Goods and Services Tax (GST), implemented on July 1, 2017, has revolutionized the Indian indirect tax system by replacing multiple taxes with one unified tax. One of the cornerstones of the GST regime is GST return filing, a mandatory compliance activity for registered businesses. Filing GST returns ensures proper tax reporting, input tax credit claims, and legal compliance.

This article provides a

comprehensive guide to GST return filing in India, including its types, filing

process, due dates, penalties, and compliance best practices.

What is a GST Return?

A GST return is a document

that a registered taxpayer under GST must file with the Goods and Services Tax

Network (GSTN). It contains information about:

- Sales (outward supplies)

- Purchases (inward supplies)

- Output GST (on sales)

- Input GST (on purchases)

These returns help the

government track tax liabilities and input tax credit (ITC) claims and detect

evasion.

Who Should File GST Returns?

Every person registered under

the GST Act is required to file returns. This includes:

- Regular taxpayers

- Composition dealers

- Input Service Distributors (ISD)

- E-commerce operators

- Non-resident taxable persons

- TDS/TCS deductors under GST

Even if there is no business

activity (nil return), filing is mandatory.

Types of GST Returns

Below are the key GST returns

to be filed under the GST regime:

1. GSTR-1: Outward Supplies

Return

- Filed by: Regular taxpayers

- Frequency: Monthly or Quarterly (under

QRMP)

- Details: Invoice-wise details of outward

supplies/sales

- Due Date:

- 11th of the following month (Monthly)

- 13th of the month after the quarter (QRMP

scheme)

2. GSTR-3B: Summary Return

- Filed by: Regular taxpayers

- Frequency: Monthly or Quarterly

- Details: Summary of outward and inward

supplies, tax liability, and ITC

- Due Date: 20th of the following month (or

22nd/24th for QRMP)

3. GSTR-4: Composition Scheme

Return

- Filed by: Composition scheme dealers

- Frequency: Annually

- Due Date: 30th April of the next financial

year

4. GSTR-5: Non-Resident

Taxpayer Return

- Filed by: Non-resident taxable persons

- Frequency: Monthly

- Due Date: 20th of the following month

5. GSTR-6: Input Service

Distributor Return

- Filed by: ISDs distributing input tax

credit

- Frequency: Monthly

- Due Date: 13th of the following month

6. GSTR-7: TDS Return under

GST

- Filed by: Tax deductors under GST

- Frequency: Monthly

- Due Date: 10th of the following month

7. GSTR-8: TCS Return for

E-Commerce Operators

- Filed by: E-commerce operators collecting

TCS

- Frequency: Monthly

- Due Date: 10th of the following month

8. GSTR-9: Annual Return

- Filed by: Regular taxpayers (turnover

above ₹2 crore mandatorily)

- Frequency: Annually

- Due Date: 31st December of the following

financial year

9. GSTR-9C: Reconciliation

Statement

- Filed by: Taxpayers with turnover

exceeding ₹5 crore

- Certified by: Chartered Accountant or Cost

Accountant

GST Return Filing Process

(Step-by-Step)

Here’s a step-by-step guide to

file a GST return online:

Step 1: Login to GST Portal

Visit www.gst.gov.in and

log in with your credentials (GSTIN, username, and password).

Step 2: Navigate to Returns

Dashboard

Go to ‘Services’ → ‘Returns’ →

‘Returns Dashboard’. Choose the financial year and month.

Step 3: Select the Return Form

Choose the applicable return

(e.g., GSTR-1, GSTR-3B). Click on 'Prepare Online'.

Step 4: Enter Relevant Details

- For GSTR-1: Add invoice-wise details of

B2B and B2C sales

- For GSTR-3B: Enter outward supply summary,

ITC claim, and tax payable

Step 5: Preview and Validate

Review the data thoroughly and

validate to check for any errors.

Step 6: Submit the Return

Click ‘Submit’ to lock the

data. No changes can be made after submission.

Step 7: File with DSC/EVC

Use Digital Signature

Certificate (DSC) or Electronic Verification Code (EVC) to complete filing.

Step 8: Download

Acknowledgment

Save and download the

Acknowledgment Reference Number (ARN) for future reference.

Due Dates for GST Returns

|

Return Type |

Frequency |

Due Date |

|

GSTR-1 |

Monthly |

11th of next month |

|

GSTR-3B |

Monthly |

20th of next month |

|

GSTR-4 |

Annual |

30th April |

|

GSTR-9 |

Annual |

31st December |

For quarterly filers under

QRMP:

- GSTR-1: 13th of the month after the

quarter

- GSTR-3B: 22nd or 24th depending on state

Penalty for Late Filing of GST

Returns

Failure to file GST returns on

time leads to:

1. Late Fees

- GSTR-1 & 3B:

₹50 per day (₹25 CGST + ₹25 SGST)

- Nil return:

₹20 per day (₹10 CGST + ₹10 SGST)

- Maximum Cap:

₹5,000 per return

2. Interest on Late Payment

Interest at 18% per annum is

applicable on outstanding tax liabilities from the due date till the date of

payment.

Input Tax Credit and GST

Returns

Claiming Input Tax Credit

(ITC) is closely linked with GST returns. ITC is allowed only when:

- Supplier has uploaded the invoice in

GSTR-1

- Buyer reflects the same in GSTR-3B

- Supplier has paid the tax to the

government

Hence, timely and accurate

return filing by both supplier and buyer is crucial.

GST Return Filing under QRMP

Scheme

The Quarterly Return Monthly

Payment (QRMP) scheme is for taxpayers with annual turnover up to ₹5 crore.

Features:

- GSTR-1 is filed quarterly

- GSTR-3B is filed quarterly

- Tax is paid monthly using PMT-06 challan

- Optional Invoice Furnishing Facility (IFF)

allows monthly B2B invoice uploads

Common Mistakes to Avoid

- Mismatched

invoices

- Always

reconcile GSTR-1 and GSTR-3B with books of accounts.

- Missing

Nil Returns

- Even

if there are no transactions, file nil returns to avoid penalties.

- Wrong

GSTIN usage

- Double-check

recipient GSTIN while issuing invoices.

- Skipping

ITC reconciliation

- Reconcile

ITC with GSTR-2B before claiming.

- Delay

in return filing

- Leads

to interest, late fee, and blockage of ITC.

Importance of Timely GST

Return Filing

Timely filing of GST returns:

- Ensures smooth ITC flow

- Avoids penalties and interest

- Maintains compliance rating

- Builds credibility for loans and tenders

- Keeps business records up-to-date

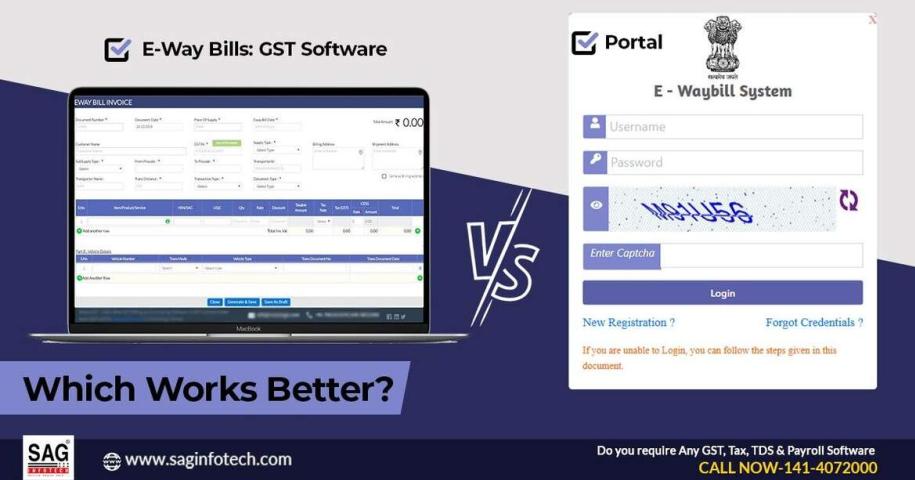

Tools and Services for GST

Return Filing

Businesses can use:

- GSTN Portal

- GST Suvidha Providers (GSPs)

- ERP and Accounting Software (like Tally,

Zoho, Marg)

- Chartered Accountants or GST Practitioners

- Third-party platforms like Compliance

Calendar, ClearTax, etc.

Conclusion

GST return filing is a vital

compliance activity for every GST-registered business in India. While the

process may seem complex initially, understanding the types of returns, due

dates, and filing steps helps ensure timely and accurate compliance. With digital

tools and expert assistance, businesses can simplify GST filing and focus more

on core operations.

Staying compliant not only avoids penalties but also builds a robust credit and tax history an asset in today's competitive marketplace.