Introduction

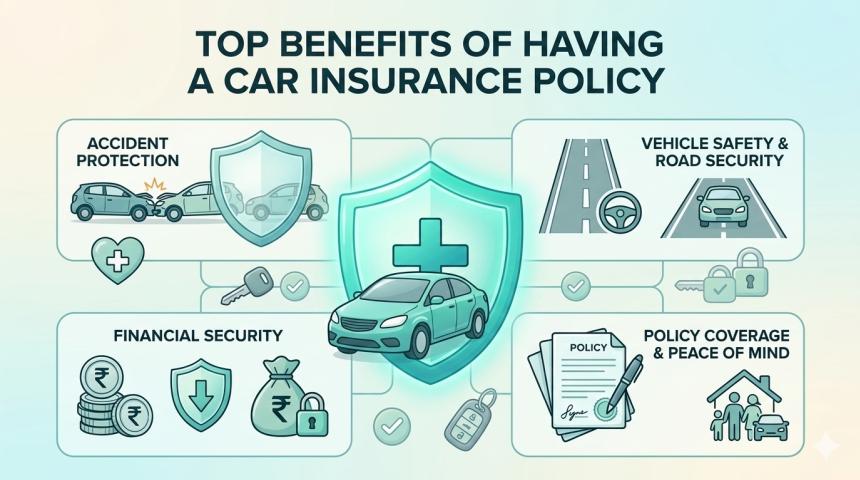

Renewing your car insurance on time is one of the most important responsibilities for every vehicle owner. With the digital shift accelerating across India, more people now prefer to renew car insurance online because it is quick, simple, and often more affordable. In 2025, online platforms offer added transparency, real-time policy comparisons, instant premium calculators, and paperless processing—making the renewal experience better than ever.

If you want to save money while

ensuring your car stays fully protected, this detailed guide will walk you

through smart tips to renew car insurance online in the most cost-effective

way.

Why

Renewing Car Insurance Online Makes Sense in 2025

Online car insurance renewal has

transformed the entire process. It eliminates middlemen, reduces paperwork,

helps you compare multiple insurers, and gives you access to better discounts

and add-on options. Renewing online also ensures:

- Faster processing

- Transparent policy details

- Easy claim history checks

- Quick access to policy documents

- Convenient payment methods

This means staying protected on the

road without wasting time or paying unnecessary costs.

1. Compare Policies Before You Renew

One of the biggest advantages of

renewing car insurance online is the ability to compare policies instantly. You

can evaluate:

- Premiums

- Coverage options

- IDV (Insured Declared Value)

- Add-ons

- Claim settlement ratio

- Network garage list

Many people stick to their old

policy without checking new options. But even a small difference in premium or

coverage can help you save a significant amount annually.

2. Choose the Right Type of Policy

When renewing car insurance online,

selecting the right policy type is essential for balancing cost and protection.

Third-Party

Insurance

- Mandatory by law

- Covers damage to other vehicles, property, or people

- Cheapest option, but offers no protection for your own

car

Comprehensive

Insurance

- Covers both third-party and own-damage

- Ideal for complete financial protection

- Slightly higher premium, but better long-term value

Standalone

Own-Damage Cover

- If you already have a valid third-party cover

- Lets you choose different insurers for OD and TP plans

Choosing wisely can help you avoid

paying extra for unnecessary coverage.

3. Opt for Add-Ons That Matter

Add-ons enhance your coverage but

also influence the premium amount. When renewing car insurance online in 2025,

select only those add-ons that match your driving needs.

Popular add-ons include:

- Zero Depreciation Cover

- Roadside Assistance

- Engine Protection

- Return to Invoice

- Consumables Cover

- No Claim Bonus (NCB) Protection

Avoid selecting too many add-ons

just because they are available. Choose only the essential ones to save money.

4. Increase Your Voluntary Deductible

A voluntary deductible is the amount

you agree to pay from your own pocket during a claim. The higher your voluntary

deductible, the lower your premium becomes.

But make sure:

- The deductible amount is affordable for you

- You do not compromise on financial safety

This simple trick is one of the

easiest ways to lower your premium while renewing car insurance online.

5. Renew Before the Policy Expiry Date

Many car owners delay renewing their

insurance, which causes:

- Loss of accumulated NCB

- Higher premiums

- Mandatory vehicle inspection

- Risk of driving uninsured

To avoid this, make sure you renew

your car insurance online before the expiry date. It not only keeps your

coverage active but also saves money by preserving your No Claim Bonus.

6. Take Advantage of No Claim Bonus (NCB)

NCB is a reward insurers give when

no claim is made during the policy period. It can reduce your own-damage

premium by 20% to 50%.

When renewing online, always:

- Check your NCB

- Ensure your insurer has correctly applied the discount

- Use NCB Protection add-on if you want to keep the

benefit even after one minor claim

NCB is one of the biggest

money-saving tools during renewals.

7. Avoid Small Claims

Minor repairs like scratches or

small dents should ideally be handled without making a claim. Filing frequent

claims reduces your NCB and increases your future premium.

If the repair cost is close to your

deductible amount, paying out of pocket is often a wiser choice.

8. Maintain a Good Driving Record

Safe driving not only keeps you safe

but also helps in getting:

- Lower premiums

- Better discounts

- Zero-penalty renewals

- Higher insurer trust

Many insurers in 2025 also offer usage-based

insurance where good driving behavior results in lower renewal charges.

9. Update Your Policy Details During Renewal

Small updates can reduce your

premium significantly. While renewing car insurance online, ensure you check

and update details like:

- Annual mileage

- Vehicle usage (personal/commercial)

- Security devices installed

- Change in parking location

- Updated contact/address details

Even adding an anti-theft device

approved by the authorities can help reduce your premium.

10. Use Discounts and Cashback Offers

Online platforms frequently offer:

- Festive discounts

- App-only offers

- Renewal cashback

- Payment gateway discounts

- Long-term policy discounts

Utilizing these offers during

renewal can further reduce your overall premium.

Conclusion

Renewing car insurance online is the

smartest way to secure your vehicle in 2025. It saves time, offers better

financial advantages, and gives you complete control over your policy. By

comparing plans, choosing the right coverage, maintaining your NCB, and

applying the smart tips mentioned above, you can easily reduce your premium

without compromising on safety.

If you want expert assistance,

transparent services, and easy online renewal options, Square Insurance

offers a seamless platform to renew your policy quickly and cost-effectively.

With a customer-first approach and reliable support services, they ensure a

smooth renewal experience for every vehicle owner.

Frequently Asked Questions

1.

Is it safe to renew car insurance online?

Yes, renewing car insurance online

is completely safe. Reputed platforms offer secure payment gateways, instant

policy documentation, and transparent details.

2.

Can I change my insurance company during renewal?

Yes, you can switch insurers any

time when renewing. Comparing plans helps you save money and find better

coverage.

3.

Will I lose my NCB if my policy expires?

If you fail to renew within 90 days

of expiry, your NCB will be lost. Renewing on time helps you retain your bonus.

4.

Can I renew my car insurance if it has already expired?

Yes, you can. However, your vehicle

may require inspection and your NCB may be affected.