website, click on “New User? Register,” enter your

policy details, create a User ID and password, verify using OTP, and login.

Q3. Can I pay my LIC premium online through the portal?

Yes, the portal supports online premium payments via net banking, debit/credit

cards, or UPI.

Q4. Is the LIC portal secure for transactions?

Yes, the portal uses OTP verification, encryption, and two-factor

authentication to ensure secure access and transactions.

Q5. Can I access my policy documents digitally?

Yes, the LIC portal provides access to policy contracts, premium receipts, and

endorsements in digital format.