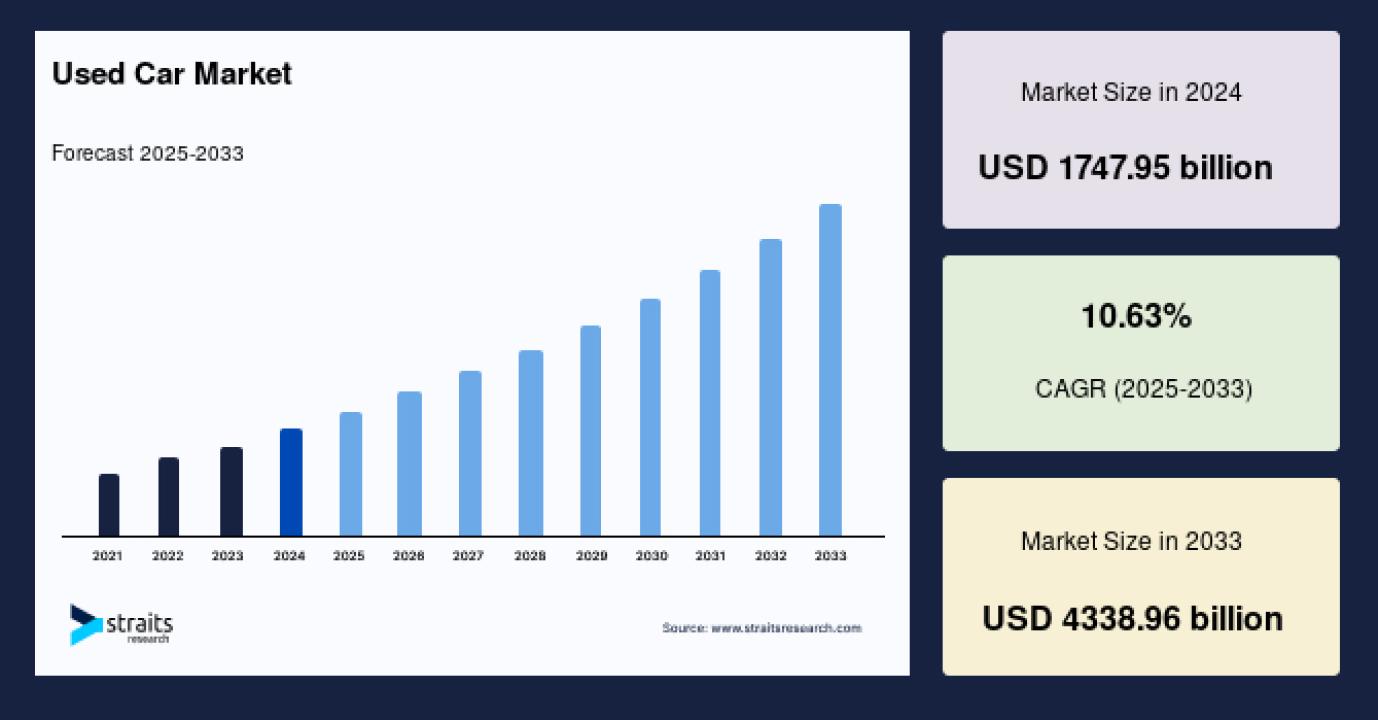

The global used car market is undergoing rapid expansion, driven by cost-effectiveness, increasing digitalization in vehicle sales, and changing consumer mobility preferences. According to Straits Research, the global used car market size was valued at USD 1,747.95 billion in 2024, is expected to grow to USD 1,933.76 billion in 2025, and is projected to reach USD 4,338.97 billion by 2033, exhibiting a robust CAGR of 10.63% during 2025–2033.

For comprehensive insights and detailed analysis, request a sample report at https://straitsresearch.com/report/used-car-market/request-sample

Market Drivers

1. Affordability and Value for Money

Used cars remain an attractive option for budget-conscious buyers, offering significant savings compared to new vehicles. Financing solutions and certified pre-owned programs have enhanced consumer trust, further boosting adoption.

2. Digital Transformation of Auto Sales

Online platforms are reshaping the used car industry by enabling virtual showrooms, AI-driven pricing tools, and secure payment gateways. This digital shift has enhanced transparency, accelerating consumer confidence in buying cars online.

3. Rising Vehicle Replacement Cycle

Consumers are upgrading vehicles more frequently, resulting in a strong supply of high-quality pre-owned cars. This cycle directly fuels the secondary market, increasing both availability and demand.

4. Environmental Awareness

Purchasing pre-owned vehicles promotes sustainability by extending vehicle lifecycles and reducing environmental impact compared to manufacturing new cars.

Market Challenges

Quality and Trust Issues: Concerns about hidden repairs, accident history, and authenticity still affect consumer confidence, especially in unorganized sectors.

Regulatory Compliance: Varying rules regarding registration, taxation, and certifications complicate interstate and cross-border sales.

Competition from New Cars: Attractive financing and discounts on new vehicles pose competitive pressure on the used car industry.

Market Segmentation

By Vehicle Type

Hatchbacks: Favored for compactness and affordability.

Sedans: Popular for comfort and mid-range pricing.

SUVs: Rising in demand for their versatility and durability.

By Fuel Type

Petrol Cars: Widely available and dominant in sales.

Diesel Cars: Preferred by high-mileage users.

Electric & Hybrid Cars: Emerging as sustainability drives consumer choices.

By Distribution Channel

Organized Sector: Includes certified dealerships and online marketplaces offering transparency and warranties.

Unorganized Sector: Still dominant in emerging markets, with transactions through local dealers or direct sales.

Buy Report Now, visit https://straitsresearch.com/buy-now/used-car-market.

Top Players Analysis

Key companies are investing in digital platforms, financing solutions, and strategic acquisitions to strengthen market presence:

Cox Automotive – Global leader with platforms like Autotrader and Kelley Blue Book.

CarMax, Inc. – Major U.S. retailer known for transparent pricing.

Lithia Motors, Inc. – Expanding rapidly through acquisitions.

Group 1 Automotive, Inc. – Leveraging digital solutions for sales and after-sales.

AutoNation, Inc. – Strong U.S. presence with integrated digital services.

Cazoo – UK-based disruptor offering a fully online car-buying experience.

Cars24 – Leading Asian platform simplifying car resale through digital auctions.

TrueCar, Inc. – U.S. player specializing in data-driven pricing.

Alibaba Group – Expanding automotive e-commerce in China.

Mahindra First Choice – India’s largest certified multi-brand used car retailer.

Regional Insights

North America: Leads due to organized dealerships and strong digital adoption.

Europe: Sustainability concerns are boosting demand for electric used cars.

Asia-Pacific: The fastest-growing region, fueled by rising middle-class incomes and online platform penetration.

Future Outlook

The used car industry is set for sustained growth through 2033, driven by digital sales platforms, electric vehicle adoption, and evolving consumer behavior. Companies that prioritize trust-building mechanisms, AI-powered valuations, and sustainable models will remain at the forefront of this highly competitive landscape.

Conclusion

With affordability, digital innovation, and sustainability shaping the market, the global used car industry is poised for significant expansion. Organized players and tech-driven platforms are expected to play a key role in transforming consumer trust and streamlining transactions, ensuring robust growth opportunities in the years ahead.

FAQs

Q1. What is the market size of the used car industry in 2024?

The global used car market was valued at USD 1,747.95 billion in 2024.

Q2. How much will the market grow by 2025 and 2033?

It is projected to reach USD 1,933.76 billion in 2025 and USD 4,338.97 billion by 2033.

Q3. What is the CAGR of the used car market?

The market is expected to expand at a CAGR of 10.63% during 2025–2033.

Q4. Which region will see the fastest growth?

Asia-Pacific is expected to lead growth due to rising incomes and digital adoption.

Q5. Who are the top players in the global used car market?

Some leading players include Cox Automotive, CarMax, Lithia Motors, AutoNation, Cars24, and Mahindra First Choice.