Filing personal taxes can feel overwhelming, especially when multiple income sources, deductions, and credits come into play. Thankfully, QuickBooks Tax Form 1040 simplifies the process for individuals, self-employed professionals, and freelancers. Whether you are filing for the first time or switching from manual methods, this guide will walk you through everything you need to know—from setup to submission—so you can file with confidence and accuracy.

Learn how to file QuickBooks Tax Form 1040 for individuals with a step-by-step guide. Get expert help anytime at +1(866)500-0076.

In this detailed guide, you’ll learn how to prepare, review, and file Form 1040 using QuickBooks, common mistakes to avoid, and expert tips to stay IRS-compliant.

What Is QuickBooks Tax Form 1040?

Form 1040 is the standard IRS tax form used by individuals to file their annual income tax return. When paired with QuickBooks, it becomes a powerful tool that:

- Organizes income and expense data automatically

- Calculates taxes accurately

- Reduces manual entry errors

- Saves time during tax season

Using QuickBooks Tax Form 1040, individuals can pull financial data directly from their QuickBooks records, making tax filing faster and more reliable.

Who Should Use QuickBooks Tax Form 1040?

This solution is ideal for:

- Self-employed individuals

- Freelancers and consultants

- Independent contractors

- Individuals with multiple income streams

- Side hustlers and gig workers

If you track income and expenses in QuickBooks, using QuickBooks Tax Form 1040 ensures consistency between your books and your tax return.

Benefits of Using QuickBooks Tax Form 1040

Using QuickBooks for Form 1040 filing offers several advantages:

- Automated calculations reduce errors

- Real-time data sync from QuickBooks accounts

- Built-in checks for missing or incorrect information

- Easy deduction tracking

- Faster filing and refunds

These benefits make QuickBooks Tax Form 1040 a smart choice for individuals seeking accuracy and efficiency.

Step-by-Step: How to File QuickBooks Tax Form 1040

Follow these steps carefully to file your taxes smoothly:

Step 1: Prepare Your Financial Information

Before you start, ensure you have:

- Income records (1099s, W-2s, invoices)

- Expense details

- Bank statements

- Previous year’s tax return

QuickBooks automatically organizes much of this data, saving valuable time.

Step 2: Log in to QuickBooks

- Sign in to your QuickBooks account

- Navigate to the Taxes or Tax Forms section

- Select Form 1040

Your financial data will populate automatically based on your records.

Step 3: Review Income Details

Check all income categories carefully:

- Self-employment income

- Interest and dividend income

- Other taxable earnings

Ensure everything matches your records to avoid IRS discrepancies.

Step 4: Add Deductions and Credits

This is where QuickBooks Tax Form 1040 truly shines. You can easily include:

- Home office deductions

- Business expenses

- Education credits

- Health insurance deductions

QuickBooks helps maximize eligible deductions while maintaining compliance.

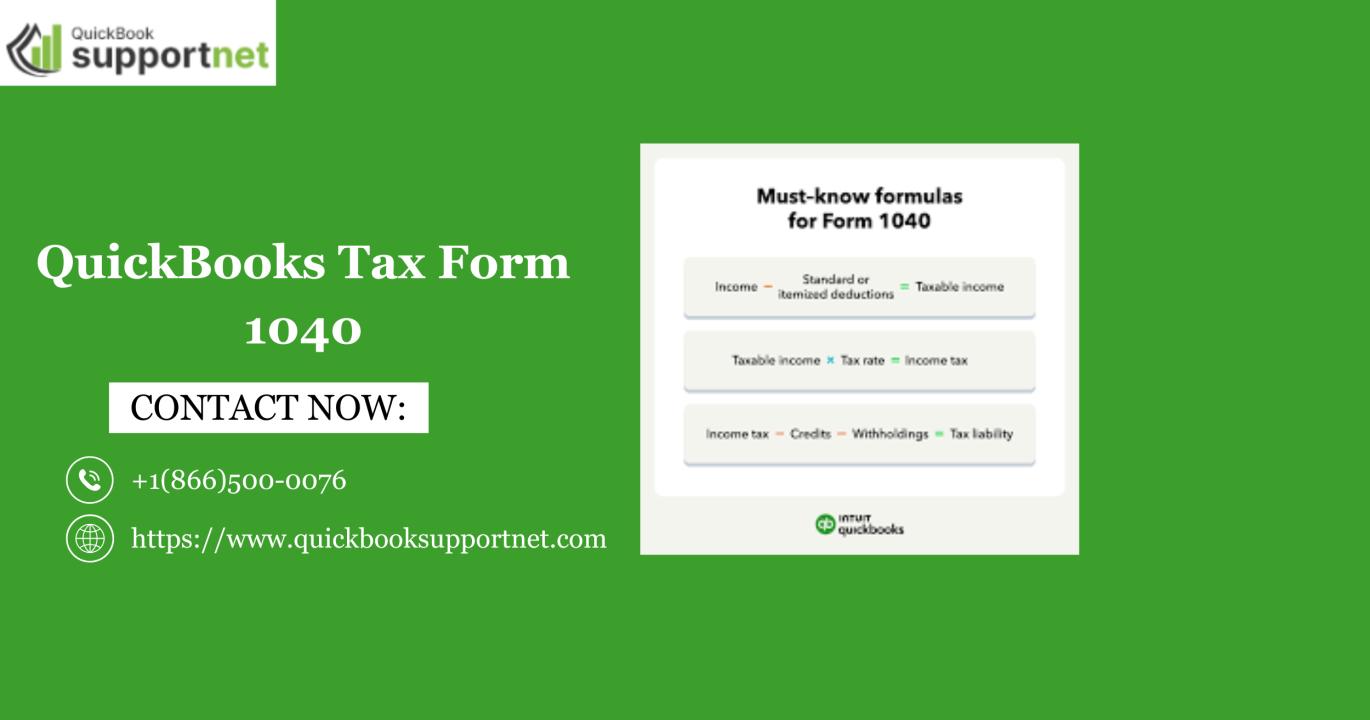

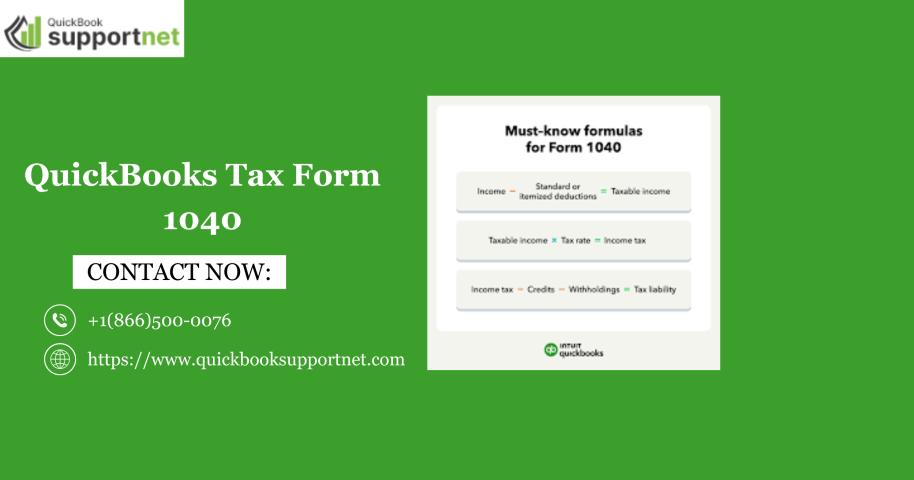

Step 5: Verify Tax Calculations

QuickBooks automatically calculates:

- Adjusted Gross Income (AGI)

- Taxable income

- Tax owed or refund due

Double-check all figures before proceeding.

Step 6: File and Submit

Once reviewed:

- E-file directly through QuickBooks (if available)

- Or export Form 1040 for manual submission

Save a copy for your records.

Common Mistakes to Avoid

Even with automation, mistakes can happen. Avoid these common errors:

- Forgetting to report all income sources

- Missing eligible deductions

- Incorrect personal details (SSN, address)

- Filing with outdated QuickBooks data

Regularly reconciling your accounts reduces these risks.

Tips for Accurate Filing with QuickBooks Tax Form 1040

- Reconcile accounts monthly

- Categorize expenses correctly

- Keep digital copies of receipts

- Review reports before filing

- Consult a tax professional for complex returns

These practices ensure smooth filing and fewer IRS issues.

Is QuickBooks Tax Form 1040 Secure?

Yes. QuickBooks uses advanced encryption and security protocols to protect your financial data. Regular updates ensure compliance with the latest IRS regulations, making QuickBooks Tax Form 1040 a safe and reliable choice.

Conclusion

Filing individual taxes doesn’t have to be stressful. With QuickBooks Tax Form 1040, individuals can streamline tax preparation, reduce errors, and file with confidence. From income tracking to deduction management, QuickBooks handles the heavy lifting so you can focus on what matters most.

If you want a complete accounting and tax solution, consider professional assistance or tools like Download QuickBooks Desktop to manage your finances efficiently year-round.

For expert help with setup or filing, contact +1(866)500-0076 anytime.

Frequently Asked Questions

1. What is QuickBooks Tax Form 1040 used for?

QuickBooks Tax Form 1040 is used by individuals to file annual income tax returns using financial data stored in QuickBooks.

2. Can freelancers use QuickBooks Tax Form 1040?

Yes, freelancers and independent contractors commonly use it to report self-employment income and deductions.

3. Does QuickBooks automatically calculate taxes?

Yes, QuickBooks automatically calculates taxable income, deductions, and estimated tax liability.

4. Is QuickBooks Tax Form 1040 IRS-compliant?

Yes, it follows current IRS guidelines and updates regularly to stay compliant.

5. Can I get help filing Form 1040 in QuickBooks?

Absolutely. You can contact support or a tax expert at +1(866)500-0076 for assistance.