Running a business means adapting to changes, and sometimes that includes updating your company's legal name. Whether you've rebranded, undergone a merger, or simply decided on a fresh identity, keeping your financial records accurate is crucial. If you're using QuickBooks to manage your accounting, you'll need to know how to change legal company name in QuickBooks properly. This comprehensive guide walks you through the entire process for both QuickBooks Desktop and QuickBooks Online, ensuring your financial data remains consistent and compliant.

Learn how to change legal company name in QuickBooks Desktop & Online with our step-by-step tutorial. Need help? Call +1(866)500-0076 for expert assistance today!

Many business owners hesitate to make this change, worried about disrupting their existing data or creating confusion in their records. The good news? QuickBooks makes this process straightforward when you follow the right steps. Let's dive into everything you need to know about updating your company name in both versions of QuickBooks.

Why You Might Need to Change Your Legal Company Name

Before we get into the technical steps, let's understand common scenarios that necessitate a name change:

- Business Rebranding: You've decided to refresh your market presence with a new identity

- Legal Entity Changes: Converting from an LLC to a Corporation or vice versa

- Mergers and Acquisitions: Combining businesses under a unified name

- Spelling Corrections: Fixing errors that were made during initial setup

- Ownership Transfers: New ownership requiring a different business name

Whatever your reason, maintaining accuracy across all platforms—including QuickBooks—ensures professional consistency and legal compliance.

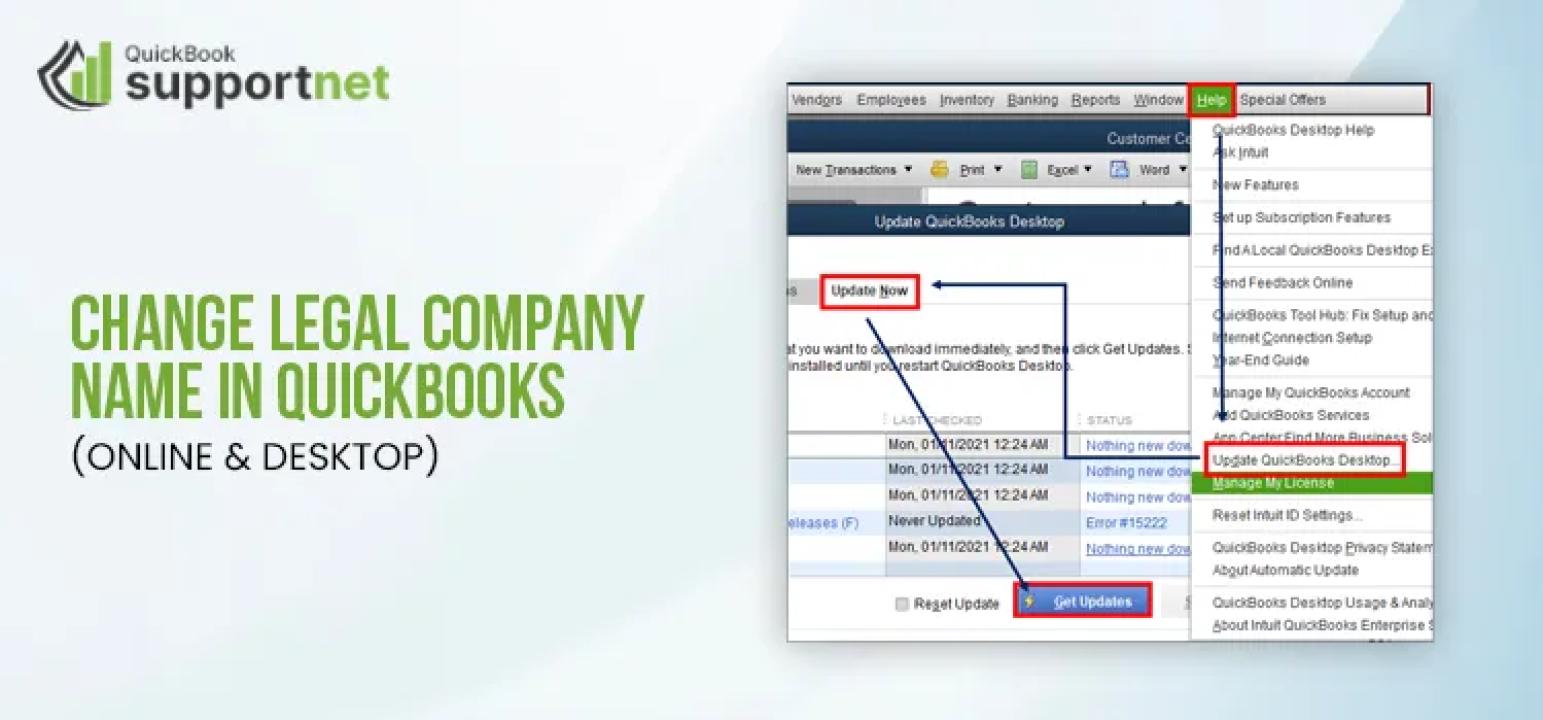

How to Change Legal Company Name in QuickBooks Desktop

QuickBooks Desktop users have a straightforward process for updating their company information. Here's your step-by-step roadmap:

Step 1: Create a Backup

Before making any changes, always create a backup of your company file. This safety net protects your data if anything goes wrong.

- Navigate to File in the top menu

- Select Back Up Company

- Choose Create Local Backup

- Follow the prompts and save your backup to a secure location

Step 2: Access Company Information

Now you're ready to make the actual change:

- Click on Company in the main menu bar

- Select My Company from the dropdown menu

- A window will appear displaying your current company information

Step 3: Update the Legal Name

- Click the Edit button (usually a pencil icon) in the top right corner

- Locate the Legal Name field

- Delete the old name and enter your new legal company name

- Make sure to update the Legal Address if that has changed as well

Step 4: Update Additional Information

While you're here, review and update these fields if necessary:

- DBA (Doing Business As) name

- Tax ID or EIN

- Contact information

- Email address

- Website

Step 5: Save Your Changes

- Click OK to save all modifications

- QuickBooks will apply the changes immediately

- Close the Company Information window

Important Considerations for Desktop Users

Your new company name will now appear on invoices, estimates, purchase orders, and reports generated after the change. However, historical documents will retain the original name unless you specifically edit them. This is actually beneficial for maintaining an accurate audit trail.

How to Change Legal Company Name in QuickBooks Online

QuickBooks Online follows a slightly different process, but it's equally simple. Here's what you need to do:

Step 1: Navigate to Account and Settings

- Click the Gear icon in the upper right corner

- Under "Your Company," select Account and Settings

Step 2: Access Company Information

- Click on the Company tab on the left sidebar

- You'll see your current company information displayed

Step 3: Edit the Legal Name

- Locate the Company name section

- Click the Edit button (pencil icon) next to it

- Update the Legal name field with your new business name

- You can also modify the Legal address here if needed

Step 4: Update Contact Details

In the same section, review and update:

- Company email

- Customer-facing email

- Company phone number

- Website address

Step 5: Save All Changes

- Click Save at the bottom of the section

- Click Done to exit Account and Settings

- Your changes are now active across your QuickBooks Online account

Additional Tips for QuickBooks Online Users

QuickBooks Online automatically applies your new company name to future transactions, invoices, and forms. Just like the desktop version, historical records maintain their original information for compliance and record-keeping purposes.

What Happens After You Change Your Company Name?

Understanding the impact of this change helps you manage expectations:

Immediate Changes:

- New invoices will display the updated name

- Sales receipts reflect the new legal entity

- Estimates show the modified business name

- Email communications from QuickBooks use the new name

What Stays the Same:

- Historical transactions maintain original name

- Past reports show the name that was current at the time

- Archived documents remain unchanged

- Bank reconciliation history stays intact

This dual approach ensures you maintain accurate historical records while presenting your current brand identity going forward.

Best Practices When Changing Your Company Name

To ensure a smooth transition, follow these professional recommendations:

Notify Stakeholders

- Inform clients and customers about the name change

- Update vendors and suppliers in your system

- Notify your bank and payment processors

- File necessary paperwork with state agencies

Update All Systems

- Change your name across all software platforms

- Update your website and social media profiles

- Revise email signatures and letterheads

- Order new business cards and marketing materials

Maintain Documentation

- Keep records of why and when the change occurred

- Document the legal process of your name change

- Store old and new business registration documents

- Maintain a transition timeline for reference

Review Tax Implications

- Consult with your accountant about tax reporting

- Ensure your EIN matches your new legal name

- Update Form W-9 for vendors and clients

- File appropriate forms with the IRS if required

Troubleshooting Common Issues

Sometimes you might encounter challenges when updating your company name. Here are solutions to frequent problems:

Can't Find the Edit Button? Make sure you have admin or master admin permissions in QuickBooks. Standard users typically cannot modify company information.

Changes Not Appearing on Forms? Refresh your browser or restart QuickBooks Desktop. Sometimes the system needs a moment to update templates.

Name Still Showing Incorrectly on Invoices? Check your invoice template customization settings. You might need to update custom templates separately.

Bank Feeds Not Working After Name Change? This rarely affects bank connections, but if it does, disconnect and reconnect your bank feed using your new credentials.

Conclusion

Changing your legal company name in QuickBooks—whether you're using Desktop or Online—is a manageable process that requires attention to detail but doesn't disrupt your existing data. By following the steps outlined in this guide, you can confidently update your business information while maintaining the integrity of your financial records.

Remember, this change is just one piece of your overall rebranding or restructuring puzzle. Coordinating your QuickBooks update with legal filings, bank notifications, and stakeholder communications ensures a professional and seamless transition.

Taking the time to do this correctly now saves headaches later and keeps your business operating smoothly throughout the transformation.

Frequently Asked Questions

Q1: Will changing my company name in QuickBooks affect my historical data?

No, your historical transactions, reports, and records will remain unchanged. Only new documents created after the change will display your updated company name. This preserves the accuracy of your financial history.

Q2: Do I need to notify the IRS when I change my company name in QuickBooks?

Yes, changing your name in QuickBooks is separate from legal name changes. You must file the appropriate paperwork with the IRS and your state business registration office. QuickBooks only updates your accounting software records.

Q3: Can I change my company name if I'm not the administrator?

No, only users with administrator or master admin permissions can modify company information in QuickBooks. Contact your account administrator if you need this change made.

Q4: How long does it take for the name change to appear on all documents?

The change is immediate in QuickBooks. However, you may need to refresh custom templates or restart the software. New invoices, estimates, and forms will reflect the updated name right away.

Q5: Will my customers see the new company name on their existing invoices?

Existing invoices that have already been sent will retain the original company name. Only newly created invoices will show your updated legal name. This helps maintain accurate records for both you and your customers.

Q6: Do I need to create a new QuickBooks account when changing my company name?

No, you don't need a new account. Simply update the company information within your existing QuickBooks Desktop or Online account using the steps provided in this guide.

Q7: What if I made a mistake and entered the wrong company name?

You can repeat the process to correct any errors. Simply follow the same steps to edit your company information again and enter the correct legal name.

Q8: Will this change affect my subscription or billing with QuickBooks?

No, changing your company name within QuickBooks does not impact your subscription, billing, or account status. Your subscription remains active under your login credentials.