Insurance plays a vital role in financial protection by safeguarding individuals and families from unexpected events such as medical emergencies, accidents, disability, or the loss of an earning member. Life,..

Corporate leaders often focus their attention on revenue growth, innovation, and operational efficiency, but one of the most underestimated pillars of sustainable success is insurance. Far from being a mere..

Launching a startup means navigating uncertainty, tight budgets, and constant pressure to grow. Amid the hustle of product development, hiring, and fundraising, insurance is often overlooked—until it's too late.Risk Is..

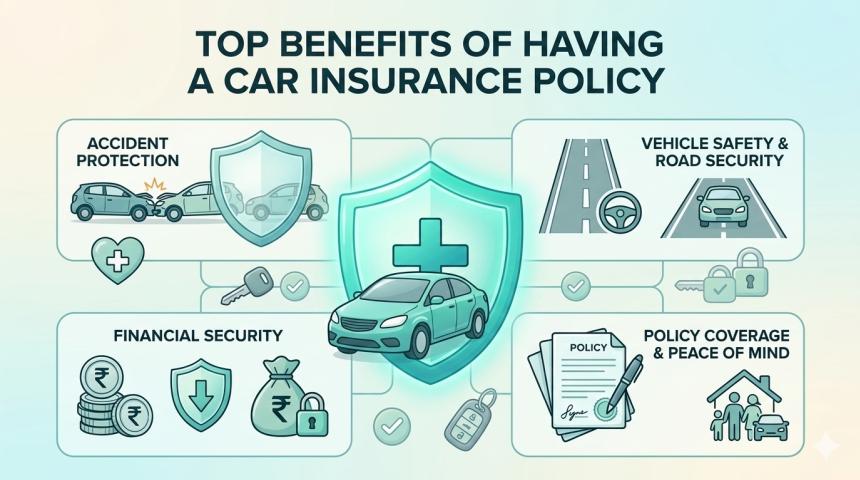

IntroductionOwning a car brings convenience,

independence, and comfort to everyday life. However, along with these benefits

comes the responsibility of protecting the vehicle from financial risks that

may arise due..

Owning a car is a significant

financial investment that offers comfort, convenience, and mobility in daily

life. However, vehicle ownership also comes with several risks such as road

accidents, theft,..

Car insurance is an

essential part of owning a vehicle. It protects you from financial loss caused

by accidents, theft, natural disasters, and other unexpected situations. In

India, having at..

Buying car insurance is not just

about fulfilling a legal requirement—it is about protecting your financial

stability. With increasing traffic density, rising repair costs, and

unpredictable weather conditions in India,..

Car ownership in India continues to grow rapidly in 2026, driven by rising

incomes, improved road infrastructure, and easier financing options. However,

owning a vehicle also brings legal and financial..

AI-powered insurance compliance software is redefining how insurers manage regulatory complexity while preserving customer trust. By automating compliance monitoring, policy validations, documentation checks, and audit trails, AI-driven systems reduce manual..

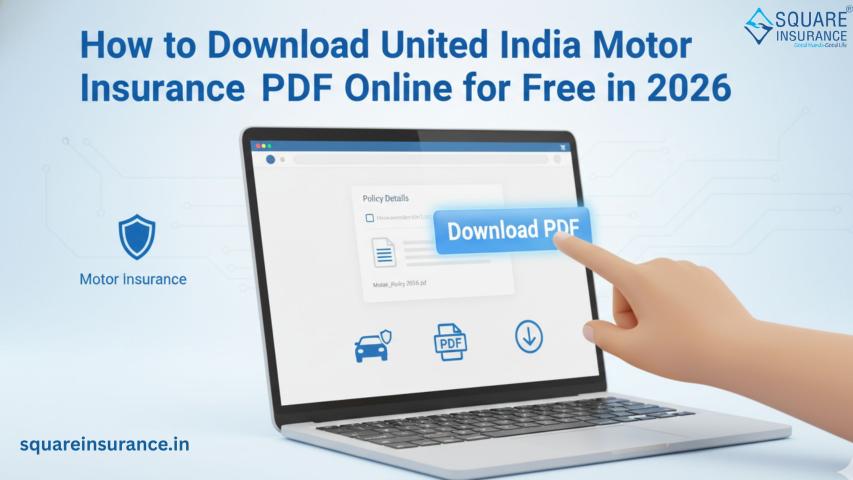

In today’s digital age, managing

insurance documents has become much easier than before. You no longer need to

depend only on printed papers or worry about losing your policy file...

How do carriers spot suspicious patterns among thousands of applications? Identifying fraud and emerging risks challenges even experienced underwriters when reviewing applications manually. Traditional detection methods rely on individual experience..

The unified architecture of modern underwriting platforms transforms isolated data into actionable business insights. Insurance organizations who implement insurance underwriting software gain the capability to deliver personalized services that align..

Extended application processing times create friction for customers and brokers. Manual underwriting workflows often require days or weeks to complete standard applications. Lengthy processing times impact customer satisfaction and create..

Modern insurance underwriting software is a digital platform that automates and enhances insurance application evaluation. These platforms integrate data management, workflow automation, and analytics capabilities into unified systems. Insurance underwriting..

The complexity of integrating analytics platforms with existing systems, training staff on new workflows, and ensuring compliance with regulatory requirements presents significant challenges. That’s why partnering with InsurTech service providers..

SaaS

marketing automation is no longer a “nice-to-have” for growing software

companies. It’s a core part of how modern SaaS businesses attract leads,

nurture prospects, convert users, and retain customers..

Modern companies run on hundreds of moving parts: sales forecasts, inventory levels, invoices, supplier data, and internal approvals. When these workflows live in separate tools, even simple decisions become slow..

In today’s fast-paced digital environment, businesses are constantly under pressure to do more with less. Teams are expected to deliver high-quality customer experiences, respond quickly to market changes, and manage..