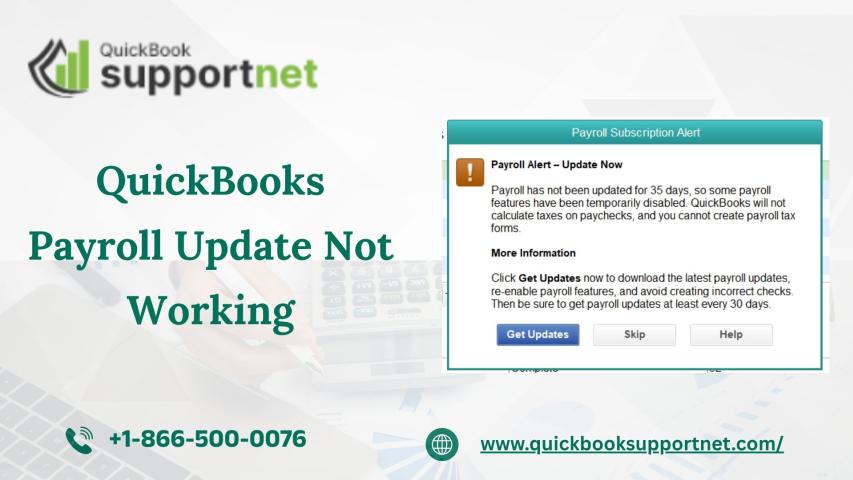

When managing payroll in QuickBooks, keeping your payroll updates current is crucial for compliance and accurate calculations. However, encountering the "QuickBooks Payroll Update Not Working" error is a common frustration for businesses. This comprehensive guide explains how to fix QuickBooks payroll update errors, explores their causes, and walks you through proven solutions so you can get back to processing payroll without hassles.

Common Causes of QuickBooks Payroll Update Not Working

Before jumping into the solutions, it's important to understand why these update issues occur. The most frequent causes include:

Outdated QuickBooks Desktop software

Corrupt or incomplete payroll tax table files

Incorrect system date or time settings

Faulty internet connectivity

Blocked permissions due to Windows settings or antivirus/firewall

Pending payroll data that hasn’t been sent to Intuit

User Account Control (UAC) interference

Damaged components or folders in QuickBooks

Step-by-Step Solutions to Fix Payroll Update Errors

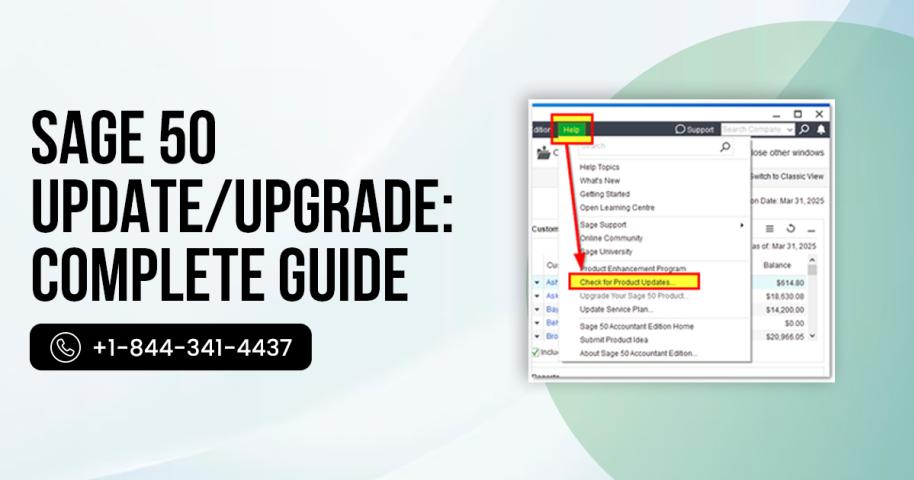

1. Update QuickBooks Desktop to the Latest Release

Running an outdated version of QuickBooks Desktop frequently causes payroll update errors. Always check for the latest release:

Close your company file and QuickBooks Desktop.

Right-click the QuickBooks Desktop icon and select Run as Administrator.

Go to the Help menu and choose Update QuickBooks Desktop.

Switch to the Update Now tab, tick Reset Update, then click Get Updates.

When prompted after restart, install the acquired updates.

2. Ensure Internet Connectivity and Firewall Permissions

Payroll updates require a stable internet connection. If you see update failures:

Test your Internet connection: Try opening a web page.

Temporarily disable firewalls or configure your security software to allow QuickBooks updates.

Verify Internet Explorer as your system’s default browser (QuickBooks relies on it for some background processes).

3. Run QuickBooks as Administrator

Administrative rights are required for updates:

Close QuickBooks.

Right-click the QuickBooks Desktop icon and select Run as Administrator.

Proceed to update payroll.

4. Send All Pending Payroll Data

Unsent data can block updates, especially if direct deposit is enabled or partial payroll runs are in progress:

Go to the Employees menu and select Send Payroll Data.

Click Send All to submit any pending items.

Enter your payroll PIN if prompted and allow QuickBooks to process the queue.

5. Rename the CPS Folder

A corrupt CPS folder can block payroll updates. Renaming it forces QuickBooks to create a new, healthy folder.

Close QuickBooks.

Navigate to:

C:\Program Files\Intuit\QuickBooks (YEAR)\Components\Payroll\CPSRename the CPS folder to CPSSOLD.Reopen QuickBooks and attempt to update payroll again.

6. Update Payroll Tax Table Manually

Open QuickBooks Desktop and log in as Admin.

Go to Employees > Get Payroll Updates.

Select Download Entire Update.

Click Update. Wait for the "Update Complete" message.

7. Turn Off User Account Control (UAC)

In some cases, User Account Control (UAC) settings may block QuickBooks from updating necessary components:

Press Windows+R, type

control panel, and hit Enter.Go to User Accounts > User Accounts > Change User Account Control settings.

Lower the slider to Never Notify.

Click OK and restart your computer.

Try updating payroll again. Remember to restore original UAC settings after troubleshooting for security reasons.

8. Run QuickBooks in Safe Mode (Selective Startup)

Third-party applications or services may disrupt QuickBooks updates.

Create a backup of your company file.

Press Windows+R, type

msconfig, and hit Enter.Under the General tab, select Selective Startup and Load System Services.

Under the Services tab, select Hide all Microsoft services, then Disable All.

Ensure Windows Installer is ticked.

Click OK, then Restart.

Try updating payroll.

To revert, repeat the steps and select Normal Startup.

9. Give Full Windows Permissions to QuickBooks Folders

Lack of proper permissions can prevent updates.

Go to C:\Program Files\Intuit\QuickBooks (Year) or C:\Program Files (x86)\Intuit\QuickBooks (Year).

Right-click QBW32.EXE, select Properties > Security > Edit > Add.

Add "Everyone" and "Users", granting Full Control permissions.

Click Apply and OK.

Additional Tips

- Backup Your Data: Always back up your QuickBooks company file before making significant changes or attempting troubleshooting steps.

- Check for Stuck Paychecks: Errors like PS038 may indicate paychecks stuck as "Online to Send". These must be resolved by sending or deleting them.

- Contact Intuit Support: If persistent errors like 15242 or 557 occur, consult official QuickBooks support channels for expert assistance.

- Preventing Future Payroll Update Issues

Maintain your QuickBooks Desktop and Windows OS up-to-date.

Schedule regular payroll update checks.

Periodically review and clear any unsent payroll data.

Ensure user access rights and system permissions are correctly configured.

By methodically following these steps, you’ll resolve most QuickBooks Payroll update errors and restore your ability to process payroll accurately and on time, avoiding errors and compliance issues.