The cryptocurrency exchange landscape is packed with ambition, but not every platform survives long enough to gain user trust. New exchanges launch regularly, yet many exit early due to development complexity, liquidity issues, compliance pressure, and security incidents. The pattern repeats often enough that founders naturally ask:

Is there a more sustainable way to launch without repeating the same failures?

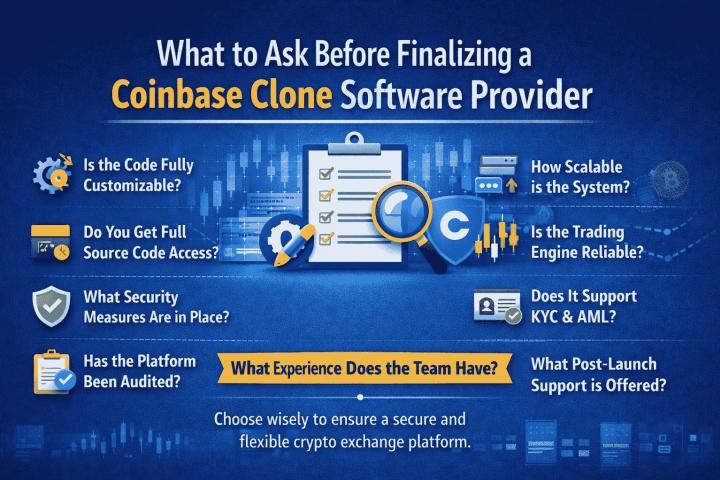

One approach gaining credibility is beginning with a Coinbase Clone Script — not to shortcut innovation, but to remove the heavy technical lift of building every feature from zero. When the foundation is stable, teams can invest their efforts where survival actually depends: liquidity, compliance, scalability, and long-term trust.

Why New Crypto Exchanges Fail Early

After observing trends across exchange launches, failures generally stem from a few recurring problems:

1. Long Development and Delayed Go-Live

Building a full trading platform — matching engines, wallet systems, UI/UX layers, blockchain integration — can stretch into a year or more. By the time a product is ready, market momentum or funding may already be gone.

2. Security Oversights

Even small vulnerabilities can cause asset theft, personal data exposure, or API exploitation. A lack of hardened wallet management is often the first point of failure.

3. Liquidity Gaps

Traders avoid empty markets. No orders means no activity, and no activity means users leave. Many early platforms launch before solving liquidity flow.

4. Regulatory Slowdowns

A crypto exchange is more than code — it’s a financial environment. Licensing, AML/KYC, audit-ready logs, and cross-border regulations take time, and many startups stall here.

5. Resource Burnout

Teams that spend everything on engineering rarely have enough left for liquidity partnerships, security audits, user education, and long-term development.

How a Coinbase Clone Script Helps Reduce Early Failure Risk

A Coinbase Clone Script cannot guarantee success, but it can remove several early risk points. Instead of building complex fundamentals from scratch, founders start from an already structured base. This allows the product to move faster and more confidently through early growth stages.

Where it makes a practical difference:

It shortens development time significantly

Core structure is already audited and tested

Liquidity integrations are typically simpler

Compliance frameworks like KYC/AML are pre-aligned

Teams can allocate budget to scaling instead of re-engineering

The goal isn’t to copy; it’s to build on top of something proven.

What a Coinbase Clone Framework Usually Includes

Most Coinbase Clone Software setups offer a foundational architecture designed for extension, branding, liquidity scaling, compliance work, and regional expansion. It is not limited to UI design — it spans wallet logic, trading engine mechanics, and administrative monitoring tools.

Security + Wallet Infrastructure

Multi-signature wallet controls

Cold + hot storage split for risk minimization

Identity and transaction monitoring

Layered authentication systems

Trading + Exchange Engine

Real-time matching algorithms

Limit and market order execution

Market depth visibility and charting tools

Fee configuration for platform economics

User Navigation + Experience

Simple onboarding flow for beginners

Mobile adaptability and Coinbase Clone App compatibility

Notification-based account alerts

Support for fiat gateways or payment rails

Admin + Compliance Framework

KYC/AML verification layers

Dispute resolution modules

Audit-friendly transaction logs

Policy-driven access controls

These components form a foundation — innovation happens above this layer.

Avoid Early Crypto Exchange Failure

Why do new exchanges shut down early?

Most fail due to security weaknesses, liquidity limitations, long development cycles, regulatory friction, and resource exhaustion.

How does a Coinbase Clone Script help?

It supplies exchange fundamentals — trading engine, wallet system, security logic — reducing development time and operational risk.

Is a Coinbase Clone App usable for mobile trading?

Yes. Many frameworks support mobile-responsive interfaces and app-level expansion for Android/iOS.

Does this limit future innovation?

No. It simply removes baseline engineering so teams can focus on growth, compliance, and trust building.

Key Takeaways

Crypto exchange failure usually stems from operational weight, not conceptual weakness.

A Coinbase Clone Script offers a stable starting point for development, audit-readiness, and user onboarding.

Teams gain time to work on liquidity, compliance, security reviews, and long-term scaling.

Launching strong is less about rushing — more about reducing risk early.

Final Reflection

Many exchanges don't fail because their idea lacks potential, but because the execution window is short, expensive, and unforgiving. A Coinbase Clone Software provides a structural base so founders can focus on resilience rather than survival. The pressure shifts from building foundational code to building durable trust.