The global Big Data Security Market is emerging as a critical segment in the cybersecurity landscape, driven by the explosive growth of data, rising cyber threats, and stringent regulatory mandates. As organizations increasingly rely on big data analytics for strategic decisions, securing this vast and complex data becomes paramount to prevent breaches, data leaks, and financial losses.

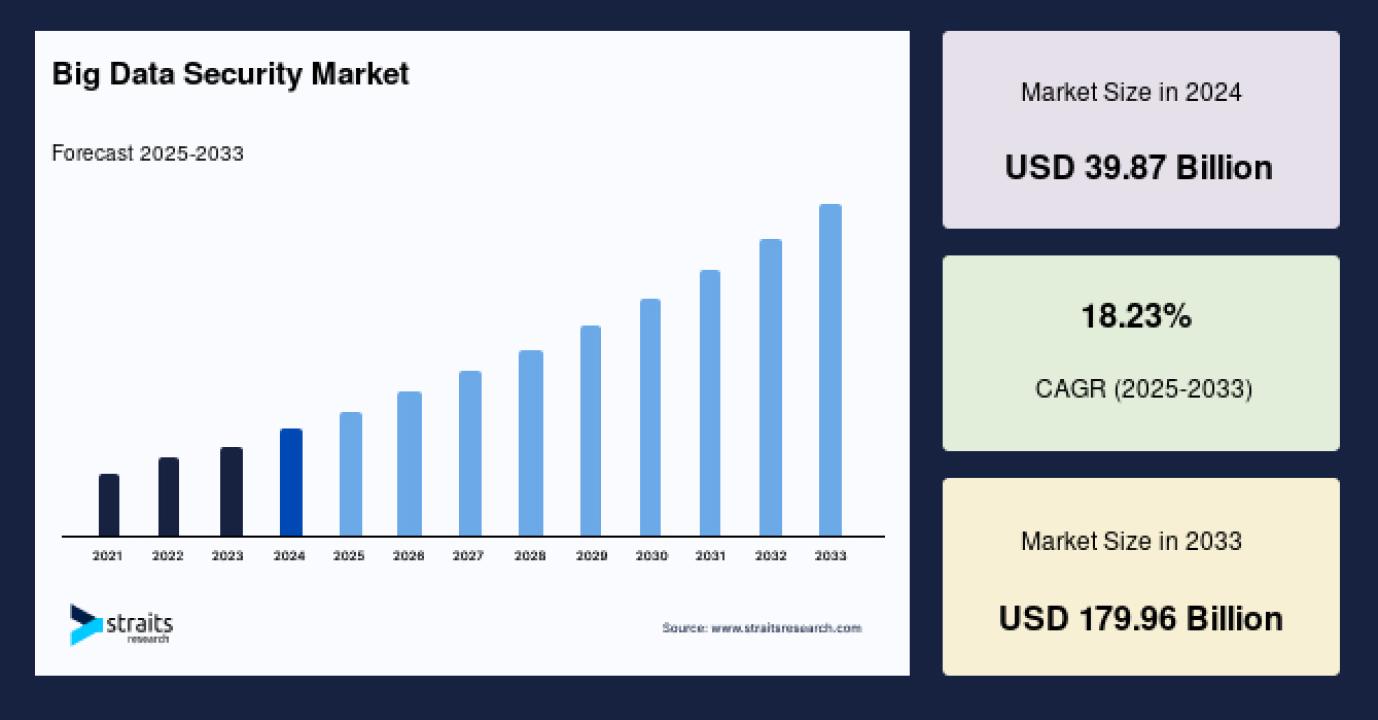

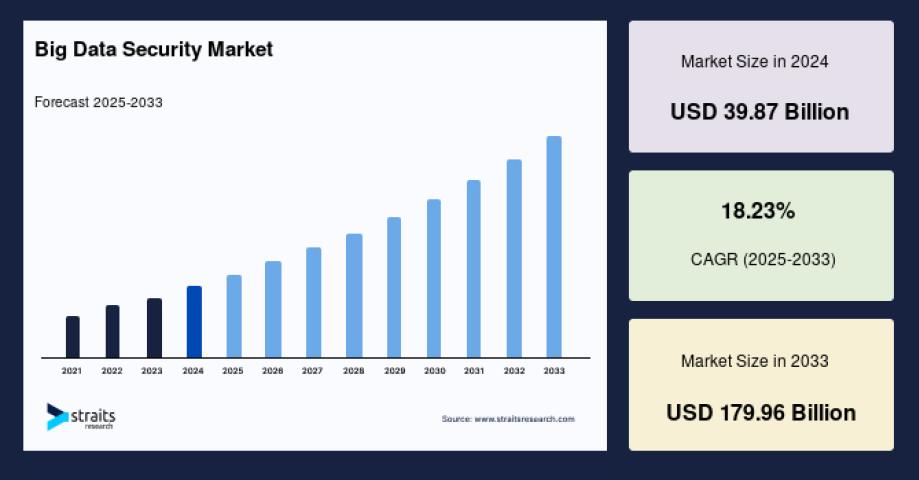

Market Size 2024 – USD 39.87 billion

Market Size 2025 – USD 47.13 billion

Market Size 2033 – USD 179.96 billion

CAGR (2025–2033) – 18.5%

For detailed quantitative insights and forecasting, request a sample report here: https://straitsresearch.com/report/big-data-security-market/request-sample

Market Drivers

The primary growth drivers for the big data security market include the rapidly increasing volume and complexity of data generated by organizations worldwide. The proliferation of IoT devices, cloud computing, and digital transformation initiatives has expanded attack surfaces and elevated cyber risk levels.

Continuous breaches and ransomware attacks targeting sensitive corporate and personal information compel enterprises to invest heavily in advanced big data security solutions and services. The financial impact of data breaches and legal consequences from non-compliance with regulations such as GDPR, HIPAA, and CCPA drive demand for proactive data protection technologies.

Technological advancements such as AI and machine learning integration empower security platforms to detect anomalies, predict threats, and automate response, enhancing overall security posture. The growing adoption of zero-trust security models and container security frameworks aligns strongly with big data security requirements, promoting faster and safer data access.

Increasing awareness among small and medium enterprises (SMEs) about cybersecurity risks and the availability of cost-effective cloud-based solutions further bolster market growth. Geographic expansion, especially in Asia-Pacific and North America, also fuels emerging market opportunities.

Market Challenges

Despite promising prospects, the big data security market faces notable challenges. High implementation and operational costs, particularly for advanced software and services, pose barriers for SMEs and cost-sensitive organizations.

Managing data security across heterogeneous environments, including on-premises, cloud, and hybrid setups, adds complexity. Fragmented data ecosystems make comprehensive protection difficult without sophisticated tools and skilled personnel.

There is a widespread shortage of cybersecurity professionals with expertise in big data environments, limiting rapid adoption. Additionally, evolving threat landscapes require continuous updates and agility, which some enterprises struggle to maintain.

Data privacy concerns and regulatory complexities, especially with cross-border data transfers, require organizations to adopt adaptive and compliant security architectures, often challenging for resource-limited players.

Market Segments

The big data security market is segmented by component, technology, deployment model, organization size, verticals, and region:

By Component

Software: Encompasses data encryption, masking, auditing, governance, and threat intelligence platforms, forming the dominant market revenue segment.

Services: Covers consulting, managed security, implementation, training, and technical support, the fastest-growing segment due to increased demand for expert handling.

By Technology

Encryption & Tokenization

Data Loss Prevention (DLP)

Identity and Access Management (IAM)

Security Intelligence and Analytics (SIEM, UEBA, advanced analytics)

Others

By Deployment Model

On-premises: Chosen by organizations looking for strict control over sensitive data environments.

Cloud-based: Preferred for scalability and flexible security management in digital-first enterprises.

By Organization Size

Large Enterprises: Main revenue contributors, investing continuously in data security infrastructure.

Small and Medium Enterprises (SMEs): Exhibit high growth owing to rising awareness and availability of cloud services.

By Industry Vertical

BFSI (Banking, Financial Services, and Insurance): Largest contributor due to stringent data protection regulations and high exposure to cyber threats.

IT and Telecommunications

Healthcare and Social Assistance

Retail

Utilities and Others

By Region

North America: Holds the largest market share, driven by early adoption of advanced security technologies, robust regulatory frameworks, and mature cybersecurity ecosystems.

Asia-Pacific: Second-largest and fastest-growing market, fueled by increasing digital connectivity, cybercrime awareness, and government initiatives.

Europe: Growing rapidly due to GDPR enforcement and demand for cloud security solutions.

LAMEA (Latin America, Middle East, and Africa): Emerging markets investing in cybersecurity infrastructure.

For comprehensive segmentation and purchase details, get the full report here: https://straitsresearch.com/buy-now/big-data-security-market

Top Players Analysis

Key players dominating the big data security market include:

IBM Corporation

Cisco Systems, Inc.

Dell Technologies

Hewlett Packard Enterprise (HPE)

Microsoft Corporation

Symantec Corporation (Broadcom Inc.)

McAfee LLC

Fortinet, Inc.

Check Point Software Technologies

Trend Micro Incorporated

These companies lead with robust portfolios across encryption, threat intelligence, identity management, and data governance. IBM integrates AI-driven analytics with big data platforms, while Cisco offers network-centric security combined with data protection. Microsoft’s cloud security suite and Dell’s data center solutions provide comprehensive security ecosystems. Strategic partnerships, AI integration, and cloud security innovations shape their competitive edge.

Straits Research is a market intelligence company providing global business information reports and services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insight for thousands of decision-makers. Straits Research Pvt. Ltd. provides actionable market research data, especially designed and presented for decision making and ROI.

Frequently Asked Questions (FAQs)

What is the size of the global big data security market in 2024 and forecast for 2033?

Market Size 2024 – USD 39.87 billion

Market Size 2025 – USD 47.13 billion

Market Size 2033 – USD 179.96 billion

CAGR (2025–2033) – 18.5%

What are the main drivers for big data security market growth?

Rising cyber threats, increasing data volumes, regulatory compliances, and AI-enhanced security solutions are key drivers.

Which industries invest most in big data security?

Banking, financial services & insurance (BFSI), IT & telecom, healthcare, and retail.

What regions dominate the big data security market?

North America holds the largest share; Asia-Pacific is the fastest-growing region.

Who are the leading players in the market?

IBM, Cisco, Dell, HPE, Microsoft, Symantec, McAfee, Fortinet, Check Point, and Trend Micro.