Introduction

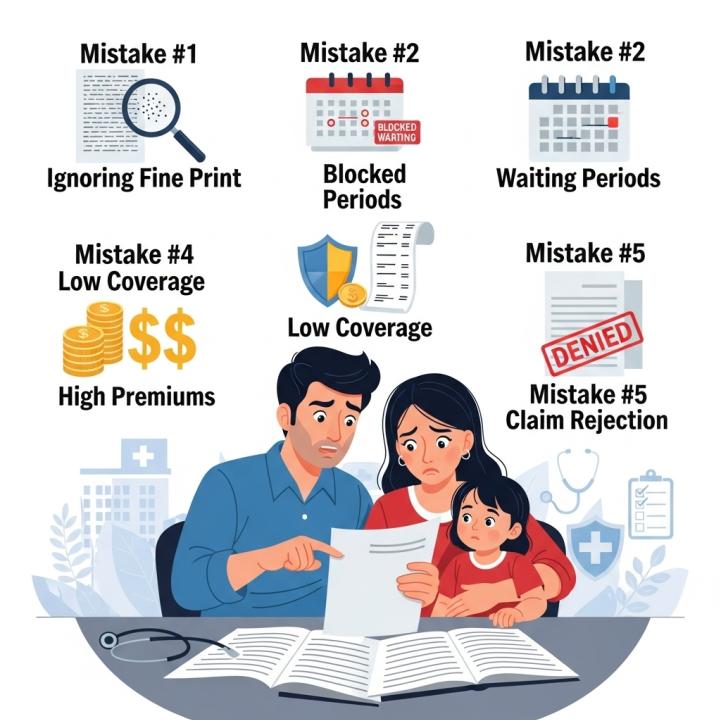

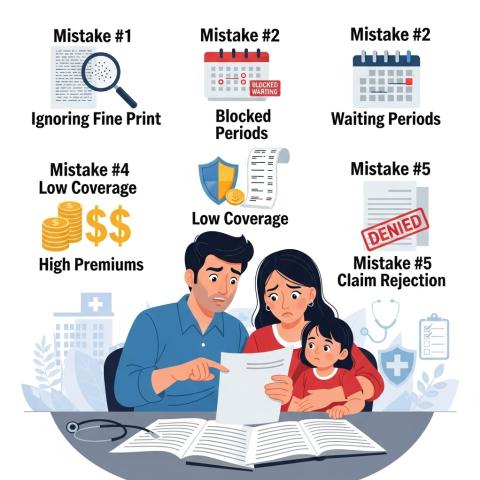

In today's fast-paced world, a medical emergency can arise at any moment, and with healthcare costs skyrocketing, a good medical insurance plan is not just a luxury but a necessity. However, while purchasing a health insurance policy, many people unknowingly make mistakes that can cost them both financially and emotionally later.

To help you make a wise and informed decision, here are the top 7 common mistakes to avoid when buying a medical insurance plan, especially in India.

1. Choosing a Plan Based Only on Premium Cost

One of the most common mistakes people make is selecting a medical insurance plan solely because it offers the lowest premium. While affordability is important, a low-cost plan may offer minimal benefits or insufficient coverage.

What to Do:

Compare plans not just based on premiums, but also on the sum insured, network hospitals, waiting period, daycare procedures, and co-payment clauses.

A slightly higher premium may give you better value in the long run.

2. Not Understanding the Policy Terms and Conditions

Medical insurance policies come with a host of terms, conditions, and exclusions. Skipping the fine print is a huge mistake that can lead to rejected claims or unexpected out-of-pocket expenses.

What to Do:

- Carefully go through the policy brochure, especially sections on exclusions, waiting periods, and claim procedures.

- Ask your insurer or agent for clarity if something is unclear.

3. Ignoring the Waiting Periods

Many insurance buyers are unaware that most health insurance plans have waiting periods for certain diseases, treatments, or pre-existing conditions. You might think you are covered, but during this period, you cannot raise a claim for specific treatments.

What to Do:

Check the initial waiting period (usually 30 days) and specific disease waiting periods (1–4 years).

If you or your family members have pre-existing health conditions, choose a policy with the shortest waiting period.

4. Underinsuring Yourself or Your Family

To save on premiums, many people opt for a lower sum insured, thinking it will be enough. However, with rising treatment costs, an underinsured policy may be of little help in a real emergency.

What to Do:

Consider your city of residence, family health history, and number of family members when deciding on the sum insured.

For a family of 4 in a metro city, a cover of ₹10–15 lakh is often recommended.

5. Not Disclosing Pre-Existing Diseases Honestly

Another mistake is hiding or not declaring pre-existing diseases or past treatments. Many people think this helps in getting lower premiums, but it can lead to claim rejection later.

What to Do:

Always declare all existing health issues and past surgeries during the proposal stage.

Insurers conduct medical underwriting and may still provide coverage with some conditions or waiting periods.

6. Not Considering Lifetime Renewability

Some older policies in India had restrictions on renewability, especially after a certain age. Although IRDAI now mandates lifetime renewability, not checking this clause is still a risk, especially for senior citizens.

What to Do:

Choose a health insurance plan that comes with lifetime renewability.

This ensures you're protected even in your older years when you are more likely to need coverage.

7. Overlooking the Cashless Hospital Network

During emergencies, finding a hospital in your insurer’s network is crucial to avail cashless treatment. If your preferred hospitals are not on the list, you may need to pay from your own pocket and go through tedious reimbursement processes.

What to Do:

Always check the insurer’s list of network hospitals, especially in your area.

Prefer insurers that have wide coverage in Tier I, II, and III cities.

Bonus Tips to Make the Right Choice

Apart from avoiding these 7 mistakes, here are some quick tips to further simplify your health insurance journey:

Compare Plans Online:

Use insurance comparison websites to check and compare benefits, claim settlement ratios, premiums, and customer reviews.

Buy Early:

Purchasing a policy when you’re young ensures lower premiums, no pre-existing conditions, and completion of waiting periods early on.

Read Customer Reviews:

Don’t just rely on the insurer’s claims. Go through genuine user feedback on claim processes, service, and support.

Check for Add-Ons:

Many insurers offer riders or add-on covers like maternity benefits, critical illness, or personal accident cover. Evaluate their relevance for your family.

Why Making the Right Choice Matters

Buying a medical insurance policy is not a one-time transaction; it’s a long-term financial safeguard. A wrong decision may not seem costly initially, but it can impact your ability to get proper healthcare when it matters the most.

By being informed and cautious, you can avoid the most common pitfalls and select a plan that truly secures your family’s health and peace of mind.

Conclusion

Choosing the right medical insurance plan doesn’t have to be overwhelming. By steering clear of these 7 critical mistakes and understanding your family’s health needs, you can confidently invest in a policy that offers protection, value, and peace of mind.

Remember, the best health insurance for a family is the one that offers the right balance between coverage, affordability, and claim support — not just the cheapest premium.