The Life Insurance Corporation of India (LIC) is one of the

most trusted insurance providers in the country. Millions of people rely on LIC

for life insurance, savings plans, and investment opportunities.

In today’s digital world, LIC has made it easier for its

customers to manage their policies through the LIC online portal. With LIC

login, you can pay premiums, check policy details, download receipts, and even

request services, all from the comfort of your home.

In this blog, we will guide you through the LIC login process online in simple steps so you can access your account easily and securely.

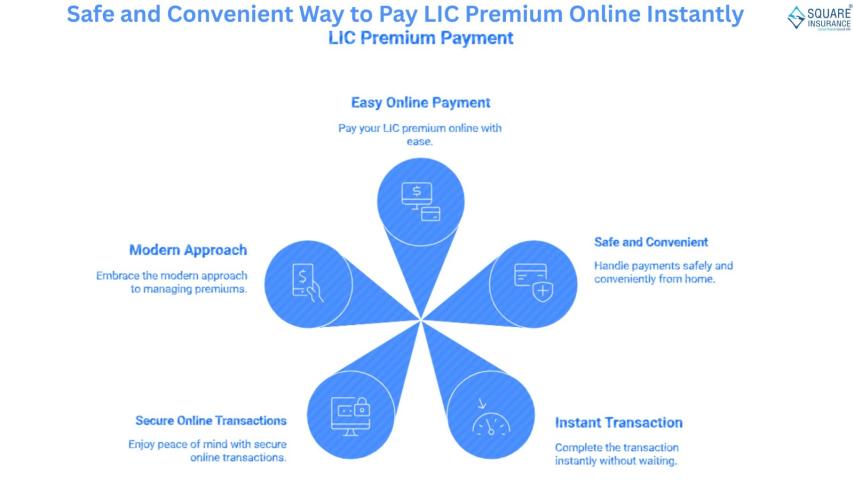

1. Why Use LIC Login Online?

Before we jump into the process, let’s understand why using

the LIC online portal is so helpful.

- 24/7

Access – You can log in anytime, from anywhere.

- Quick

Premium Payments – Pay premiums instantly through multiple payment

modes.

- View

Policy Details – Check policy status, maturity dates, and bonus

details in seconds.

- Manage

Multiple Policies – Link and manage all your LIC policies under one

account.

- Safe

and Secure – The portal uses encryption to protect your data.

2. Types of LIC Login Options

LIC offers different login options for different users:

- Customer

Login – For policyholders to manage their accounts.

- Agent

Login – For LIC agents to manage their clients’ policies.

- Merchant

Login – For LIC merchants who collect premiums.

In this blog, we will focus mainly on LIC customer login.

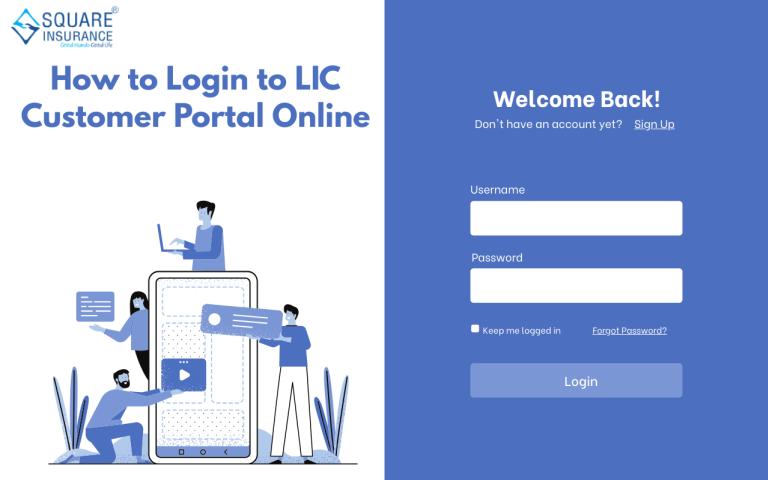

3. Steps for LIC Login Online (For Existing Users)

If you have already registered on the LIC portal, follow

these simple steps:

Step 1: Visit the official LIC website and click on "Customer

Portal".

Step 2: Select "Registered User".

Step 3: Enter your username, password, and date of birth.

Step 4: Click "Sign In".

Step 5: Once logged in, you can access all your policy details and

services.

4. How to Register for LIC Login (New Users)

If you have not used the LIC online portal before, you will

need to register first.

Step 1: Go to the LIC website and click on "Customer

Portal."

Step 2: Select "New User" registration.

Step 3: Fill in the required details:

- Policy

number

- Premium

amount

- Date

of birth

- Mobile

number

- Email

address

Step 4: Create a username and password for your

account.

Step 5: Enter the OTP sent to your registered mobile number.

Step 6: Click "Submit" to complete the registration.

You can now log in anytime using your new credentials.

5. How to Link Multiple Policies to Your LIC Login

If you have more than one LIC policy, you can manage them

all under one account.

Step 1: Log in to your account.

Step 2: Go to "Enroll Policies".

Step 3: Enter the policy number and premium details.

Step 4: Save the changes.

This will help you keep track of all your policies in one

place.

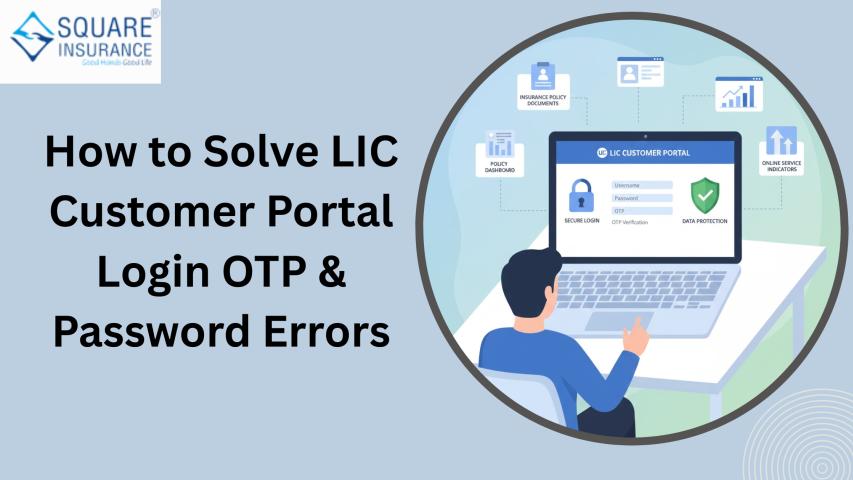

6. Common Issues During LIC Login and How to Fix Them

Sometimes, you might face difficulties logging in. Here are

some common problems and solutions:

- Forgot

Password: Use the "Forgot Password" option to reset it via

OTP.

- Wrong

Username/Password: Double-check your credentials before logging in.

- Account

Locked: Wait a few minutes and try again, or reset your password.

- Technical

Error: Clear your browser cache or try a different browser.

7. Services Available After LIC Login

Once logged in, you can access several useful services:

- Pay

premiums online

- Download

premium receipts

- Check

policy status and details

- Update

personal information

- Apply

for a policy loan

- Track

claim status

- Request

policy revival

8. Safety Tips for Using LIC Login

- Always

log in from the official LIC website.

- Do not

share your password with anyone.

- Avoid

using public Wi-Fi for transactions.

- Log

out after each session.

Conclusion

The LIC login online process is simple, quick, and secure.

Whether you need to pay premiums, check policy details, or download receipts,

the online portal makes it easy to manage your LIC account anytime, anywhere.

If you are new to LIC online services, register today and

enjoy the convenience of managing your policies from home.

For expert advice and help in choosing the right insurance

plan, Square Insurance can be your trusted partner to guide you in

securing your financial future.