The cryptocurrency exchange market has reached unprecedented heights in 2025, with the global platform market projected to grow from $50.95 billion in 2024 to $63.38 billion in 2025. As more entrepreneurs explore opportunities to launch their own trading platforms, the decision between centralized and decentralized architectures represents one of the most critical choices that will shape platform success and sustainability.

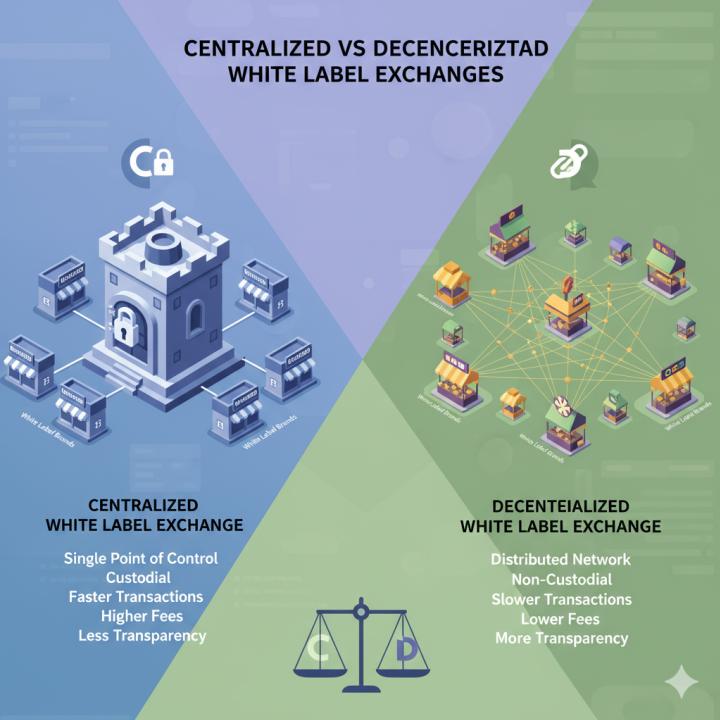

White label exchange solutions have emerged as the preferred entry method for businesses seeking to capitalize on this booming market without prohibitive development costs. However, understanding the fundamental differences between centralized and decentralized models becomes essential for making informed decisions that align with business objectives, target markets, and available resources.

Understanding Centralized White Label Exchanges

Architecture and Core Functionality

Centralized white label exchanges operate on a traditional financial model where a single entity controls the platform's infrastructure and manages user assets. These exchanges function as intermediaries between buyers and sellers, maintaining custody of user funds in centralized wallets while facilitating trades through internal order matching systems. When users deposit cryptocurrencies, the platform stores these assets in hot and cold wallets under the exchange's control, with trading occurring within internal systems and blockchain transactions only executed during withdrawals.

The architecture enables rapid trade execution with sophisticated order types and instant settlement within the platform's ecosystem. White label solutions come pre-integrated with essential components including matching engines, order books, wallet management systems, KYC/AML compliance tools, and administrative dashboards. These turnkey solutions allow businesses to launch fully functional trading platforms within weeks, complete with fiat on-ramps and institutional-grade features.

Key Advantages

Centralized exchanges typically offer superior liquidity compared to decentralized counterparts. Binance commands 39.8% of spot trading market share and processes $698.3 billion in monthly volume as of July 2025, demonstrating the ability to aggregate substantial order books. White label solutions often include integrations with external liquidity providers and market makers, ensuring adequate depth from launch.

High-performance matching engines can process thousands of orders per second with minimal latency, essential during high market volatility. The platforms support complex order types including limit orders, stop-loss orders, margin trading, and futures contracts that sophisticated traders require. Fiat currency support through banking integrations removes barriers for mainstream users, dramatically expanding the addressable market.

The user experience prioritizes intuitive interfaces designed to accommodate traders across all skill levels. Streamlined onboarding processes, comprehensive customer support systems, and real-time portfolio tracking make cryptocurrency trading accessible to beginners while providing advanced features for experienced traders.

Challenges and Considerations

Security represents a significant concern for centralized exchanges due to custodial responsibilities. The cryptocurrency industry recorded 344 hacking and scam events in the first half of 2025, with losses exceeding $2.47 billion. While reputable white label providers implement enterprise-grade security including cold storage, multi-signature wallets, and comprehensive DDoS protection, the concentration of assets creates attractive targets for attackers.

Regulatory compliance capabilities are deeply integrated but come with substantial costs. Built-in KYC/AML modules facilitate identity verification, transaction monitoring systems flag suspicious activities, and automated reporting maintains audit trails. As regulatory frameworks tighten globally, compliance investments consume significant operational budgets, though they provide legitimacy that attracts institutional investors.

Implementation costs range from $50,000 to $200,000 depending on customization requirements, with ongoing expenses for server infrastructure, security monitoring, and customer support creating continuous operational overhead.

Understanding Decentralized White Label Exchanges

Architecture and Core Functionality

Decentralized white label exchanges leverage blockchain technology and smart contracts to eliminate centralized intermediaries. These platforms facilitate peer-to-peer trading where users retain complete control over their private keys and assets throughout the trading process. The non-custodial architecture means exchanges never take possession of user funds, significantly reducing counterparty risk.

Automated Market Maker protocols have become the dominant model, using liquidity pools rather than traditional order books. Users provide liquidity by depositing token pairs into pools and earning fees from trades, while algorithms determine prices based on pool ratios. White label DEX software includes pre-audited smart contracts deployed across multiple blockchain networks including Ethereum, BNB Chain, Polygon, and Solana.

Key Advantages

The non-custodial architecture offers inherent security advantages. Since users control their private keys and funds never leave personal wallets until trade execution, the risk of exchange hacks resulting in mass asset theft is eliminated. This distributed security model protects individual users from platform-level breaches.

Lower implementation costs represent another significant advantage, with solutions starting from $10,000 to $75,000. Reduced operational overhead stems from simpler infrastructure requirements since blockchain networks handle transaction processing and storage. The platforms also provide censorship resistance and privacy advantages, appealing to users prioritizing financial sovereignty.

DEX spot trading volumes reached $876.3 billion in Q2 2025, capturing 25% market share against centralized platforms and growing 25% quarter-over-quarter. The derivatives market grew 132% in 2024 to reach $1.5 trillion, with projections suggesting $3.48 trillion in 2025, demonstrating substantial growth potential.

Challenges and Considerations

User experience requires higher technical proficiency from participants. Users must install and configure cryptocurrency wallets, and each transaction requires wallet confirmation, blockchain network fees, and waiting periods for on-chain settlement. These complexities create barriers for mainstream adoption among users seeking simplified experiences and customer support.

Liquidity remains fragmented across numerous protocols and blockchain networks, sometimes resulting in less favorable pricing and higher slippage on large trades compared to centralized platforms. While liquidity mining programs and DEX aggregators address these challenges, the gap persists.

Regulatory uncertainty represents a significant risk. The IRS announced that reporting requirements will expand to DEXs by 2027, while various jurisdictions struggle to classify these platforms. The ambiguous legal treatment creates compliance challenges and potential exposure for platform operators.

Comparative Analysis: Key Decision Factors

Factor | Centralized Exchange | Decentralized Exchange |

Initial Cost | $50,000 - $200,000 | $10,000 - $75,000 |

Launch Timeline | 4-8 weeks | 2-4 weeks |

Liquidity | High, centralized order books | Moderate, fragmented pools |

User Experience | Intuitive, beginner-friendly | Technical, wallet-required |

Custody | Platform holds assets | Users control assets |

Security Risk | Centralized hack target | Smart contract vulnerabilities |

Regulatory Clarity | Clear but complex | Ambiguous and evolving |

Operating Costs | High (servers, compliance, support) | Lower (mainly liquidity incentives) |

Revenue Model | Multiple streams (fees, listings, margin) | Primarily trading fees |

Target Market | Mainstream retail, institutions | Crypto natives, DeFi users |

Making Your Strategic Choice

Business Objectives Alignment

The fundamental decision should align with core business objectives. Companies prioritizing rapid profitability, mainstream adoption, and institutional relationships generally find centralized platforms better suited to these goals. The established revenue models, clear regulatory frameworks, and user-friendly experiences support traditional business development approaches.

Organizations motivated by philosophical alignment with decentralization principles or strategy to serve underbanked populations may prefer decentralized solutions. The growing DeFi market projected to reach $260 billion by 2032 offers substantial opportunities for platforms effectively serving this segment.

Resource Requirements

Successful centralized exchange operations require substantial organizational capabilities including legal teams for licensing, compliance personnel for AML/KYC programs, customer support staff, and banking relationship managers. The human capital requirements create ongoing operational overhead.

Decentralized platforms require blockchain developers understanding smart contract interactions, Web3 specialists implementing wallet integrations, and liquidity managers optimizing pool parameters. While white label solutions reduce these requirements, competent technical teams remain essential.

Risk Assessment

Centralized exchanges face regulatory risk as governments worldwide implement stricter oversight, though this is offset by clearer legal frameworks. Competitive risk stems from established giants like Binance and Coinbase dominating market share.

Decentralized platforms face regulatory uncertainty creating existential risk as authorities may classify protocols as illegal securities offerings. Technology risk includes smart contract vulnerabilities, though security audits mitigate concerns. The rapid protocol evolution requires continuous development resources to remain competitive.

Implementation Best Practices

Platform Selection

Choose white label providers through thorough due diligence beyond feature comparison. Evaluate track records through reference checks, review security audit reports, and verify insurance coverage. Assess technology stack scalability and understand revenue-sharing models to ensure sustainable economics at scale.

Liquidity Strategy

Centralized platforms should establish market maker partnerships before launch and allocate capital for internal market-making during early stages. Decentralized platforms require bootstrap liquidity through capital allocation to primary pools and implement liquidity mining programs distributing governance tokens to providers.

Marketing Approach

Build differentiation messaging that clearly articulates unique value propositions. Centralized exchanges might emphasize regulatory compliance and customer service, while decentralized platforms highlight privacy features and community governance. Calculate customer acquisition costs across channels and ensure lifetime values exceed acquisition costs by 3-5x for sustainable scaling.

Conclusion

The choice between centralized and decentralized white label exchanges depends on your specific business context, resources, and strategic vision. Centralized platforms offer clear paths to profitability and mainstream appeal but require higher operational costs and compliance burdens. Decentralized platforms provide lower entry barriers and DeFi ecosystem positioning but face regulatory uncertainty and liquidity challenges.

Success in the competitive cryptocurrency exchange market projected to reach $63.38 billion in 2025 requires more than platform selection. It demands clear differentiation, sufficient capital, technical competence, effective marketing, and sustained commitment to building user communities. By thoroughly evaluating your objectives, capabilities, and risk tolerance, you can make informed decisions that position your exchange for sustainable growth in the dynamic cryptocurrency trading landscape.