The global B2B Payments Market is undergoing significant expansion, driven by increasing digitalization, the growth of global trade, and rising demand for automation in financial transactions. Business-to-business (B2B) payments are vital for smooth corporate operations, enabling transactions between suppliers, wholesalers, retailers, and enterprises. The complexity of these transactions, which often involve multiple stakeholders and cross-border payments, creates opportunities for innovative payment solutions that ensure security, speed, and transparency.

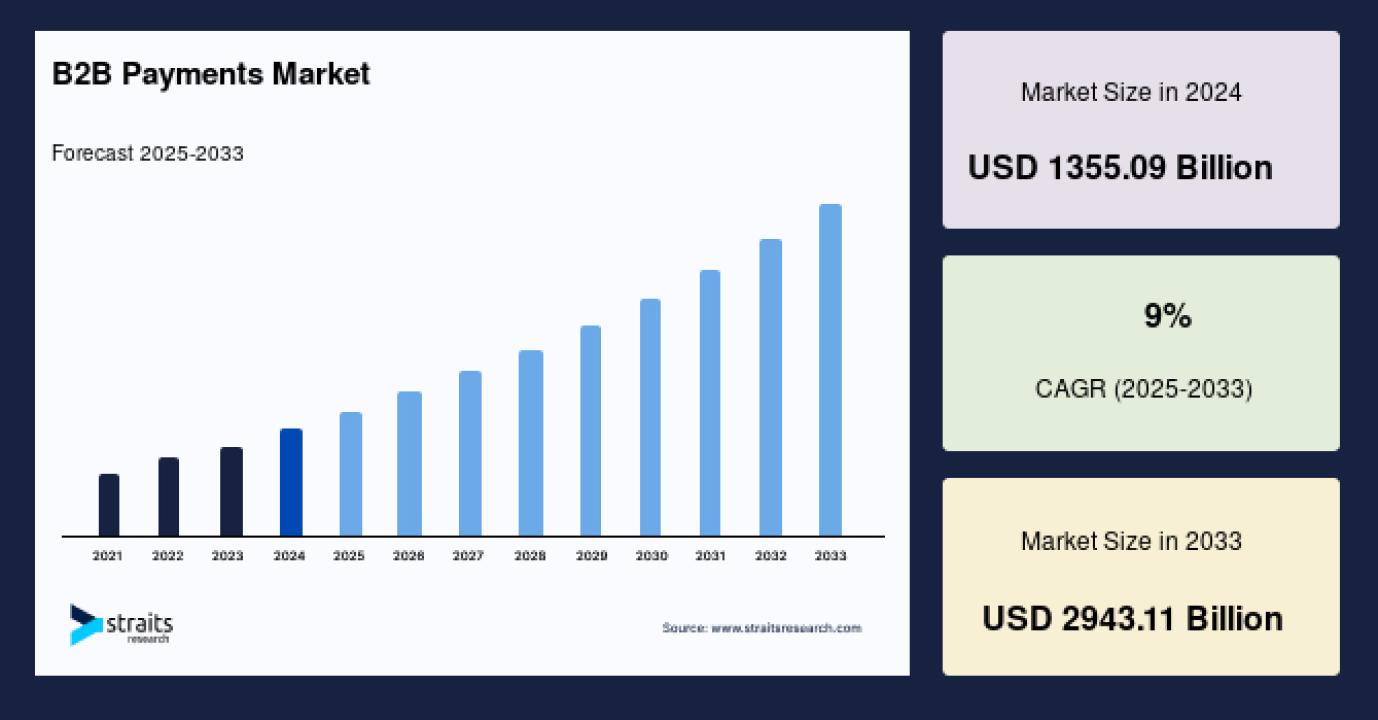

Market Size 2024 – USD 1355.09 billion

Market Size 2025 – USD 1477.05 billion

Market Size 2033 – USD 2943.11 billion

CAGR (2025–2033) – 9%

For an in-depth market understanding and detailed forecast, request a sample report here: https://straitsresearch.com/report/b2b-payments-market/request-sample

Market Drivers

Digital transformation in the financial sector is the primary driver of B2B payments market growth. Businesses worldwide are automating their payment processes to improve accuracy, reduce transaction time, and lower operational costs. The shift towards cashless payments during the COVID-19 pandemic accelerated this trend, increasing reliance on electronic payments and digital wallets.

Growing international trade has bolstered cross-border payments, necessitating solutions that handle multiple currencies, regulatory compliance, and fraud prevention efficiently. Payment providers are partnering with fintech firms to innovate and expand their offerings, making digital B2B payments more accessible and secure.

The rise of SMEs and startups globally, especially in emerging Asia-Pacific markets, demands scalable, easy-to-use payment platforms integrated with supply chain and accounting systems. This increased demand drives investments in cloud-based B2B payment solutions.

Developments in real-time payment systems, virtual cards, and blockchain technologies further fuel the market by accelerating transaction speeds and ensuring transparency.

Market Challenges

Despite growth, the B2B payments landscape faces obstacles. Commercial payment fraud and cyber threats pose significant risks, requiring continuous investment in security technologies. Fragmented legacy systems and manual processes still prevalent in many organizations hinder full digital adoption.

Disparities in regulations between countries complicate cross-border payments, delaying transactions and increasing costs. Additionally, small businesses may face difficulty accessing the latest payment technologies due to budget constraints or lack of technical know-how.

Resistance to change and concerns about data privacy, system integration, and transaction reliability remain challenges that slow B2B payment digitization.

Market Segmentation

By Transaction Type:

Domestic Payments: Largest revenue segment due to ease of processing and automation benefits, expected to grow steadily with SMEs and regional businesses increasing digital payment adoption.

International Payments: Growing due to globalization and demand for seamless cross-border transactions, supported by multicurrency conversion and advanced fraud prevention technologies.

By Payment Mode:

Traditional Payment Methods: Includes cash, cheques, and bank transfers. Remains dominant for cost-sensitive and smaller transactions but gradually losing ground to digital modes.

Digital Payment Methods: Gains increasing share as digital wallets, mobile payments, e-invoicing, and virtual cards become popular. Digital modes offer enhanced security, speed, and traceability.

By Payment Method:

Automated Clearing House (ACH)

Wire Transfers

Cheques

Cash

Others: Virtual cards, e-wallets, mobile payments.

By Industry Vertical:

IT and Telecom: Largest segment due to technological integration and rapid digital adoption.

BFSI: Highly regulated sector with increasing demand for fraud-resistant and compliant payment solutions.

Manufacturing: Growing use of B2B payments to manage complex supplier networks and procurement processes.

Retail: Rising digitization of order management and supplier payments.

Energy, Metals and Mining, and Other sectors also contribute substantially.

By Enterprise Size:

Small-sized enterprises dominate market volume, driven by increased digital payment adoption to optimize workflows.

Medium and large enterprises adopt B2B payment solutions to manage high transaction volumes, ensure compliance, and reduce risk.

By Geography:

Asia Pacific: Largest and fastest-growing region driven by China, India, and Japan’s expanding e-commerce and fintech sectors.

Europe: Second-largest with strong regulatory frameworks driving advanced payment technology adoption.

North America: Third largest, home to numerous fintech innovators and high digital penetration.

Latin America, Middle East, and Africa are emerging markets with significant growth potential.

For detailed segmentation and purchasing information visit: https://straitsresearch.com/buy-now/b2b-payments-market

Top Players Analysis

Key industry players include:

FIS (Fidelity National Information Services)

Fiserv, Inc.

Citibank, N.A.

Accenture Plc

Bottomline Technologies (bottomline.com)

Mastercard, Inc.

JPMorgan Chase & Co.

PayPal Holdings, Inc.

Mastercard Incorporated

Visa, Inc.

These companies emphasize innovation in cloud infrastructure, AI-driven fraud prevention, and multi-currency processing. Partnerships with fintech startups and advancements in blockchain and real-time payments are shaping their competitive strategies. Their combined efforts make B2B payments more seamless, secure, and globally accessible.

Straits Research is a market intelligence company providing global business information reports and services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insight for thousands of decision-makers. Straits Research Pvt. Ltd. provides actionable market research data, especially designed and presented for decision making and ROI.

Frequently Asked Questions (FAQs)

What is the size of the global B2B Payments Market in 2024 and its forecast for 2033?

Market Size 2024 – USD 1355.09 billion

Market Size 2025 – USD 1477.05 billion

Market Size 2033 – USD 2943.11 billion

CAGR (2025–2033) – 9%

What drives the growth of the B2B payments market?

Digitalization, automation, global trade expansion, and fintech partnerships.

Which industries are primary users of B2B payment solutions?

IT & telecom, BFSI, manufacturing, retail, energy, and metals sectors.

What are challenges in B2B payments?

Fraud, regulatory complexity, legacy system integration, and data privacy.

Who are the major players in B2B payments?

FIS, Fiserv, Citibank, Accenture, Bottomline Technologies, Mastercard, JPMorgan, PayPal, Visa.