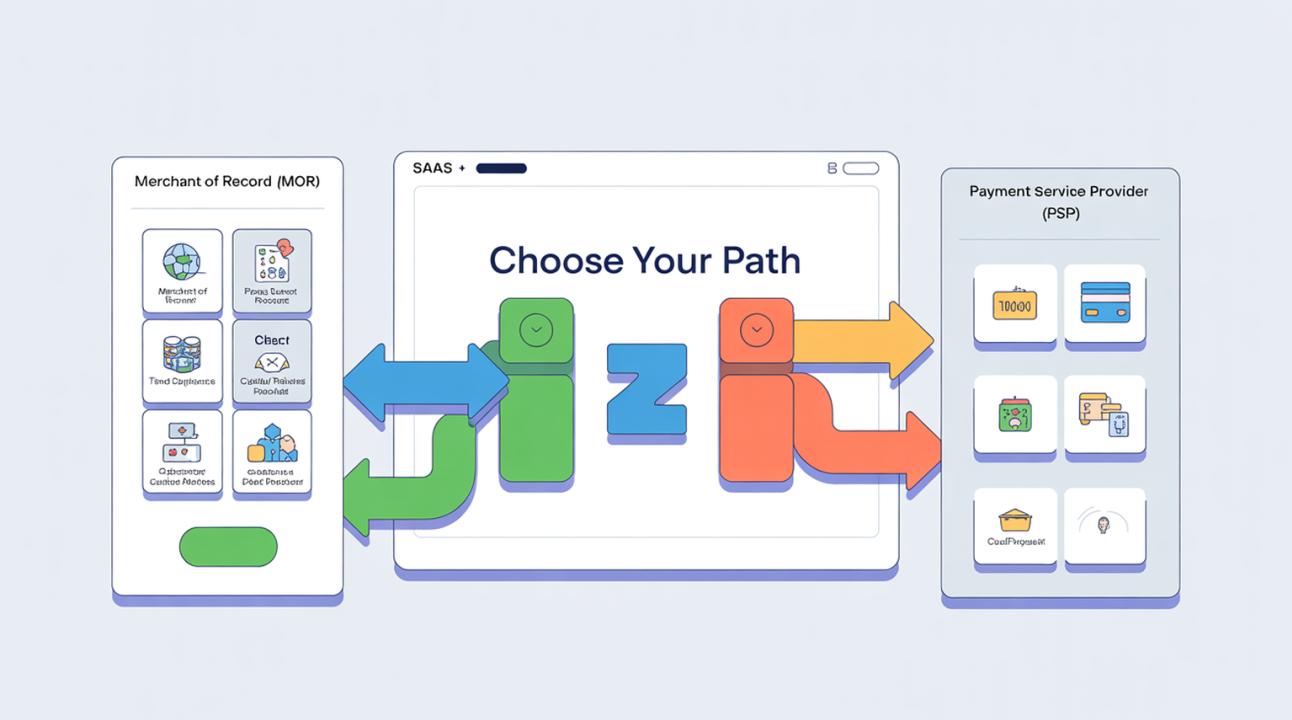

When running a SaaS business, one of the most important decisions is how to manage payments across different countries. Choosing between a Merchant of Record (MOR) and a Payment Service Provider (PSP) can greatly affect compliance, tax handling, and your ability to grow internationally.

Both MOR and PSP models facilitate online payments, but they have different responsibilities, risk management practices, and user experiences. Knowing these differences helps SaaS founders make smart choices that save time, ensure compliance, and make operations easier.

Let’s look at how each model works, their advantages and drawbacks, and which one suits your SaaS growth strategy best.

What is a Merchant of Record (MOR)?

A Merchant of Record (MOR) is a third-party entity that manages all aspects of customer transactions. They do more than just process payments; they own the sale.

This means the MOR is responsible for billing customers, collecting and remitting taxes (such as VAT or GST), handling chargebacks, and ensuring compliance with payment regulations around the world. In short, they act as the legal seller on your behalf.

Popular MOR providers include Paddle, FastSpring, and Digital River. These companies help SaaS businesses expand globally without needing to set up entities in every country.

Key Responsibilities of a MOR

- Acts as the official seller to the customer

- Handles tax compliance (sales tax, VAT, GST, etc.)

- Manages refunds, chargebacks, and fraud protection

- Provides localized payment methods and currency support

What is a Payment Service Provider (PSP)?

A Payment Service Provider (PSP) is a platform that allows businesses to accept payments online. They provide the tools and infrastructure to process credit cards, digital wallets, and bank transfers, but you stay as the merchant of record.

With a PSP, your company handles compliance, taxes, and customer billing issues. PSPs work well for businesses that want more control and already have the legal and operational setup to manage international payments.

Examples include Stripe, Adyen, PayPal, and Braintree.

Key Responsibilities of a PSP

- Provides secure payment processing infrastructure

- Enables multiple payment methods and currencies

- Offers APIs for integration with your website or app

- Leaves compliance, taxes, and risk management to you

MOR vs PSP: The Core Differences

| Feature | Merchant of Record (MOR) | Payment Service Provider (PSP) |

| Legal Seller | MOR | Your Business |

| Tax & VAT Handling | Managed by MOR | Handled by You |

| Compliance & Regulations | Fully managed | You must ensure compliance |

| Risk & Chargebacks | MOR takes responsibility | You handle disputes |

| Global Expansion | Easier — MOR supports multiple regions | Harder — requires local entities |

| Customization | Limited to MOR system | Full control over payment flow |

| Setup Time | Faster for global markets | Longer setup for compliance |

Pros and Cons of Merchant of Record (MOR)

Pros

- Global Reach: Sell in multiple currencies and countries without registering entities.

- Compliance Handled: MOR ensures local tax, GDPR, and payment regulations are met.

- Less Risk: They handle chargebacks and fraud protection.

Cons

- Less Flexibility: You rely on their payment infrastructure.

- Higher Fees: MORs charge a higher commission (usually 5–10%) for handling compliance and risk.

- Brand Transparency: Customers may see the MOR’s name on invoices instead of your company’s.

Pros and Cons of Payment Service Provider (PSP)

Pros

- Greater Control: Full ownership of payment flow, invoicing, and branding.

- Lower Fees: PSPs often charge 2–3% per transaction.

- Custom Integrations: Ideal for businesses with in-house developers and compliance teams.

Cons

- Compliance Burden: You must manage global taxes, VAT, and KYC regulations.

- Complex Expansion: Setting up entities and tax registrations in each market takes time.

- Chargeback Risk: Your business absorbs losses from disputes or fraud.

Which is Best for SaaS Businesses?

Choosing between an MOR vs PSP depends on your business size, global goals, and operational capacity.

- For startups and small SaaS companies, a Merchant of Record is often the best option. It simplifies international expansion and ensures compliance from the start.

- For established SaaS businesses with legal teams, in-house accounting, and a global presence, a PSP provides more control and lower long-term costs.

Often, companies begin with an MOR for its simplicity and shift to a PSP once they scale up.

FAQs about MOR vs PSP

1. Is a Merchant of Record the same as a Payment Processor?

No. A payment processor just facilitates transactions, while an MOR legally sells your product and manages compliance, taxes, and chargebacks. The MOR effectively becomes your payment and legal representative.

2. Can I use both MOR and PSP in my SaaS business?

Yes. Many SaaS companies use a mix of both, using MORs in certain regions while opting for PSPs for direct sales elsewhere. This gives you scalability and flexibility.

3. Which is cheaper — MOR or PSP?

PSPs are cheaper in terms of transaction fees (about 2 to 3%). However, when you consider compliance, tax management, and legal setup, MORs can save money for smaller teams that cannot handle those tasks in-house.

4. How does an MOR help with tax compliance?

An MOR automatically calculates, collects, and remits VAT, GST, and sales tax to local authorities for you. This removes the need for multiple tax registrations or hiring external accountants.

5. What happens during a chargeback with an MOR vs PSP?

With an MOR, the provider manages chargebacks, disputes, and refunds. With a PSP, your business needs to handle the whole process, which includes financial loss and customer communication.

6. Which option ensures faster global expansion?

A Merchant of Record is better for this. it gives you instant access to global markets without the hassle of setting up local entities or managing compliance manually. PSPs require more groundwork before you can scale.

Conclusion

In the world of SaaS payment solutions, the choice between MOR and PSP influences how quickly and compliantly your SaaS business can grow.

If your focus is on speed, simplicity, and reaching global markets, the Merchant of Record model is a great choice. It takes care of compliance, risk, and tax complexities, letting you concentrate on your product.

If you need full control and have the necessary resources to manage payments, compliance, and localization, a Payment Service Provider might be the right fit.

In the end, the best solution depends on your growth stage, operational capacity, and target markets. Whichever option you select, ensuring a smooth and secure payment experience is crucial for successful scaling in today’s SaaS economy.