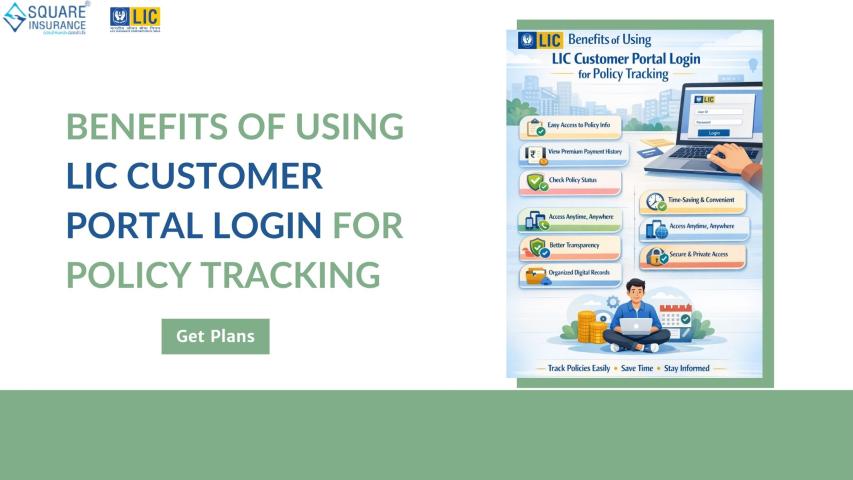

Managing life insurance policies has become easier with the availability of online services. Policyholders today prefer simple and convenient ways to access information without visiting offices repeatedly. The LIC Customer Portal Login is designed to help policyholders manage their policies from the comfort of their home. It provides a digital platform where important policy-related details can be viewed and basic services can be accessed at any time.

Using the LIC Customer Portal does not replace personal support but complements it by offering quick access to essential information. This article explains the key benefits of using the LIC Customer Portal Login for policy management in a clear and neutral manner.

Easy Access to Policy Information

One of the main benefits of using the LIC Customer Portal Login is easy access to policy details. Once logged in, policyholders can view important information such as policy number, sum assured, premium amount, and policy status.

This eliminates the need to search through physical documents every time information is required. Having policy details available in one place helps policyholders stay informed and organized.

Convenience and Time Saving

The portal allows policyholders to access services at any time, without being restricted by office hours. This flexibility is especially helpful for people with busy schedules.

Instead of traveling to a branch or waiting for assistance, users can log in and check their policy details within minutes. This saves time and reduces the effort involved in routine policy management tasks.

Premium Payment Tracking

Keeping track of premium payments is an important part of maintaining an active policy. The LIC Customer Portal Login helps policyholders view their premium payment history and upcoming due dates.

By having clear information about payment schedules, policyholders can avoid missed payments and ensure their policies remain in force. This feature also helps in planning monthly or yearly finances more effectively.

Policy Status Updates

Understanding the current status of a policy is essential. Through the customer portal, policyholders can check whether their policy is active, paid-up, or nearing maturity.

This transparency helps policyholders stay aware of where their policy stands and take necessary actions if required. It also reduces uncertainty by providing clear and updated information.

Easy Access to Policy Documents

The portal provides access to digital copies of policy-related documents. This includes policy bonds and other essential records.

Having digital access reduces the risk of losing important papers and makes it easier to refer to documents whenever needed. It also supports a more organized and paper-free approach to policy management.

Simplified Address and Contact Updates

Keeping contact information updated is important to receive timely communication. The LIC Customer Portal Login allows policyholders to update basic personal details such as address, phone number, or email.

This ensures that important notices, reminders, and policy-related updates reach the policyholder without delay. It also reduces the chances of miscommunication due to outdated information.

Nominee and Policyholder Information Management

The portal helps policyholders review nominee details linked to their policies. While certain changes may require formal procedures, having visibility into nominee information helps ensure that records are accurate.

This feature encourages policyholders to regularly review their policy details and make informed decisions when necessary.

Transparency and Clarity

Transparency is a key benefit of online policy management. The LIC Customer Portal Login provides clear and structured information that helps policyholders understand their policies better.

When information is easily available, policyholders feel more confident about their coverage and financial planning. This clarity reduces confusion and improves overall awareness.

Reduced Dependency on Physical Visits

While in-person support remains important, the portal reduces the need for frequent branch visits for basic inquiries. This is particularly beneficial for people living far from service centers or those with limited mobility.

By handling routine tasks online, policyholders can focus physical visits on more complex needs when necessary.

Secure Access to Information

The LIC Customer Portal Login is designed with security in mind. Login credentials and verification measures help ensure that policy information remains private and protected.

Knowing that personal and financial data is accessed through a secure platform gives policyholders confidence in using digital services.

Better Financial Planning

Access to accurate and updated policy information helps in better financial planning. Policyholders can review their insurance coverage, payment schedules, and maturity details while planning future expenses.

This awareness supports informed decision-making and long-term financial discipline.

Helpful for Senior Citizens and Families

The portal can be especially helpful for families managing multiple policies. Having all policy details in one account makes it easier to track information without confusion.

With guidance, senior citizens can also benefit from the portal by accessing policy details without frequent travel.

Encourages Digital Awareness

Using the LIC Customer Portal Login helps policyholders become more familiar with digital tools. This gradual adoption of online services builds confidence and reduces dependence on paperwork.

Digital access also supports timely information sharing and smoother communication.

Reduced Errors and Misunderstandings

When policy details are viewed directly by the policyholder, the chances of misunderstanding information are reduced. Clear records help avoid confusion related to premium amounts, due dates, or policy terms.

This accuracy contributes to smoother policy management.

Support During Important Life Stages

During important life events such as marriage, relocation, or retirement, having easy access to policy information is helpful. The portal allows policyholders to review and manage their policies as their needs change.

This flexibility supports continuity and planning during different life stages.

Conclusion

The LIC Customer Portal Login offers a simple and effective way to manage life insurance policies online. It provides easy access to policy information, helps track premium payments, and supports better organization of documents and records.

By saving time, reducing paperwork, and offering secure access, the portal makes policy management more convenient and transparent. While traditional support systems remain valuable, the customer portal serves as a helpful digital companion for policyholders.

Using the LIC Customer Portal Login encourages awareness, clarity, and responsible policy management. For individuals seeking a straightforward way to stay connected with their policy details, the portal provides a practical and user-friendly solution.

Also Read:- Top Advantages of Using the