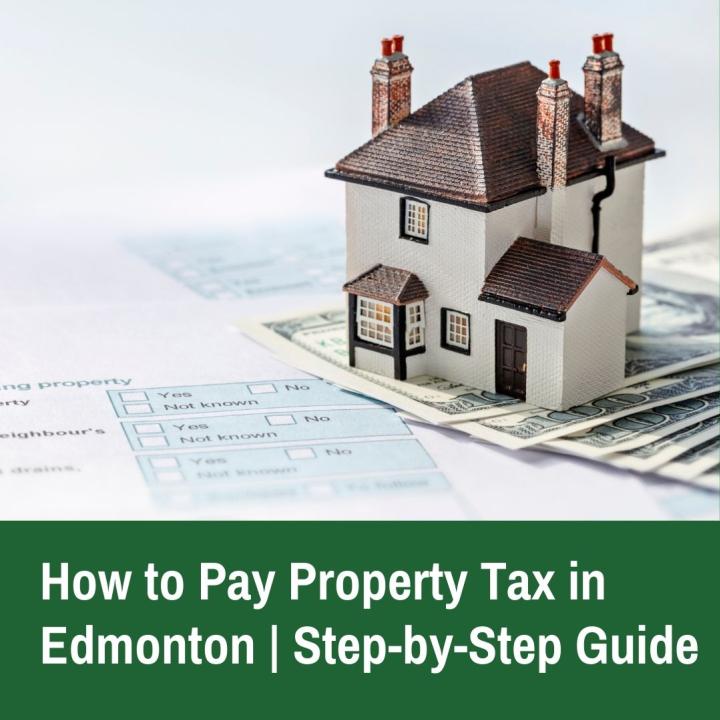

Learn how to pay property tax in Edmonton with ease. This guide covers payment options, deadlines, and tips to manage your taxes stress-free.

Read More: https://thehomess.com/news/how-to-pay-property-tax-in-edmonton

How to Pay Property Tax in Edmonton

Written by

thehomess

442 days ago

Related articles:

Steps to follow when you are investing in a house to build wealth

When it comes to investing in real estate, residential properties also play a crucial role, as you can rent them out, generating a fixed source of income, and realise a..

Property Lawyer in Pune: Why Legal Due Diligence Is Essential Before Buying Property

Buying property is one of the biggest financial decisions you will ever make. Whether it is a residential flat, commercial office, or investment land, every transaction involves legal documentation, ownership..

How to Scale Faster and Cut Costs with Professional Property Management Back Office Services

How to Outsource Professional Property Management Back Office Services for Scalable Growth | iRapidO Global Property management companies aiming for rapid expansion often encounter operational bottlenecks long before market demand..

Modernize Property Casualty Insurance Operations with Digital Solutions

Maintaining outdated systems drains resources. Carriers must retain specialized personnel familiar with obsolete programming languages. These systems require manual workarounds for routine tasks that could be automated. IT departments spend..

Property Lawyer in Pune – Complete Legal Protection for Real Estate Transactions with Propdox

Buying or selling property is one of the biggest financial decisions a person makes. In a fast-growing city like Pune, real estate opportunities are increasing rapidly. However, with growth also..

When You Must Update Your Commercial RPR (And What It Costs)

Owning or managing commercial property involves more than maintenance and day-to-day operations. One essential aspect often overlooked is keeping your Commercial Real Property Report in Edmonton current. These reports are..

Property Lawyer in Pune – Why Legal Support is Essential for Safe Real Estate Transactions | Propdox

Buying or selling property is one of the biggest financial decisions you will ever make. Whether it is a residential flat, commercial office, plot, or investment property, every transaction involves..

Property Lawyer in Pune: Secure Your Real Estate Transactions with Propdox

Buying, selling, or investing in property is one of the most significant financial decisions in a person’s life. Whether it’s a residential flat, commercial space, or land purchase, legal verification..

When Boundary Markers Disappear: How Edmonton Surveyors Re‑Establish Lost Property Lines

Property boundaries aren’t always as clear as they appear. Over time, markers such as stakes, fences, or survey pins can shift, get removed, or become buried. For homeowners and developers..

Property Lawyer in Pune: Secure Your Property Transactions with Propdox

Buying or selling property is one of the most important financial decisions a person makes. In a rapidly developing city like Pune, where residential and commercial real estate is constantly..

Are Crypto Gains Taxed? Unraveling 2025’s Crypto Tax Puzzle

The crypto is humming like a virtual gold rush, and you are piling your winnings on a Bitcoin trade or DeFi harvest. However, the shadow of the taxman is always..

Understanding Tax Deductions for Businesses in the U.S.: A Startup’s Guide

Tax deductions are an important tool for businesses in the United States, helping to lower taxable income and reduce overall tax liabilities. For startups, understanding which expenses are deductible can..

Digital Marketing That Increases Revenue

In today’s competitive business environment, digital marketing is no longer optional—it is essential for sustainable revenue growth. Companies that strategically leverage digital channels can attract qualified leads, nurture prospects, convert..

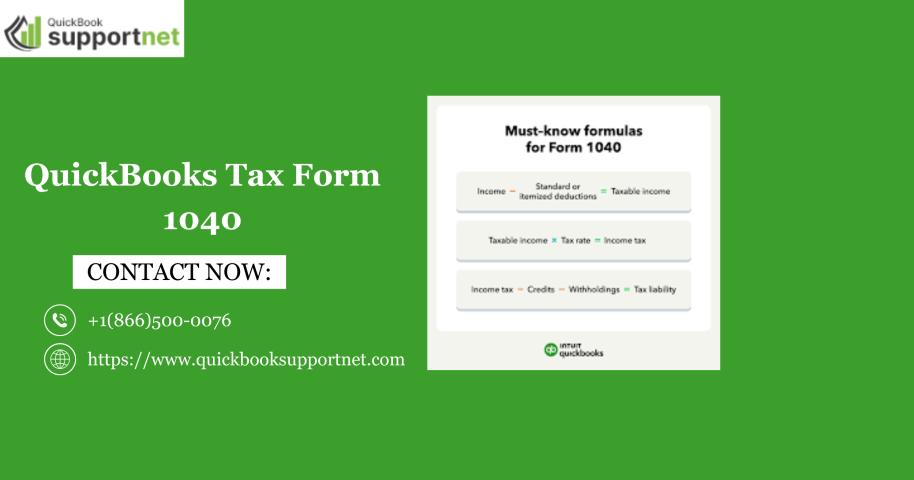

QuickBooks Tax Form 1040 Tutorial: Accurate & Fast Tax Filing

Filing personal taxes doesn’t have to feel overwhelming or confusing. With the right preparation and accounting tools, you can complete your federal return accurately and on time. Many individuals, freelancers,..

QuickBooks Tax Form 1040 for Individuals – Step Guide

Filing personal taxes can feel overwhelming, especially when multiple income sources, deductions, and credits come into play. Thankfully, QuickBooks Tax Form 1040 simplifies the process for individuals, self-employed professionals, and..

Tax Agent Portal Guide – What Your Accountant Does Behind the Scenes

Ever wondered how your accountant manages your tax so efficiently?

This Tax Agent Portal Guide breaks down how the portal works and why it helps accountants lodge accurately and on..

QuickBooks Payroll Tax Table Update Download: Step-by-Step Guide for 2026

Keeping payroll accurate and compliant is one of the most critical responsibilities for any business. With changing tax laws and annual updates, payroll software must stay current to avoid calculation..

What are the Top 10 Challenges of Tax Consultants?

Taxation is one of the trickiest aspects of running a business. It’s not just about calculating numbers — it’s about interpreting laws, staying compliant, and making sure no one pays..