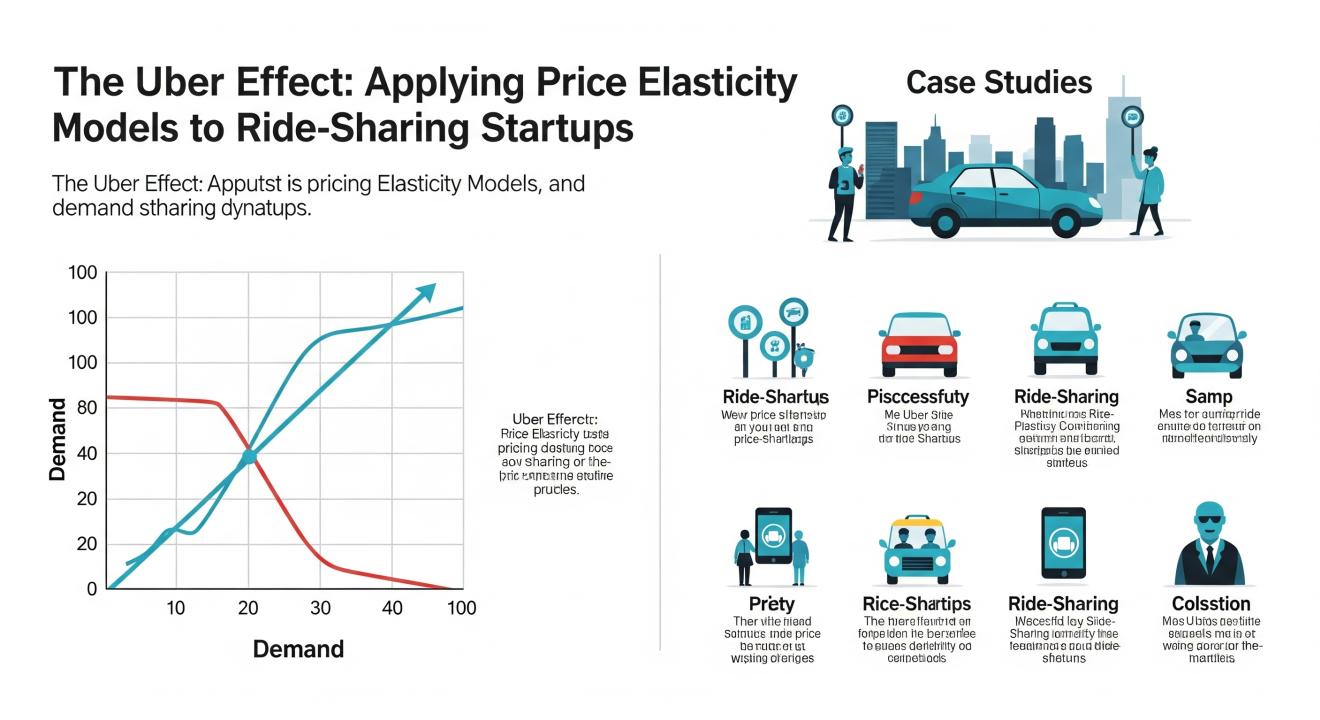

In the dynamic world of modern economics, few companies have disrupted traditional market structures as profoundly as Uber . Since its launch in 2009, Uber has transformed urban transportation by leveraging technology, data analytics, and innovative pricing strategies. One of the most significant economic concepts behind Uber’s success—and a key factor in its expansion into global markets—is price elasticity .

Price elasticity of demand measures how responsive the quantity demanded of a good or service is to changes in its price. In industries like ride-sharing, where supply fluctuates with demand and customer expectations evolve rapidly, understanding price elasticity is essential for sustainable business growth.

For students studying economics, especially those preparing assignments on market dynamics, analyzing the Uber effect provides an excellent case study of real-world applications of price elasticity models. Platforms offering economics coursework help often use Uber as a prime example to illustrate how startups can apply economic principles to scale effectively.

Let’s explore how ride-sharing startups—Uber included—leverage price elasticity to optimize revenue, enhance user engagement, and maintain competitive advantage in a crowded market.

Understanding Price Elasticity in the Context of Ride-Sharing

Before diving into the Uber effect, it's important to understand what price elasticity means in practical terms.

What Is Price Elasticity?

Price elasticity of demand (PED) quantifies the responsiveness of consumer demand to changes in price:

PED = % Change in Quantity Demanded / % Change in Price

If demand changes significantly with small price fluctuations, the product or service is considered elastic . If demand remains relatively stable despite price changes, it’s considered inelastic .

In ride-sharing, demand varies based on time, location, and urgency. This makes the application of price elasticity models not just relevant—but crucial for business strategy.

How Uber Pioneered Dynamic Pricing Using Elasticity Concepts

Uber’s pricing model is famously dynamic. It uses real-time algorithms to adjust prices based on current demand and available drivers. This approach, known as surge pricing , directly reflects an understanding of price elasticity.

Real-Time Demand Analysis

During peak hours, such as rush hour or after major events, Uber increases prices to balance supply and demand. This helps:

- Manage rider demand : Higher prices discourage non-essential rides.

- Attract more drivers : Increased earnings potential brings more drivers online1.

This system works because Uber understands that demand for rides isn't perfectly elastic—it has some inelastic characteristics during high-demand periods. People will still pay higher prices if they need to get somewhere urgently, making surge pricing effective.

Elasticity-Based Revenue Optimization

By continuously testing how users respond to price changes, Uber fine-tunes its pricing strategy to maximize revenue without driving customers away permanently. For instance, Uber may increase fares by 30% during peak times and observe whether demand drops by only 10%, indicating relatively inelastic demand .

This insight allows Uber to set optimal pricing points across different cities and time slots, ensuring both profitability and user retention.

The Broader Impact on Ride-Sharing Startups

The Uber effect refers not just to Uber’s market dominance but also to how it reshaped the industry’s approach to pricing, competition, and innovation. Many ride-sharing startups—from Lyft in the U.S. to Ola in India and Grab in Southeast Asia—have adopted similar elasticity-based models to manage their operations.

These companies face the same core challenge: how to maintain service quality while optimizing pricing strategies to remain competitive and profitable.

Case Study: Lyft’s Elasticity Strategy

Lyft, Uber’s primary competitor in North America, uses machine learning algorithms to predict demand patterns and adjust pricing accordingly. Like Uber, Lyft applies elasticity insights to:

- Optimize fare structures

- Improve driver incentives

- Balance ride availability

While Lyft’s algorithmic approach is slightly different from Uber’s, both companies rely heavily on elasticity analysis to stay ahead in the market

Regional Adaptation: Ola and Grab

In emerging markets like India and Southeast Asia, ride-sharing platforms must account for different consumer behavior patterns and income levels. These companies conduct localized elasticity studies to determine how much users are willing to pay during peak hours versus off-peak times.

Ola and Grab have found that in many urban centers, ride demand is more elastic than in Western markets—meaning even small price increases lead to a sharp drop in usage. As a result, these companies implement more conservative pricing adjustments to retain ridership

Why Price Elasticity Matters for Ride-Sharing Startups

Startups entering the ride-sharing space must understand the underlying economic forces shaping the market. Here’s why price elasticity is a critical tool for new entrants:

1. Demand Forecasting

Elasticity models help startups anticipate how riders will react to price changes. By analyzing historical data and user behavior, companies can better allocate resources and avoid overpricing—or underpricing—their services.

2. Revenue Management

Dynamic pricing allows ride-sharing firms to maximize revenue during high-demand periods. Startups that fail to incorporate elasticity into their pricing models risk losing market share or experiencing unsustainable losses during low-demand phases.

3. Competitive Positioning

Understanding how price-sensitive users are in different regions allows startups to position themselves strategically. For example, a startup might offer flat-rate pricing in areas where demand is highly elastic, ensuring consistent usage even at lower profit margins.

4. Regulatory Compliance

Governments in various jurisdictions are scrutinizing ride-sharing pricing models due to concerns about affordability and transparency. Companies that demonstrate a clear grasp of price elasticity and fair pricing practices are more likely to navigate regulatory hurdles successfully

Challenges in Implementing Elasticity-Based Pricing

Despite its strategic advantages, applying price elasticity models comes with several challenges:

1. Data Collection and Accuracy

To build accurate elasticity models, ride-sharing startups need access to vast amounts of real-time and historical data. This includes:

- User booking trends

- Driver availability

- Market-specific income levels

- Competitor pricing data

Without comprehensive datasets, startups risk misjudging demand responses and implementing flawed pricing strategies.

2. User Perception and Trust

Surge pricing can create backlash when users perceive it as unfair or unpredictable. Startups must balance economic efficiency with user experience , ensuring that pricing shifts feel justified and transparent.

3. Regional Variability

As seen in international markets, elasticity is not universal. Urban vs. rural settings, income levels, and cultural attitudes toward car ownership all influence how users respond to price changes

4. Competition and Market Saturation

New ride-sharing startups often enter markets already dominated by established players like Uber and Lyft. Without a deep understanding of local elasticity, they may struggle to compete effectively

Academic Relevance: Studying the Uber Effect

For economics students, the Uber effect offers a rich field for academic exploration. Universities increasingly assign case studies and research papers that examine how ride-sharing companies apply microeconomic theories like price elasticity to real-world business decisions.

However, many students find this topic complex due to the interplay between theory and practice. That’s where professional support becomes invaluable. Services offering academic writing services provide structured assistance in interpreting economic models and crafting well-researched, insightful assignments.

Whether you're exploring how Uber changed taxi license values

or analyzing regional elasticity differences , having expert guidance ensures your work meets academic standards and demonstrates a strong grasp of economic principles.

Real-World Application: How Students Can Use Elasticity Models in Assignments

Here’s how students can integrate price elasticity into their economics coursework using Uber as a reference point:

Research Topic 1: Analyzing Surge Pricing During Peak Hours

Use Uber’s surge pricing data to calculate elasticity coefficients. Compare different cities or time slots to see how demand responsiveness varies. Incorporate findings into reports or presentations.

Research Topic 2: Comparative Elasticity Between Ride-Sharing and Traditional Taxi Services

Study how the entry of Uber affected demand for traditional taxis. Use historical data to assess the decline in value of licensed taxicabs, linking this shift to changing consumer preferences and elasticity of demand.

Research Topic 3: Impact of Income Levels on Ride-Sharing Adoption

Explore how price sensitivity differs between developed and developing economies. Use elasticity models to explain why ride-sharing adoption rates vary across regions.

Research Topic 4: Policy Implications of Dynamic Pricing Models

Investigate how governments regulate ride-sharing pricing. Does regulation affect elasticity? What happens when surge pricing is banned in certain areas?

These topics not only deepen students’ understanding of economic theory but also provide real-world relevance that enhances academic performance.

Conclusion: Leveraging Economic Theory for Startup Success

The Uber effect has proven that price elasticity is not just a theoretical concept—it’s a powerful tool that shapes the success of ride-sharing startups worldwide. From surge pricing to regional adaptation, elasticity plays a central role in how companies manage demand, optimize revenue, and sustain growth.

For students navigating complex economic models and struggling to apply them to real-life scenarios, services like nursing paper help may seem unrelated—but they highlight a broader trend: students across disciplines increasingly rely on expert support to bridge knowledge gaps and improve assignment outcomes.

And for those specifically working on economics-related tasks, platforms offering economics coursework help provide tailored academic assistance that demystifies elasticity models and connects them to contemporary business practices.

Ultimately, understanding the Uber effect through the lens of price elasticity equips students with valuable insights into how modern startups operate—and how economic theory continues to shape the future of digital markets.

So whether you're analyzing Uber’s impact on traditional taxis or exploring how startups apply elasticity models to ride-sharing, remember: the goal is not just to understand the numbers—but to interpret their broader implications in a fast-evolving economic landscape.