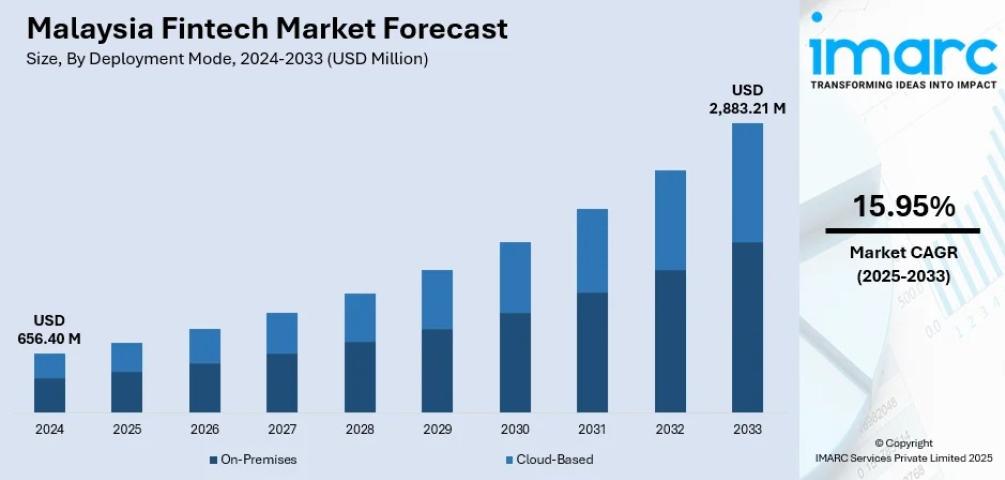

The financial services industry is experiencing a massive transformation, driven by rapid advancements in digital technologies. One of the most impactful innovations is Fintech Automation, which empowers institutions to scale operations, reduce costs, and enhance service delivery. By automating critical functions such as payments, risk assessment, and especially automated loan processing, financial organizations are streamlining their workflows and increasing efficiency.

Automated loan processing has become a cornerstone of modern financial operations. Traditionally, loan origination was slow, labor-intensive, and prone to errors. With fintech-driven automation, lenders can now verify documents, assess creditworthiness, and approve loans in minutes. This efficiency not only enhances the customer experience but also enables businesses to process higher volumes without sacrificing accuracy or compliance.

Understanding Fintech Automation and Its Role

Fintech Automation refers to the use of advanced technologies like artificial intelligence (AI), machine learning, robotic process automation (RPA), and cloud computing to perform financial tasks with minimal human intervention. These tools can be deployed across various business functions — from front-end customer interactions to back-end operations — to streamline processes and deliver faster, smarter results.

The shift toward automation is more than just a trend; it’s a necessity. As regulatory expectations increase and customer demand for speed and transparency grows, traditional financial institutions face mounting pressure to evolve. Automating repetitive, time-consuming tasks frees up human resources, reduces operational risk, and enables organizations to focus on high-value activities like customer engagement and strategic planning.

Accelerating Lending with a Fintech Lending Platform

Among the areas where automation has had the most profound impact is lending. A modern Fintech Lending Platform incorporates intelligent automation to simplify and accelerate the entire loan lifecycle — from application and underwriting to approval and disbursement.

With a robust platform, financial institutions can:

- Enable digital onboarding with real-time verification

- Use AI-driven risk models for accurate credit scoring

- Offer faster loan approvals through automated loan processing

- Integrate with third-party data sources and payment systems

This digital-first approach ensures that both lenders and borrowers benefit from a smoother, more transparent lending experience. Additionally, Fintech Lending Platforms help businesses scale their lending operations across different markets and customer segments without increasing overhead.

Key Benefits of Fintech Automation

1. Enhanced Efficiency and Productivity

Fintech Automation eliminates manual bottlenecks, enabling faster task execution with minimal errors. Financial teams can process thousands of transactions or loan applications simultaneously, drastically improving turnaround times.

2. Cost Savings

Automating routine processes reduces the need for large operational teams, thereby lowering staffing costs. Over time, these savings can be redirected toward strategic investments and innovation.

3. Improved Compliance and Risk Management

With automation, compliance becomes built-in. Systems can monitor and enforce regulations in real time, flagging suspicious activities and generating audit-ready reports. This reduces the risk of fines and enhances overall transparency.

4. Superior Customer Experience

Today’s consumers expect digital experiences that are fast, intuitive, and reliable. Fintech automation delivers by enabling 24/7 service, instant approvals, and personalized financial recommendations, creating a competitive advantage for providers.

5. Scalability

As demand grows, automated systems can scale effortlessly to handle increased workloads without compromising performance. This flexibility is crucial for institutions looking to grow without adding complexity.

Real-World Applications of Fintech Automation

Fintech automation is not limited to one aspect of finance; its use cases span a wide range of operations:

- Customer Onboarding: Automating KYC (Know Your Customer) and AML (Anti-Money Laundering) checks accelerates onboarding while ensuring compliance.

- Loan Underwriting: AI-driven models evaluate applications based on credit history, income, and even alternative data, ensuring smarter decisions.

- Payments and Transfers: Instant fund transfers and automated payment scheduling improve operational flow and customer satisfaction.

- Fraud Detection: Machine learning tools analyze patterns in real-time to identify fraudulent behavior and prevent losses.

- Portfolio Management: Robo-advisors use algorithms to manage investments based on client preferences and market trends.

- Leveraging AI Consulting Services for Implementation

While the benefits of Fintech Automation are clear, implementing it effectively requires strategic planning and deep technical knowledge. Many organizations turn to professional AI Consulting Services to navigate the complexities of automation and ensure successful integration.

These consulting services help businesses:

- Identify automation opportunities across the value chain

- Choose and customize the right tools and platforms

- Integrate new systems with the existing IT infrastructure

- Train teams to manage and operate automated workflows

- Monitor and optimize system performance over time

Partnering with experienced consultants ensures that automation aligns with business objectives and delivers measurable value.

How to Choose the Right Fintech Automation Tools

The financial technology landscape is crowded, and selecting the right automation tools can be overwhelming. Here are a few factors to consider:

- Integration Capabilities: Ensure the tool can seamlessly integrate with your current systems, including CRMs, payment gateways, and analytics platforms.

- Customization: Look for platforms that offer flexible configurations to meet your unique operational needs.

- Scalability: The tool should support future growth in volume and functionality.

- Security and Compliance: Prioritize solutions that offer strong data protection and are compliant with financial regulations such as GDPR, PCI-DSS, or SOC 2.

- User Experience: Choose intuitive platforms that are easy to navigate for both customers and internal teams.

The Future of Fintech Automation

The future of Fintech Automation is dynamic and promising. Emerging technologies such as blockchain, advanced analytics, and conversational AI are set to further enhance financial operations. We can expect:

- Smart Contracts: Automating contract execution and compliance using blockchain.

- Predictive Analytics: Using historical data to forecast customer behavior and market trends.

- Voice and Chat Interfaces: AI-powered assistants handle customer queries and transactions in real-time.

- Institutions that adopt automation now are better positioned to harness these innovations and lead in the next phase of digital finance.

Conclusion

In an increasingly competitive and digital-first financial landscape, Fintech Automation is the key to scaling operations, reducing costs, and delivering exceptional customer experiences. From automated loan processing to AI-powered risk assessment and real-time fraud detection, the impact of automation is profound and far-reaching.

A powerful Fintech Lending Platform, combined with expert support from AI Consulting Services, ensures a smooth transition into the future of finance. By embracing these tools today, financial institutions can not only meet the demands of modern customers but also build a resilient, agile, and future-ready business.