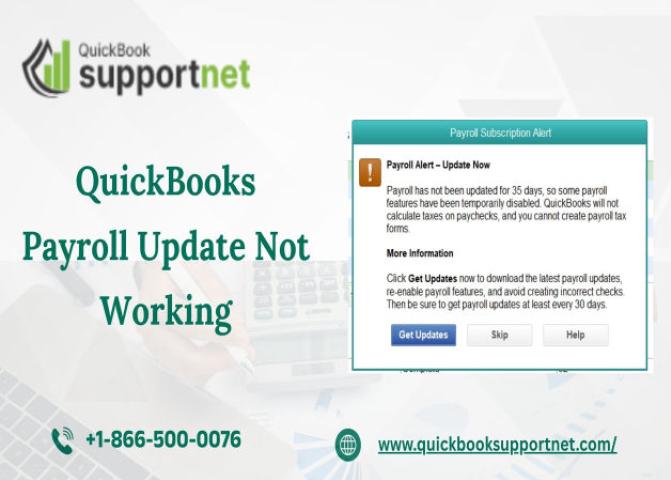

When you run payroll in QuickBooks, it’s essential that every update installs correctly—tax tables, compliance changes, and new payroll features all depend on it. But many users suddenly find that QuickBooks Payroll Update Not Working, which interrupts payroll processing and creates urgent pressure to fix the issue quickly. Whether the update freezes, fails, or returns unexpected error codes, this guide explains every possible cause and provides step-by-step solutions you can follow at home or at your office. If you’re stuck and need immediate help, you can also speak with a payroll expert at +1-866-500-0076.

Fix QuickBooks Payroll Update Not Working with this expert guide. Follow simple steps to restore payroll updates. Help available at +1-866-500-0076.

What Does It Mean When QuickBooks Payroll Updates Fail?

Payroll updates are required for accurate employee calculations and tax compliance. When the update fails, QuickBooks may show errors such as:

Update stuck at 0%

Update downloads but won't install

Payroll subscription not recognized

“Failed to download the update” message

“Payroll service connection error”

Later in the article, we will discuss related LSI keyword issues such as QuickBooks Payroll Updates Not Working and QuickBooks Desktop Payroll Updates Not Working, which often share the same underlying causes.

Top Reasons Why QuickBooks Payroll Update Not Working

Below are the most common triggers that cause payroll updates to fail:

1. Poor Internet or Firewall Blocking

If QuickBooks cannot connect to Intuit servers, the update will stop midway.

2. Incorrect Payroll Service Setup

Expired subscriptions or incorrect EIN entries can block payroll updates.

3. Damaged QuickBooks Components

Corrupted program files, missing Windows files, or damaged tax table files cause update failures.

4. Incorrect System Date & Time

Payroll servers require accurate local date/time sync.

5. Outdated QuickBooks Desktop Version

Running an older release prevents payroll updates from installing.

6. Third-Party Security Conflicts

Antivirus, firewall, and VPN programs can block QuickBooks payroll servers.

7. Admin Permission Issues

Payroll updates require Windows and QuickBooks admin access.

If you suspect any of these causes and want direct guidance, call +1-866-500-0076 for real-time troubleshooting support.

Read This Blog: Write Off Bad Debt in QuickBooks Desktop

How to Fix QuickBooks Payroll Update Not Working (Step-by-Step)

Below are the verified solutions to fix payroll update problems quickly and reliably.

Solution 1: Verify Your Payroll Subscription

Open QuickBooks Desktop

Go to Employees > My Payroll Service > Account/Billing Information

Sign in to Intuit

Confirm your subscription is active

If the subscription is expired, QuickBooks will block all payroll updates.

Solution 2: Correct the System Date & Time

Right-click your Windows taskbar clock

Select Adjust date/time

Enable Set time automatically

Restart your system

Re-open QuickBooks and retry the update

Incorrect time settings lead to server handshake failure.

Solution 3: Reset QuickBooks Update Settings

Open QuickBooks Desktop

Click Help > Update QuickBooks Desktop

Go to Update Now

Check Reset Update

Click Get Updates

This forces QuickBooks to download fresh update files.

Solution 4: Download the Latest Payroll Tax Table

Go to Employees > Get Payroll Updates

Check Download Entire Update

Select Download Latest Update

If the update stops at a specific number, corrupted tax files might be the cause.

Solution 5: Reconfigure Your Internet & Firewall Settings

QuickBooks requires the following ports:

8019

56728, 55378–55382

Steps:

Open Windows Firewall

Add inbound/outbound rules for QuickBooks

Disable VPN if active

If your firewall doesn’t allow outbound connections, payroll updates fail instantly.

Solution 6: Run QuickBooks File Doctor

The File Doctor tool repairs damaged company files and QuickBooks components:

Download QuickBooks Tool Hub

Open Company File Issues tab

Run QuickBooks File Doctor

If errors continue, contact QuickBooks specialists at +1-866-500-0076 for advanced repair steps.

Solution 7: Install QuickBooks Updates Manually

Close QuickBooks

Visit the Official QuickBooks Download Page

Choose your product version

Download and install the patch

Restart QuickBooks

Try payroll update again

Manual installation often bypasses automatic update failures.

Solution 8: Repair QuickBooks Desktop

Open Control Panel

Select Programs & Features

Choose QuickBooks Desktop

Click Repair

This fixes missing, broken, or corrupted installation files that prevent payroll updates from working properly.

Solution 9: Install QuickBooks in Selective Startup Mode

If third-party applications are interfering:

Press Windows + R

Type msconfig

Choose Selective Startup

Disable non-Microsoft services

Restart your PC

Reinstall QuickBooks

This method isolates software conflicts.

Advanced Errors Linked to Payroll Update Failures

Sometimes, payroll update failures trigger additional issues such as:

✓ “Update Error 15243”

Caused by a disabled QuickBooks File Protection service.

✓ “Payroll Service Not Available”

Triggered by server or subscription issues.

✓ “Error PS036”

Occurs when QuickBooks cannot verify payroll subscription status.

For urgent resolution or if you’re experiencing repeated failures, reach out to the payroll support team at +1-866-500-0076.

Pro Tips to Prevent Payroll Update Errors

To avoid future payroll update failures, follow these best practices:

Keep QuickBooks Desktop updated to the latest release

Ensure your payroll subscription renews automatically

Use a stable high-speed internet connection

Create weekly QuickBooks backups

Avoid installing conflicting third-party antivirus tools

Keep Windows updated

You can also bookmark this guide for future reference.

Conclusion

When QuickBooks Payroll Update Not Working, it can bring payroll operations to a halt and cause compliance issues. Fortunately, most problems can be fixed with the solutions above—resetting updates, adjusting firewall settings, repairing QuickBooks, or verifying subscription details. If the issue continues, the safest and fastest option is to connect with a payroll expert. For personalized support, you can always call +1-866-500-0076 for step-by-step guidance.