Introduction

In India, employers are legally required to provide a set of welfare benefits to their employees under various labor laws. These benefits, commonly known as statutory benefits in India, ensure financial protection, social security, and better working conditions for employees across different sectors. Understanding these benefits is essential for businesses to maintain compliance and for employees to know their rights.

In this article, we will explore the key statutory benefits in India, their legal frameworks, and the obligations they place on employers.

What Are Statutory Benefits in India?

Statutory benefits in India refer to mandatory employee welfare schemes enforced by Indian labor laws. These include contributions toward retirement funds, health insurance, bonuses, gratuity, and more. They are designed to protect the interests of employees while ensuring that companies operate responsibly and ethically.

Key Statutory Benefits Every Employer Must Provide

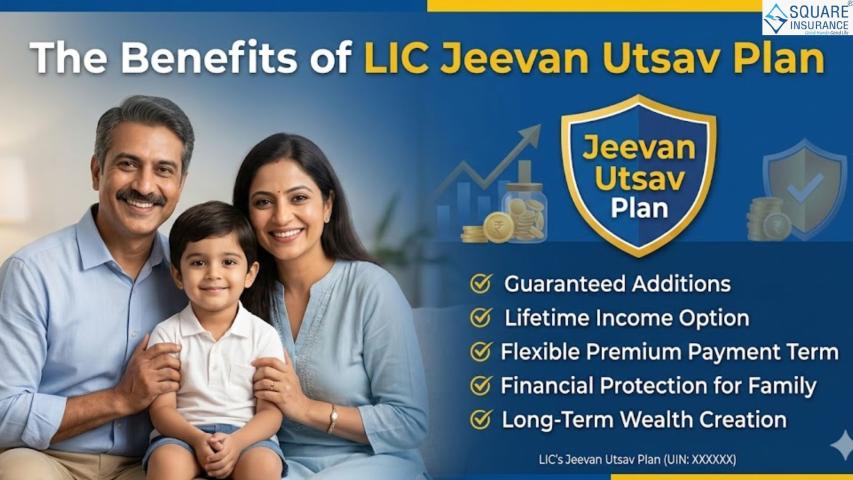

1. Employees’ Provident Fund (EPF)

Purpose: Retirement savings and long-term financial security.

Applicability: Mandatory for establishments with 20 or more employees.

Contribution: 12% of basic salary from both employer and employee.

2. Employees’ State Insurance (ESI)

Purpose: Medical care and cash benefits in case of sickness, maternity, or injury.

Applicability: Applicable to employees earning ₹21,000 or less per month.

Contribution: 3.25% by employer, 0.75% by employee.

3. Gratuity

Purpose: A lump sum paid to employees as a thank-you for long-term service.

Eligibility: Completion of 5 years of continuous service.

Governed By: The Payment of Gratuity Act, 1972.

4. Bonus

Purpose: Performance-linked financial reward.

Eligibility: Employees earning up to ₹21,000/month.

Governed By: The Payment of Bonus Act, 1965.

5. Maternity Benefits

Purpose: Paid leave during pregnancy and post-childbirth.

Entitlement: 26 weeks of paid leave for women employees.

Governing Law: Maternity Benefit Act, 1961.

6. Leave Policies

Includes: Casual leave, sick leave, earned leave, and public holidays.

Varies: According to state-specific Shops & Establishment Acts.

7. Minimum Wages

Objective: To guarantee fair pay across different industries.

Governed By: Minimum Wages Act, 1948.

Depends On: Skill level, job role, and state regulations.

8. Professional Tax

Applicable In: Select Indian states like Maharashtra, Karnataka, and West Bengal.

Responsibility: Employers deduct and deposit to the state government.

9. Labor Welfare Fund (LWF)

Purpose: To support workers' welfare activities such as housing, education, and medical aid.

Varies By: State and type of industry.

Why Statutory Benefits in India Matter

✅ Legal Compliance: Prevents penalties, audits, and legal consequences.

✅ Employee Satisfaction: Increases retention and motivation.

✅ Corporate Reputation: Builds trust among current and future employees.

✅ Social Security: Ensures long-term well-being of workers.

Employer Responsibilities

Timely registration with EPFO, ESIC, and other authorities.

Accurate calculation and timely deposit of contributions.

Maintenance of employee records and monthly/annual returns.

Display of statutory notices in the workplace.

Providing clarity to employees on deductions and entitlements.

Conclusion

Understanding and adhering to statutory benefits in India is not only a legal requirement but also a cornerstone of ethical business practices. Employers must stay updated with the evolving labor laws and ensure that their HR and payroll systems are aligned for full compliance. On the other hand, employees should be aware of these benefits to safeguard their rights and build a secure future.