SAP Business One is a reliable ERP solution specifically for

the financial sector that wants more control, more reporting, and secure data

management. Whether a small investment fund or rapidly growing fintech company,

SAP Business One helps with compliance, automates accounting, and enables

improved decision-making.

In this article, we showcase notable financial institutions

that are using SAP Business One to scale faster and strengthen their

operations.

Why Financial Institutions Choose SAP Business One

Financial institutions adopt SAP Business One because it

provides transparency, speed, and compliance in a unified system. Institutions

can empower their teams to manage financial records faster and with minimal

manual work while being ready for audits. Reasons for adopting SAP Business One

include:

·

Centralized financial data

·

Real-time dashboards and reporting

·

Speed to comply with regulations

·

Supports multi-branch and multi-currency

·

A scalable platform for future growth

Global Financial Institutions Leveraging SAP Business One

Many fast-growing financial institutions across the world

are embracing SAP Business One in order to receive reliable reporting, aligned

compliance, and consolidated back-office functions. For example, large

enterprise banks may leverage SAP's enterprise suite; nonetheless, regional

banks, microfinance institutions, investment advisory firms, insurance

brokers, and lending companies prefer SAP Business One for its easier hosting

and more favorable economics.

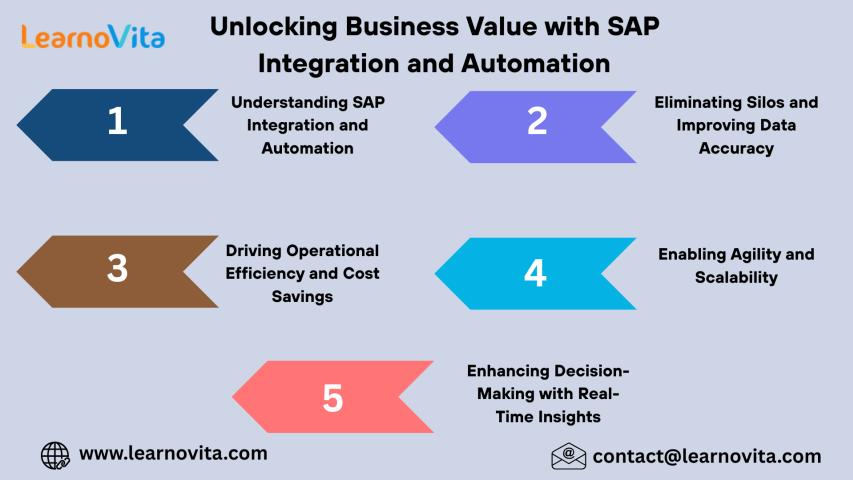

The platform allows operations in multiple countries and

allows finance teams to manage tax structures, cross-border transactions, and

visibility into their risks and exposures in real time. Institutions appreciate

its robust data governance, ease of use, and integration with their customer

relationship management (CRM), payroll, and core finance systems.

Global usage is prevalent among:

·

Regional and community financial institutions

with multi-branch operations

·

Microfinance institutions that are expanding to

new geography

·

Investment advisory and portfolio management

firms

·

Leasing and lending service providers

·

Insurance brokerages distributing networks of

clients

·

fintech companies developing hybrid businesses

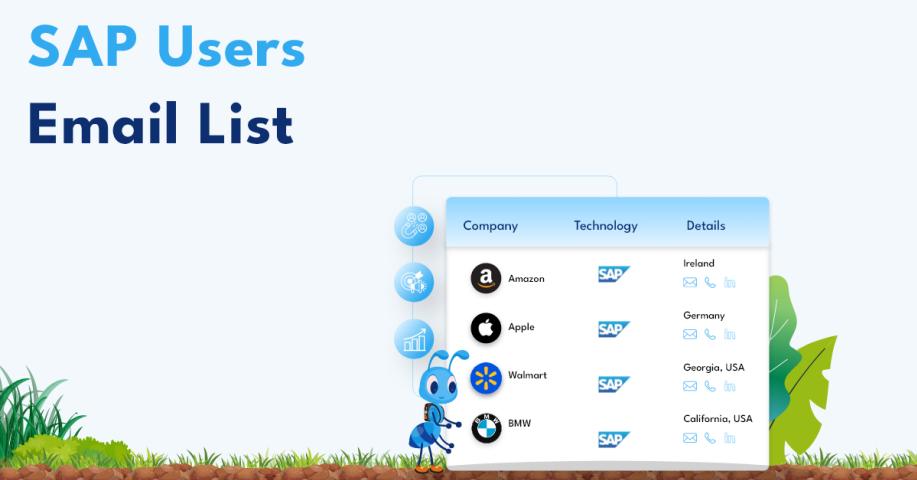

Companies that want to reach financial institutions

using SAP Business One can greatly benefit from a verified and authentic

customer list. The SAP Business One Customers List presents

comprehensive information about companies that have already deployed this ERP

software. It enables companies to develop partnerships, help identify

potential customers, and contextualize industry-wide ERP penetration.

Advantages of SAP Business One for Financial Services

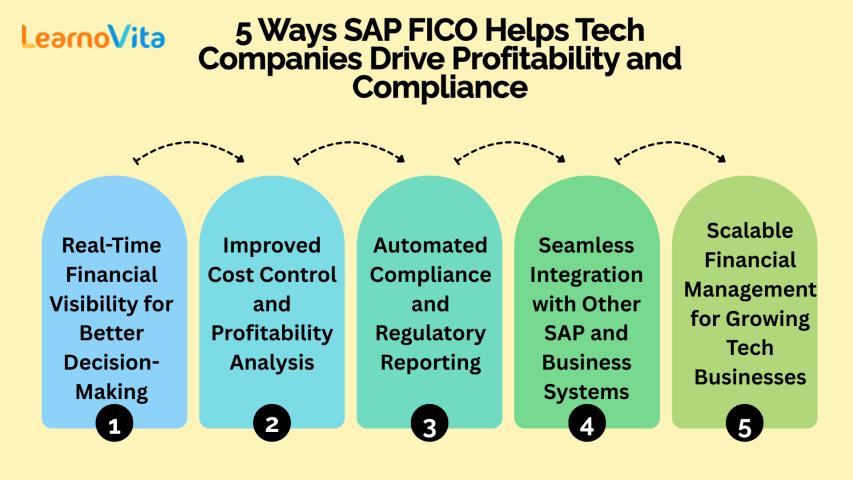

·

Increases financial transparency by aggregating

information into a single place that allows finance teams to view all

transactions across branches.

·

Simplifies reporting with real-time dashboards

to narrow the time spent on budgeting, forecasting, and performance monitoring.

·

Improves compliance and audit readiness through

controls built into the system and the ability to trace documents, as well as

provides integrated risk management features to comply with regulatory

requirements.

·

Designed to scale seamlessly for institutional

growth- such as new branches, cultural service lines, and currencies - without

disrupting the institution's day-to-day operations

Conclusion:

SAP Business One remains a dependable Enterprise Resource

Planning (ERP) option for banks and other financial organizations that need to

have control, compliance, and the opportunity to grow. It is inherently

designed to bring clearer visibility to their operations, centralize their

data, expand and adapt as necessary to maintain productivity, and issue

appropriate reports for their multi-branch structure or oversight. Thus, SAP

Business One can help an organization improve visibility, enhance governance, and

expedite long-term performance, whether the organization is already established

or just getting started.