The global automotive tire pressure monitoring system (TPMS) market is witnessing remarkable growth, fueled by rising automotive production, increasing safety regulations, and growing consumer awareness about vehicle and tire safety. TPMS technology, which continuously monitors tire pressure and alerts drivers to under-inflation, is becoming a critical safety feature in vehicles worldwide, enhancing fuel efficiency and reducing accidents.

📌 For detailed market insights and segmentation, Download Free Sample: Request Sample- https://straitsresearch.com/report/automotive-tire-pressure-monitoring-system-tpms-market/request-sample.

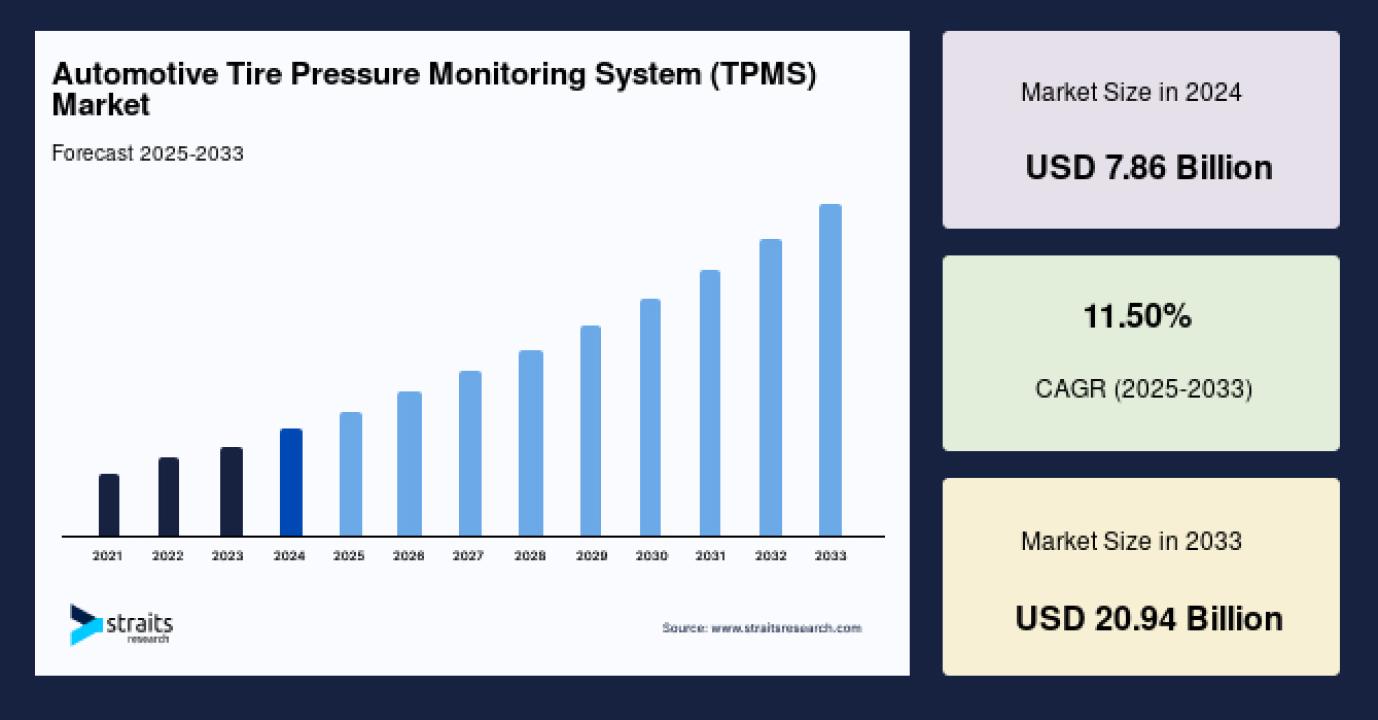

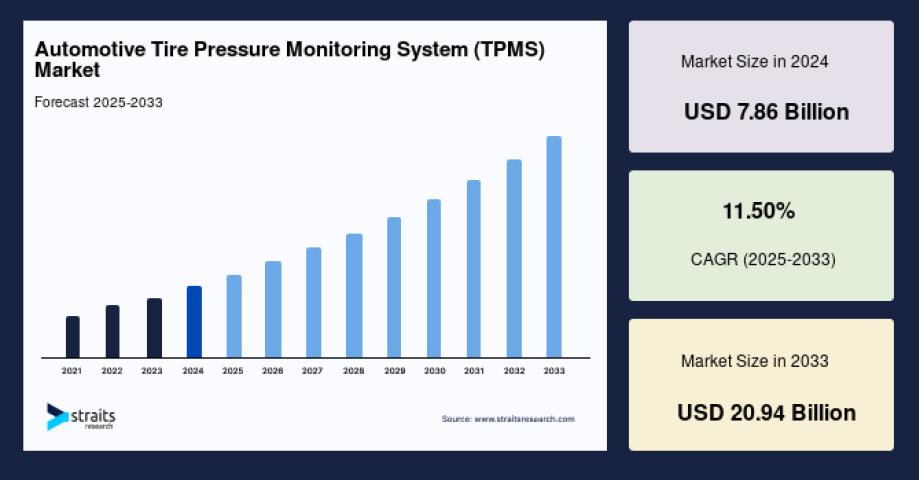

Market Size 2024 – USD 7.86 billion.

Market Size 2025 – USD 8.76 billion.

Market Size 2033 – USD 20.94 billion.

CAGR 2025-2033 – 11.50%.

Market Overview

TPMS technology involves sensors located in the tires or valve stems that provide real-time tire pressure data, helping prevent accidents caused by underinflated tires. Maintaining optimal tire pressure ensures enhanced vehicle handling, improved fuel economy, extended tire life, and reduced emissions. Growing urbanization and disposable incomes, especially in emerging economies like China, India, and Brazil, are propelling vehicle sales, thus driving TPMS adoption. Additionally, stringent government mandates in regions such as North America and Europe require installation of TPMS in new vehicles, further boosting market demand.

Market Drivers

- Rising demand for vehicle safety features drives TPMS adoption as consumers become increasingly safety conscious.

- Government regulations like the U.S. Federal Motor Vehicle Safety Standard and equivalent mandates worldwide require TPMS in newly manufactured vehicles.

- Growing awareness among vehicle owners on fuel efficiency and environmental impact encourages TPMS usage to maintain correct tire pressure.

- The rise of electric vehicles (EVs), which require accurate tire monitoring for optimal performance and range, adds impetus to TPMS market growth.

- Technological advancements in sensor accuracy, miniaturization, and IoT integration increase TPMS functionality and market appeal.

Market Challenges

- The high cost of advanced direct TPMS technologies and installation can limit acceptance, especially in lower-priced vehicle segments.

- Potential signal interference and battery-life limitations present reliability challenges.

- Integrating TPMS into diverse vehicle models and legacy systems requires OEM customization and increases complexity.

- Aftermarket TPMS replacement market faces challenges with sensor compatibility and consumer awareness.

Market Segmentation

By Type:

- Direct TPMS: Led by real-time, accurate sensors installed inside each tire, providing individual tire pressure data and preferred due to regulatory support and higher safety.

- Indirect TPMS: Uses existing ABS systems to estimate tire pressure changes; lower cost and easier installation but less precise.

By Vehicle Type:

- Passenger Vehicles: Largest segment driven by high production volumes, stringent safety regulations, and rising consumer preference for advanced vehicle safety.

- Light Commercial Vehicles (LCVs): Growing demand driven by logistics and commercial transport sectors.

- Heavy Commercial Vehicles (HCVs): Increasing fleet safety norms and telematics integration fuel adoption.

By Sales Channel:

- Original Equipment Manufacturer (OEM): Dominates the market as TPMS systems are pre-installed by manufacturers to meet safety standards.

- Aftermarket: Provides replacement and upgrade TPMS units for existing vehicles, growing due to vehicle aging and rising user awareness.

By Technology:

- Battery-Powered Direct TPMS: Largest technology share owing to accuracy and reliability.

- Solar-Powered Direct TPMS: Emerging segment leveraging renewable energy for enhanced sensor life.

- Multi-Channel Direct TPMS: Advanced sensors offering multi-frequency monitoring.

- ABS-Based Indirect TPMS and Wheel Speed Sensor Based Indirect TPMS: Cost-effective solutions primarily used in older or budget vehicles.

By Region:

- Asia Pacific: Largest regional market due to rapid automotive production, increasing safety mandates, and consumer awareness in China, Japan, India, and South Korea.

- North America: Fastest growing region powered by government regulations, luxury vehicle demand, and advanced safety system penetration.

- Europe: Second-largest market with increasing adoption driven by stringent EU safety regulations and increasing vehicle electrification.

- Latin America and MEA: Emerging markets with growing vehicle sales and governmental safety adoption initiatives.

Key Players Analysis

- Continental AG – Innovator in direct TPMS technology and integrated automotive safety solutions.

- Sensata Technologies – Leading supplier with broad product portfolio in automotive sensor technologies.

- Schrader Electronics – Pioneer in TPMS sensor development and aftermarket solutions.

- Huf Hülsbeck & Fürst GmbH & Co. KG – Strong OEM partnerships and advanced TPMS systems.

- Pacific Industrial Co., Ltd – Major manufacturer focused on cost-effective TPMS modules for Asia-Pacific.

- Denso Corporation – Technology leader in sensor and automotive electronics.

- NIRA Dynamics AB – Specialist in indirect TPMS and advanced vehicle sensor fusion.

- ZF Friedrichshafen AG – Key player integrating TPMS into broader automotive safety networks.

- Bendix Commercial Vehicle Systems – Focused on TPMS for commercial vehicles and fleet monitoring.

- Bartec USA LLC – Leading provider of aftermarket TPMS tools and devices.

📌 Buy Now this report - https://straitsresearch.com/buy-now/automotive-tire-pressure-monitoring-system-tpms-market

Conclusion

The automotive TPMS market is projected to more than double by 2033, driven by rigorous safety requirements, expanding automotive production, and consumer demand for vehicle safety and efficiency. As EV adoption increases, and advanced driver assistance systems (ADAS) become widespread, TPMS will play an increasingly critical role in the automotive safety ecosystem.

Manufacturers and OEMs must focus on innovation, cost optimization, and compatibility to stay competitive and meet evolving consumer and regulatory demands worldwide.

About Us: Straits Research is a market intelligence company providing global business information reports and services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insight for thousands of decision-makers. Straits Research Pvt. Ltd. provides actionable market research data, especially designed and presented for decision making and ROI line.

FAQs

- What is the market size of the automotive tire pressure monitoring system market for 2024, 2025, and 2033? Market Size 2024 – USD 7.86 billion. Market Size 2025 – USD 8.76 billion. Market Size 2033 – USD 20.94 billion. CAGR 2025-2033 – 11.50%.

- What are the primary types of TPMS technologies? Direct TPMS, which uses sensors in each tire for precise measurement, and indirect TPMS, which estimates pressure using ABS data.

- Which region dominates the automotive TPMS market? Asia Pacific leads due to high vehicle production rates, increasing government mandates, and rising consumer awareness.

- Who are the leading players in the automotive TPMS market? Continental AG, Sensata Technologies, Schrader Electronics, Huf Hülsbeck & Fürst, and Pacific Industrial are key market leaders.

- What challenges affect the adoption of TPMS? High costs, system integration with legacy vehicles, sensor reliability, battery life, and aftermarket compatibility are major challenges.