It sounds fun to expand your business to new states in India, but it can be challenging to follow the rules. Giving a local address is one of the trickiest..

The Goods and Services Tax (GST) is one of the most important reforms in India’s taxation system. It replaced a mix of state and central taxes with a single unified..

Goods and Services Tax (GST),

implemented on July 1, 2017, has revolutionized the Indian indirect tax system

by replacing multiple taxes with one unified tax. One of the cornerstones of..

This article provides a comprehensive overview of Section 16(4) of the GST Act, highlighting key input tax credit (ITC) court judgments related to it. Section 16(4) offers a significant benefit..

Introduction to GST Return FilingGoods and Services Tax (GST) changed the way India does business. It's a unified indirect tax system, and if you're a registered business, filing your GST..

Thinking about starting a business or already have one? Then you've probably heard of GST registration. If the thought of dealing with taxes makes you want to run the other..

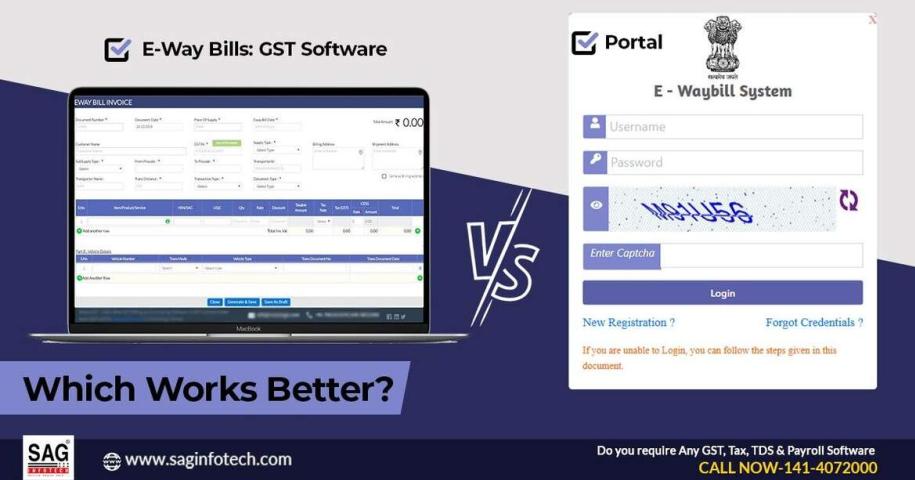

For businessmen with goods valued at over Rs 50,000, it is crucial to utilise the GST E-way bill system to effectively track the transportation of these goods. When considering the..

IntroductionWhat is GST?GST (Goods and Services Tax) is a unified, multi-stage, destination-based tax levied on every value addition in India. It replaced many indirect taxes and brought uniformity across the..

What is GST Return Filing?GST Return Filing is the process of submitting details of sales, purchases, and tax payments to the Government of India under the Goods and Services Tax..

If you are launching or operating a business in India, then you must have heard of GST, which stands for Goods and Services Tax. It is one of the most..