Butyl Rubber Prices have been under noticeable pressure during Q3 2025, reflecting broader economic challenges and weaker demand across several key industries. Around the world, prices have generally moved downward, with most regions reporting declines ranging from about 2% to 2.5%. This overall softening trend has not been driven by a single factor, but rather by a combination of slow demand, surplus supply in certain regions, and uncertainty in global trade and economic conditions.

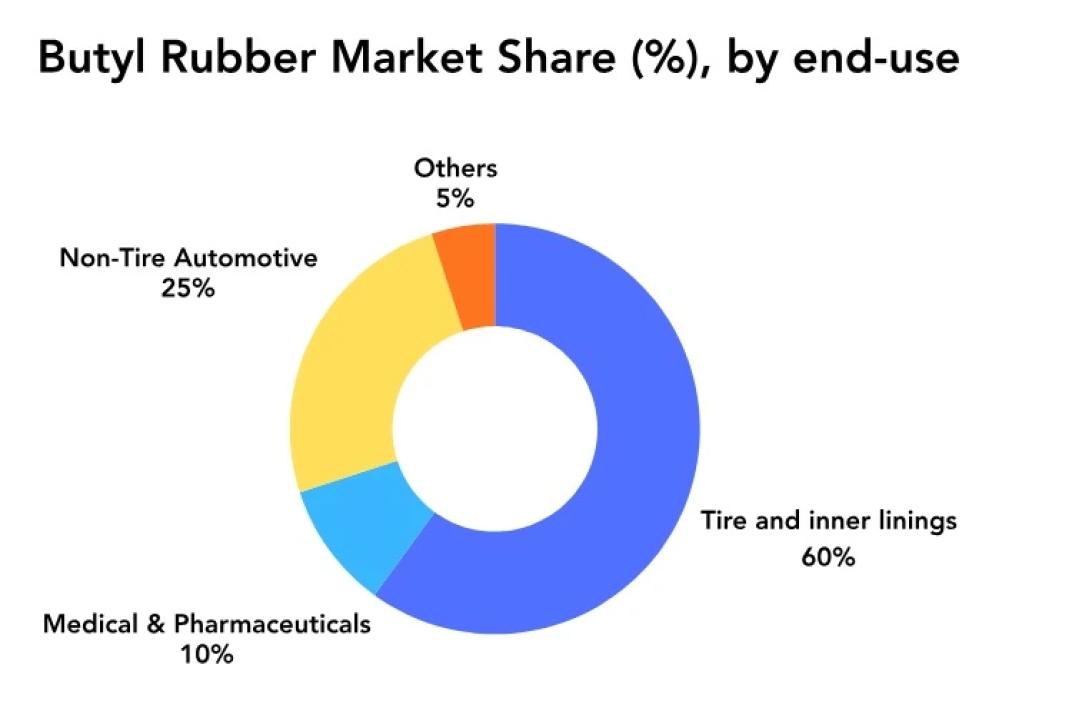

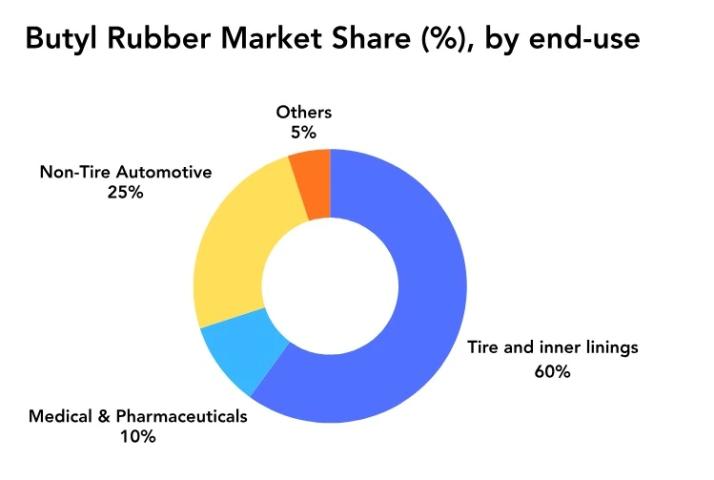

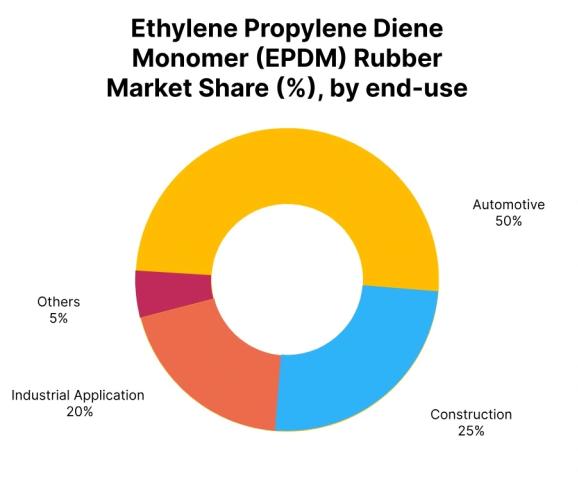

Butyl rubber is widely used in industries such as automotive manufacturing, industrial production, construction, and tire making. When these sectors slow down, the effect quickly shows up in pricing. During Q3 2025, many of these industries experienced reduced activity, leading buyers to delay purchases or reduce volumes. As a result, suppliers faced growing pressure to adjust prices in order to stay competitive.

Another important influence on Butyl Rubber Prices has been the fluctuation in raw material costs, especially for inputs like butadiene. While production levels in many regions remained relatively stable, the combination of uneven raw material pricing and weaker downstream demand created a market environment where prices struggled to hold firm. In addition, shifts in global supply chains and the availability of material in certain markets added to the softness.

Overall, the global market mood during Q3 2025 has been cautious. Producers, traders, and buyers alike have been closely watching demand signals, inventory levels, and economic indicators, hoping for signs that the market may stabilize. However, by the end of the quarter and moving into September 2025, many regions continued to experience further price declines, suggesting that the challenges were not yet over.

Please Submit Your Query For Butyl Rubber Price Trend, Market Analysis and Forecast: https://www.price-watch.ai/book-a-demo/

Singapore Market Overview

In Singapore, Butyl Rubber Prices followed a clear downward trend throughout Q3 2025. Export prices for Grade MV 51, based on FOB Jurong, declined by around 3% during the quarter. Prices were generally reported in the range of 1860 to 1900 USD per metric ton. This drop was mainly linked to weaker demand and changing global supply and demand conditions.

Despite stable production levels in the region, demand from major consuming sectors remained subdued. Buyers were cautious, and many preferred to purchase only what was necessary. Raw material price volatility, particularly related to butadiene, also played a role in shaping market sentiment. By September 2025, prices in Singapore fell by an additional 3%, extending the bearish trend and signaling that market pressure remained strong with limited signs of short-term recovery.

United States Market Conditions

The United States also saw declining Butyl Rubber Prices during Q3 2025. Export prices from Houston for Grade MV 51 dropped by about 3% over the quarter. Reduced demand from key industries such as automotive and manufacturing weighed heavily on the market. Global market shifts and supply chain adjustments further added to the downward pressure.

The broader economic environment in the US contributed to cautious buying behavior. Even though production continued, the imbalance between supply and demand made it difficult for prices to stabilize. In September 2025, prices fell by another 2% compared to August, confirming that the softness seen during Q3 had carried forward. Overall, the US market remained under pressure, with little expectation of a quick rebound.

Russia’s Market Situation

In Russia, Butyl Rubber Prices experienced one of the steeper declines during Q3 2025. Export prices from Novorossiysk for MV grades fell by around 3.5%. Weak demand, combined with regional economic pressures, played a major role in this decline. While production remained steady, consumption from key sectors was lower than expected.

Raw material cost fluctuations and regional supply-demand imbalances added to market challenges. By September 2025, prices slipped by an additional 1%, continuing the downward trend. The Russian market faced ongoing difficulties, and the outlook suggested prolonged pressure with limited chances of immediate improvement.

Indian Market Trends

In India, the decline in Butyl Rubber Prices was more moderate compared to other regions. During Q3 2025, domestically traded prices at Ex-Jamnagar fell by about 1%. Weak domestic demand and slower economic activity were key reasons behind this decline. Many industries reduced their consumption, leading to lower buying interest.

Raw material price changes and production capacity factors also influenced pricing. In September 2025, prices dropped by another 1%, showing that the downward trend was still present. Although the declines were smaller, the persistent weakness highlighted ongoing challenges in the Indian market. The overall outlook remained uncertain, with no strong signals pointing toward recovery.

Thailand’s Import Market

Thailand’s Butyl Rubber Prices, based on CIF Laem Chabang imports from Singapore, declined by around 3% during Q3 2025. The market faced soft demand from key industries, even though supply remained stable. This imbalance put continuous pressure on prices.

Global supply chain disruptions and raw material cost movements added to market uncertainty. By September 2025, prices fell by another 3%, reinforcing the negative trend. Market conditions in Thailand remained unfavorable, and short-term recovery appeared unlikely.

Vietnam’s Market Performance

Vietnam experienced one of the sharper declines in Butyl Rubber Prices during Q3 2025, with prices dropping by about 3.5% on a CIF Haiphong basis. Weak demand from manufacturing and industrial sectors was a major factor. Even with stable production, the lack of strong buying interest kept prices under pressure.

Economic uncertainties and global market changes further affected sentiment. In September 2025, prices declined by an additional 3%, signaling continued struggles. The Vietnamese market remained challenging, with persistent supply-demand imbalances and no immediate signs of improvement.

Mexico’s Import Trends

In Mexico, Butyl Rubber Prices imported from the USA via CIF Manzanillo declined by around 3% during Q3 2025. Reduced demand from major sectors and global economic fluctuations played a central role in the price drop. Surplus supply also contributed to the downward movement.

By September 2025, prices decreased by another 2%, showing that the market pressure was ongoing. Weak demand and uncertain global conditions continued to limit recovery prospects, making the near-term outlook challenging for market participants.

Brazil’s Market Outlook

Brazil also saw declining Butyl Rubber Prices during Q3 2025, with prices falling by approximately 2.5% on a CIF Santos basis. Weak domestic demand, economic slowdown, and changing global conditions all influenced the market. Despite steady production, consumption remained low.

In September 2025, prices dropped by an additional 2%, extending the bearish trend. The Brazilian market remained under pressure, with limited expectations for short-term improvement as economic challenges persisted.

Overall Market Sentiment

Across regions, Butyl Rubber Prices in Q3 2025 reflected a market struggling with weak demand, economic uncertainty, and supply-demand imbalances. While production levels were mostly stable, consumption failed to keep pace, leading to widespread price declines. As markets moved into September, the continued downward movement showed that recovery was not yet in sight.

For now, stakeholders across the global butyl rubber market remain cautious, closely watching economic signals and demand trends. Until stronger demand returns from key industries, Butyl Rubber Prices are likely to remain under pressure, with stability depending on broader improvements in global economic conditions.

Please Submit Your Query For Butyl Rubber Price Trend, Market Analysis and Forecast: https://www.price-watch.ai/book-a-demo/

About Price Watch™ AI

Price-Watch AI is an India-based, independent raw material price reporting agency that provides real-time price forecasts and data-driven insights into global raw material markets. Price-Watch AI specializes in tracking raw material prices, analyzing market trends, and delivering timely updates on plant shutdowns, supply disruptions, capacity expansions, and demand-supply dynamics. The Price-Watch AI platform empowers manufacturers, traders, and procurement professionals to make faster, smarter decisions. Leveraging AI-powered forecasting and over a decade of historical data, Price-Watch AI transforms market volatility into actionable opportunity.

Futura Tech Park,

C Block, 8th floor 334,

Old Mahabalipuram Road,

Sholinganallur, Chennai, Tamil Nadu, Pincode - 600119.

𝐋𝐢𝐧𝐤𝐞𝐝𝐈𝐧: https://www.linkedin.com/company/price-watch-ai/

𝐅𝐚𝐜𝐞𝐛𝐨𝐨𝐤: https://www.facebook.com/people//61568490385598/

𝐓𝐰𝐢𝐭𝐭𝐞𝐫: https://x.com/pricewatchai

𝐖𝐞𝐛𝐬𝐢𝐭𝐞: https://www.price-watch.ai/