The global semiconductor chemical vapor deposition (CVD) equipment market is essential for semiconductor manufacturing, powering high-performance chip fabrication for electronics, automotive, and industrial sectors. CVD technology creates ultra-thin, high-purity materials used in microelectronic circuits, sensors, and advanced components. Rapid demand for next-gen applications—such as 5G, AI, IoT, and electric vehicles—is fueling new investments and technological advancement across the CVD manufacturing supply chain.

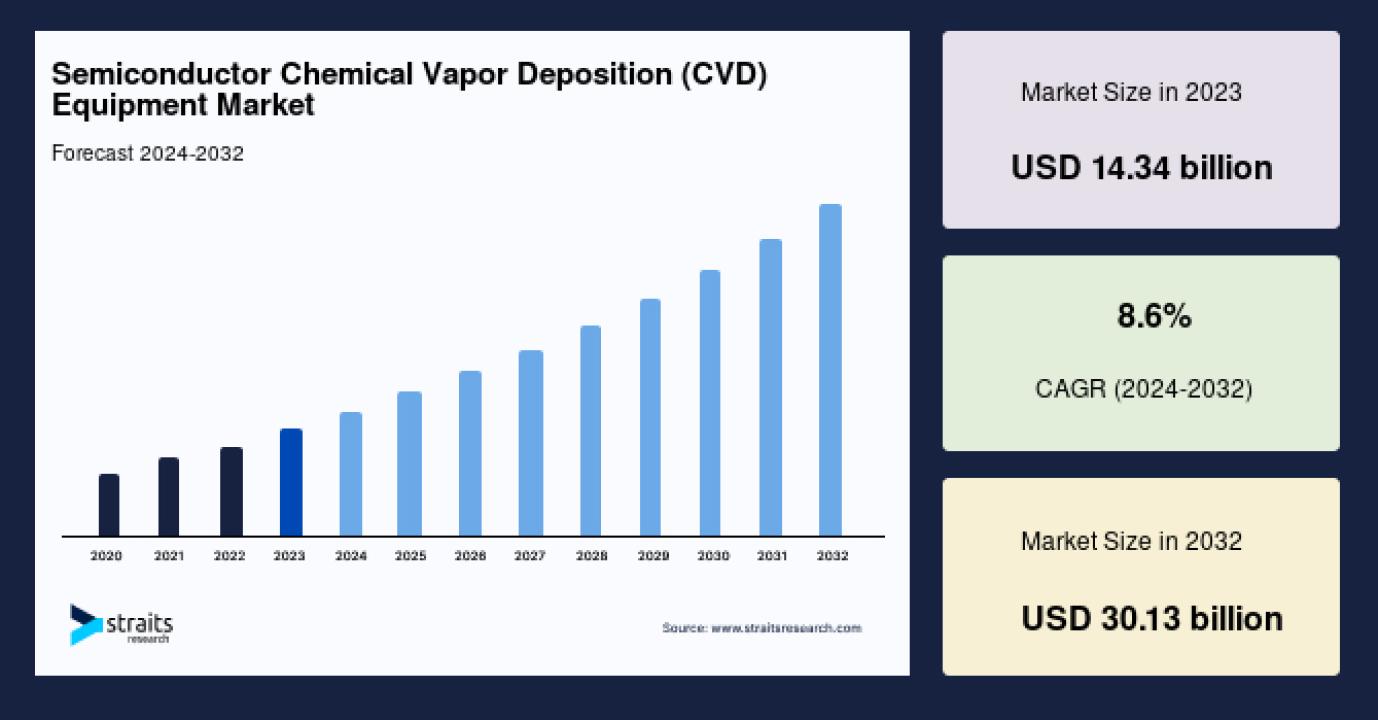

Market Size 2023 – USD 14.34 billion

Market Size 2032 – USD 30.13 billion

CAGR (2024–32) – 8.6%

For in-depth data and insights, download the free sample: Request Sample – https://straitsresearch.com/report/semiconductor-chemical-vapor-deposition-equipment-market/request-sample

Market Drivers

Key market drivers include ongoing technological advances in microelectronics, rising investments in chip manufacturing, increased demand for cutting-edge consumer electronics, and pressure from new regulatory standards. The rapid growth of industries leveraging smart devices, electric vehicles, and digital infrastructure has amplified global demand for advanced semiconductor devices. Manufacturers rely on CVD equipment to support the shift toward smaller, more complex IC architectures, vital for high-speed computing, remote connectivity, and enhanced user experiences. Regulatory focus on environmentally friendly processes also stimulates the adoption of deposition equipment that supports green manufacturing standards.

Market Challenges

Market expansion faces complexities: high capital requirements to build new foundries and back-end facilities (often USD 15–20 billion), relentless R&D investments to keep pace with node scaling, and compliance with evolving international standards. Shortages of critical raw materials and components, along with semiconductor supply chain pressures, pose risks. Firms must integrate new process technologies and maintain costly infrastructure to remain competitive, which can hinder entry for smaller players. Additionally, fast technological change requires continual equipment innovation and reflects the volatile dynamics of global trade and intellectual property protection.

Segmentation Details

By Application

Integrated Device Manufacturer (IDM): This segment leads market share, producing branded ICs (logic, sensors, optoelectronics, and discrete). IDM companies invest in node scaling, 3D architectures, and deploy CVD for thin-film growth. They design and manufacture chips in dedicated fabrication facilities.

Memory Manufacturers: Major focus on DRAM, NAND, and emerging memory technologies. Demand is driven by increasing data consumption in consumer electronics and cloud data centers. CVD enables the production of layered structures for advanced memory and plasma-enhanced deposition for performance.

Foundry: Contract manufacturers make chips for fabless design companies. They rely on sophisticated CVD processes for efficient, high-volume production in logic and memory ICs.

By Region

Asia-Pacific: Dominates global share, driven by demand for automotive semiconductors (especially in China and India), investments in R&D, and robust manufacturing infrastructure. Fastest regional CAGR, supported by rapid expansion in electric vehicles and smart devices.

North America: Second-largest market, notable for leadership in advanced semiconductor design (AI, quantum computing, 5G). Demand is stimulated by the rise in electronics and automotive components. Significant investments in new foundries and innovation hubs reinforce long-term growth.

Europe: Third-largest, home to major multinationals (Philips, STMicroelectronics, Infineon), focused on reducing reliance on US and Asian chipmaking. Emphasis on R&D, wafer processing, and scaling for automotive, telecom, and high-performance computing.

To purchase the full report: Buy Now this report – https://straitsresearch.com/buy-now/semiconductor-chemical-vapor-deposition-equipment-market

Top Players Analysis

Major global and regional leaders in the semiconductor CVD equipment market (based on Straits Research analysis):

Lam Research Corporation – Supplies advanced deposition equipment for logic and memory manufacturing.

Tokyo Electron Limited – Key innovator in process equipment and thin-film deposition.

Ulvac Inc. – Develops multi-chamber deposition systems enhancing productivity and throughput.

Veeco Instruments Inc. – Specialized in precise thin-film and nanotechnology applications.

KLA Corporation – Delivers integrated metrology solutions for process control and yield improvement.

HORIBA – Offers equipment for quality analysis and control in semiconductor manufacturing.

NBM Design – Focuses on custom semiconductor solutions and deposition technologies.

Blue Wave Semi – Specializes in ceramic coatings and advanced deposition chamber design.

PhotonExport – Provides nanotechnology equipment for high-precision applications.

Vivid Inc – Noted for high-durability ceramic coatings improving the performance of CVD equipment.

These players drive innovation, invest heavily in R&D, and push the industry forward through strategic partnerships, product launches, and global expansion.

Conclusion and About Us

The semiconductor chemical vapor deposition equipment market is positioned for strong growth as digital transformation accelerates worldwide. Technology investments, new manufacturing capacity, and constant product innovation keep the market dynamic. With the proliferation of smart cities, electric vehicles, and high-tech consumer electronics, demand for advanced CVD equipment will remain at the forefront of semiconductor industry transformation.

Straits Research is a market intelligence company providing global business information reports and services. Our exclusive blend of quantitative forecasting and trends analysis offers actionable data for decision making and ROI.

FAQs

What is the market size of the semiconductor CVD equipment sector in 2023 and 2032?

USD 14.34 billion in 2023; expected to reach USD 30.13 billion in 2032.

What is the expected CAGR over the forecast period?

8.6% during 2024–2032.

Which region leads the market?

Asia-Pacific, due to strong manufacturing and R&D infrastructure.

What is the largest application segment?

Integrated Device Manufacturer (IDM), followed by memory manufacturers and foundry.

Who are the top players in the semiconductor CVD equipment market?

Lam Research, Tokyo Electron, Ulvac, Veeco, KLA, HORIBA, NBM Design, Blue Wave Semi, PhotonExport, and Vivid Inc.

What are the main drivers behind market growth?

5G, IoT, AI, electric vehicles, miniaturization, investment in chip manufacturing, and advanced consumer electronics.