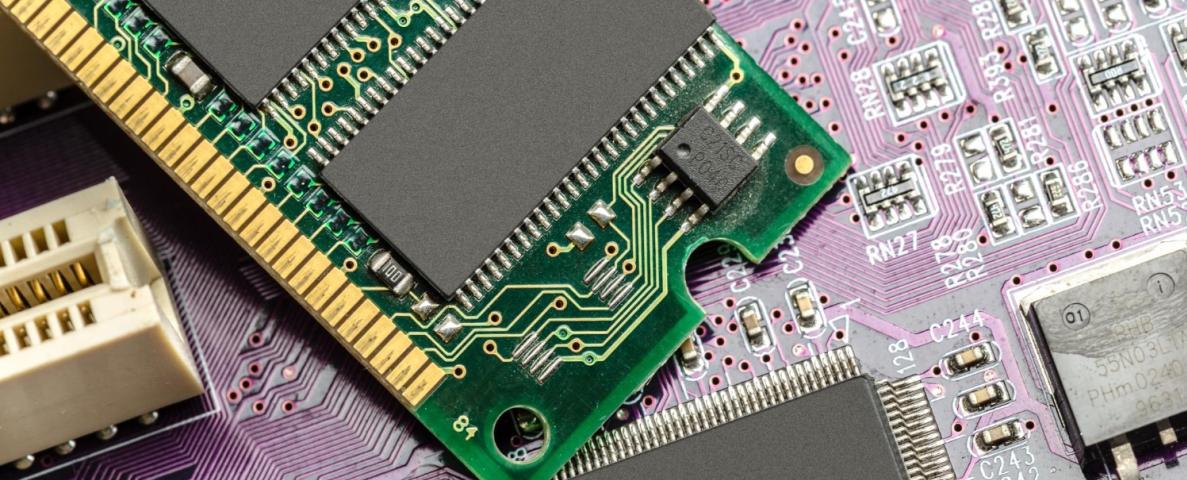

The NAND Flash Memory Market is a foundational pillar of the digital storage ecosystem—powering everything from smartphones and laptops to data centers and automotive systems. Valued at USD 68.5 billion in 2023, the market is expected to grow to USD 115.4 billion by 2033, advancing at a CAGR of approximately 5.8%.

Request Sample Report:

https://straitsresearch.com/report/nand-flash-memory-market/request-sample

Regional Trends (2021–2033)

-

Asia-Pacific dominated the NAND market in 2023, accounting for over 55% of global revenue. This dominance stems from its concentration of fabs, consumer electronics production, strong domestic demand, and government initiatives (e.g., China’s semiconductor push).

-

North America contributed roughly 20%, fueled by hyperscalers, SSD adoption in data centers and PCs, and strong OEM presence.

-

Europe held around 12%, with demand driven by industrial, automotive, and embedded systems. EV and industrial IoT adoption is boosting demand.

-

Latin America, Middle East & Africa accounted for the remaining share, growing gradually via smartphone penetration and IT infrastructure rollout.

Market Segmentation (2021–2033)

Unlock detailed coverage:

https://straitsresearch.com/report/nand-flash-memory-market

By Type (Cell Level)

-

SLC (Single-Level Cell): Highest performance and endurance, used in industrial storage and critical enterprise systems. Makes up ~3–4% of overall revenue.

-

MLC (Multi-Level Cell): Balances cost, capacity, and performance; widely used in consumer SSDs and enterprise tiers. Contributed ~22% in 2023.

-

TLC (Three-Level Cell): The leading segment (~58%), striking cost-performance balance and driving mainstream consumer SSD and smartphone adoption.

-

QLC (Quad-Level Cell): Fastest-growing cell type (~15% CAGR), gaining traction in high-capacity SSDs and cold/data-archival storage.

By Structure

-

2D NAND: Legacy planar technology that continues to serve low-cost and legacy applications; declining to ~15% of total by 2023.

-

3D NAND: The current mainstream standard, accounting for ~85% of the market due to higher capacity, improved endurance, and better pricing per gigabyte.

By Application

-

Smartphone & Mobile Phones: The single largest application segment (~35%) due to global smartphone shipments and increased image/video storage needs.

-

SSD (Client, Enterprise, Data Center): The largest cumulative category (~38%). Enterprise SSDs are seeing accelerating demand due to AI, cloud computing, and server consolidation.

-

Memory Card: SD and microSD used in cameras, drones, and industrial devices (~7%).

-

Tablet: Approximately 4%, driven by streaming and media usage.

-

Digital Still Camera (DSC) and Digital Video Camera (DVC): Legacy segments combining to ~2%.

-

USB Drive: Portable storage (~3% share).

-

Portable Media Player, Game Console, Other: Collectively ~11%; includes IoT devices, printers, and cartridges.

By Density

Storage demand has transitioned sharply from lower capacities:

| Density | 2023 | 2033 Projection |

|---|---|---|

| 512 MB – 4 GB | 8% | <5% |

| 8–32 GB | 42% | 25% |

| 64–128 GB | 30% | 20% |

| ≥256 GB | 20% | 50%+ |

High-density (256 GB+) NAND, particularly in SSDs, data centers, and premium smartphones, is the fastest-growing segment.

Top Players

Major NAND suppliers include:

-

Samsung Electronics Co. Ltd

-

KIOXIA Corporation

-

Cypress Semiconductor Corporation (Infineon)

-

Micron Technology Inc.

-

Intel Corporation (transitioning memory business)

-

Yangtze Memory Technologies (YMTC)

-

Powerchip Technology Corporation

-

SanDisk Corp. (Western Digital)

-

SK Hynix Inc.

These leaders control over 85% of global NAND capacity, investing heavily in 3D scaling, advanced process nodes, and specialized memory for automotive and industrial applications.

Market Drivers

-

Data Explosion & Content Creation: Digital consumption—streaming, gaming, AI, image/video—demands higher-capacity SSDs and mobile storage.

-

Enterprise & Cloud Growth: Hyperscalers and enterprises require dense, fast, and reliable storage for AI/ML workloads.

-

EV & Infotainment Systems: Automotive-grade NAND is used in instrument clusters, ADAS, and in-vehicle infotainment storage.

-

Mobile Photo/Video Trend: Rising camera resolutions and video formats (4K/8K) require 256 GB+ capacities in smartphones.

-

Manufacturing & IoT Needs: Industrial sensors and edge systems require reliable, rugged NAND memory.

Market Challenges

-

Price Volatility: NAND prices are highly cyclical—excess supply leads to sharp price drops, impacting suppliers.

-

Competitor Pressures: SLC/MLC erode into 3D NAND performance tiers; YMTC’s emergence poses competitive challenges.

-

Rising Production Costs: Lithography and chiplet complexity increase production costs, affecting profit margins.

-

Technology Transition Pace: Moving to 176+ layer 3D NAND requires heavy capex and delivers diminishing performance benefits.

-

Supply Chain Risks: Geopolitical tensions and concentration of production create vulnerability to disruptions.

FAQs

Q1: What is the expected market size by 2033?

A: Anticipated to reach USD 115.4 billion, up from USD 68.5 billion in 2023 (CAGR ~5.8%).

Q2: Which type of NAND cell is expanding fastest?

A:QLC is leading growth due to rising high-density SSD adoption and price-sensitive archival use cases.

Q3: Which region remains the global leader?

A:Asia-Pacific, contributing more than 55% of market revenue.

Q4: Which application segment is most dominant?

A:Smartphones and SSD jointly account for ~73% of total NAND demand.

Q5: Who are the leading suppliers?

A: The market is led by Samsung, KIOXIA, Micron, SK Hynix, Yangtze, and Western Digital—all investing heavily in advanced 3D NAND capacities.

Conclusion

The NAND Flash Memory Market remains a dynamic growth engine amid a data-driven era. With increasing density trends and wide adoption in high-capacity SSDs and premium mobile devices, NAND continues to scale both its technology and value proposition. Asia-Pacific remains the central hub for production and capacity expansion, while global demand diversifies across cloud, automotive, AI, and the IoT. Leading suppliers continue to invest heavily in next-generation 3D NAND. Market success will depend on managing price cycles, advancing process technologies, and navigating supply chain risks.