Owning a vehicle comes with certain responsibilities. Apart

from following traffic rules, maintaining documents, and keeping insurance

active, one of the most important obligations is paying road tax. Road tax is a

legal requirement for all vehicle owners in India, and it helps the government

maintain roads, highways, and overall transport infrastructure.

For people living in Baran, Rajasthan, the RTO Baran (RJ28)

manages all vehicle-related services, including the collection of road tax. But

many vehicle owners often have questions: Why is road tax important? How can it

be paid? What documents are needed?

This blog will answer all those questions in simple language

and guide you step by step on how to pay road tax at RTO Baran (RJ28).

What Is Road Tax and Why Is It Important?

Road tax is a type of tax imposed on vehicle owners for

using public roads. It is charged by the government at the time of purchasing a

new vehicle, and sometimes it may also need to be paid periodically, depending

on the type of vehicle.

The money collected from road tax is used for:

- Construction of new roads and bridges.

- Repair and maintenance of existing roads.

- Managing traffic systems and safety measures.

- Supporting better infrastructure for transportation.

Simply put, when you pay road tax, you are contributing to

smoother and safer journeys for everyone.

Who Needs to Pay Road Tax?

Almost all vehicle owners must pay road tax. It applies to:

- Two-wheelers (motorcycles, scooters, mopeds).

- Four-wheelers (cars, SUVs, jeeps).

- Commercial vehicles (taxis, trucks, buses).

- Transport vehicles carrying goods or passengers.

- The amount depends on factors like:

- Vehicle type (personal or commercial).

- Vehicle cost and engine capacity.

- Age of the vehicle.

- State rules where the vehicle is registered.

For example, commercial vehicles usually have to pay higher

road tax compared to personal vehicles.

Road Tax at RTO Baran (RJ28)

The RTO Baran (RJ28) is responsible for collecting road tax

from vehicle owners in the district. It ensures that vehicles are legally

registered and taxes are paid on time. If road tax is not paid, you may face:

- Penalties or fines.

- Problems in renewing registration or permits.

- Legal issues during traffic checks.

That is why it is always better to clear road tax dues on

time at RTO Baran.

Documents Required for Paying Road Tax at RTO Baran

Before visiting RTO Baran to pay your road tax, make sure

you have the following documents ready:

- Vehicle’s Registration Certificate (RC).

- Proof of address (Aadhaar card, voter ID, passport, etc.).

- Insurance certificate of the vehicle.

- Pollution Under Control (PUC) certificate.

- Invoice of the vehicle (for new vehicles).

- Previous road tax receipt (if applicable).

- ID proof of the vehicle owner.

Having these documents ensures a smooth process without

unnecessary delays.

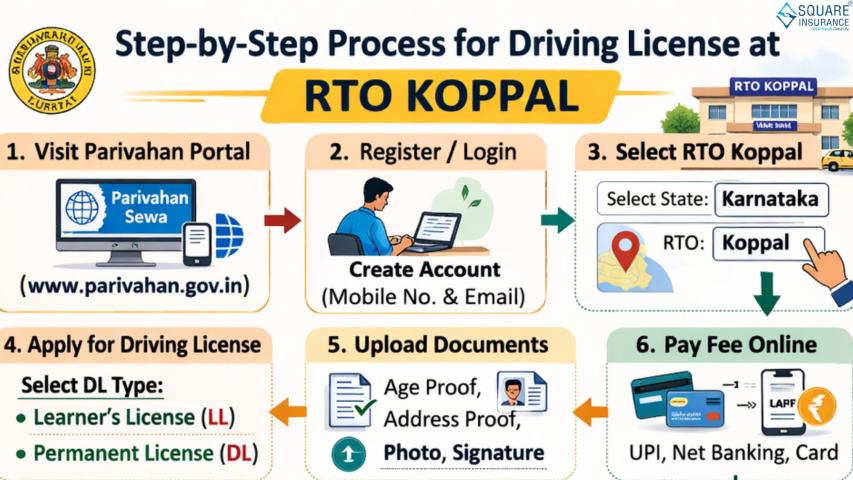

Step-by-Step Guide to Paying Road Tax at RTO Baran (RJ28)

Here’s how vehicle owners can pay road tax at the RTO:

1. Visit the RTO Office

Go to the RTO Baran (RJ28) office with your vehicle

documents. The officials will guide you to the tax section.

2. Fill Out the Application Form

You may need to fill a form for road tax payment. This will

include details like:

- Vehicle registration number.

- Vehicle type and model.

- Engine capacity.

- Owner details.

3. Submit Required Documents

Attach or show the necessary documents (RC, insurance, PUC,

ID proof, etc.) along with the application.

4. Calculation of Tax Amount

The RTO official will calculate the exact road tax based on

the type and cost of your vehicle. For new vehicles, this is often a one-time

payment at the time of registration. For commercial vehicles, it may be yearly

or quarterly.

5. Pay the Road Tax

You can pay the tax at the RTO counter. Once the payment is

made, keep the receipt safely. This receipt is proof that your road tax has

been paid.

6. Receive the Road Tax Receipt

The receipt is very important as it may be required in

future for:

- Renewing permits.

- Selling or transferring the vehicle

- Traffic checks or inspections.

Can Road Tax Be Paid Online?

In many states, road tax can also be paid online through the

transport department’s digital services. While RTO Baran may provide online

facilities, most vehicle owners still prefer visiting the office directly for

clarity and assistance.

Paying online, if available, saves time and effort, but you

must always download and keep a copy of the payment receipt.

Benefits of Paying Road Tax on Time

Paying your road tax on time at RTO Baran (RJ28) ensures

many benefits:

- Legal compliance – You can drive without worrying about

penalties.

- Hassle-free services – Vehicle registration, permits, and

license renewals become smoother.

- Peace of mind – You don’t have to worry about challans or

fines during traffic checks.

- Support for better roads – Your contribution helps improve

road infrastructure in Baran and across Rajasthan.

Common Issues Faced by Vehicle Owners

Sometimes vehicle owners face challenges while paying road

tax. These may include:

- Not knowing the correct tax amount.

- Missing documents.

- Long queues at the RTO.

- Confusion about whether the tax is one-time or recurring.

To avoid these issues, always check the required documents

in advance and keep copies ready.

Frequently Asked Questions (FAQs)

Q1. Why do I need to pay road tax at RTO Baran (RJ28)?

Road tax is a mandatory payment that ensures your vehicle is legally allowed on the road. The money is used for road construction, maintenance, and transport services in Rajasthan.

Q2. How is road tax calculated at RTO Baran?

The tax amount depends on your vehicle type, engine capacity, cost of the vehicle, and whether it is used for personal or commercial purposes.

Q3. Can I pay road tax online at RTO Baran (RJ28)?

In many cases, road tax can be paid online through state transport services, but if online facilities are not available, you can pay it directly at the RTO office.

Q4. What documents are required to pay road tax?

You will need your Registration Certificate (RC), insurance certificate, pollution certificate, proof of address, and ID proof. For new vehicles, the purchase invoice is also required.

Q5. Is road tax a one-time payment?

For private vehicles, road tax is usually a one-time payment made during registration. For commercial vehicles, it may be charged annually, quarterly, or monthly.

Q6. What happens if I don’t pay road tax on time?

If you miss paying road tax, you may face penalties, late fees, or legal trouble. Your vehicle may also face issues during permit renewal or traffic checks.

Q7. Can I transfer road tax if I move my vehicle to another state?

Yes, but you will need to apply for a refund of the road tax from the original RTO and then pay fresh road tax in the new state.

Q8. Do I need to carry proof of road tax payment?

Yes, always keep your tax payment receipt with your vehicle documents. It may be asked for during inspections, resale, or while applying for permits.

Related Article: https://www.promoteproject.com/article/198717/what-are-the-benefits-of-using-rto-bharuch-gj16-services

Conclusion

Paying road tax at RTO Baran (RJ28) is not just a legal

formality, but also a way of contributing to better roads and transport

facilities. Whether you own a two-wheeler, four-wheeler, or commercial vehicle,

timely payment of road tax ensures a smooth driving experience without legal

troubles.

Always remember to keep your documents updated, your

receipts safe, and your payments on time. Along with road tax, maintaining a

valid insurance policy is equally important for your safety and financial

protection. For reliable vehicle insurance options, you can trust Square Insurance to guide you with the best plans that suit your needs.