The crypto world is evolving faster than ever. New startups are joining the blockchain game every day, and existing businesses are leveling up with secure crypto wallet development. But here’s the catch — not every crypto wallet works the same way.

If you're a founder, investor, or business planning to launch a wallet product, understanding the types of crypto wallets is a game-changer. It’s like choosing the right vehicle — do you need a sports car, a truck, or a bulletproof van?

Let’s break it down in a simple, startup-friendly way.

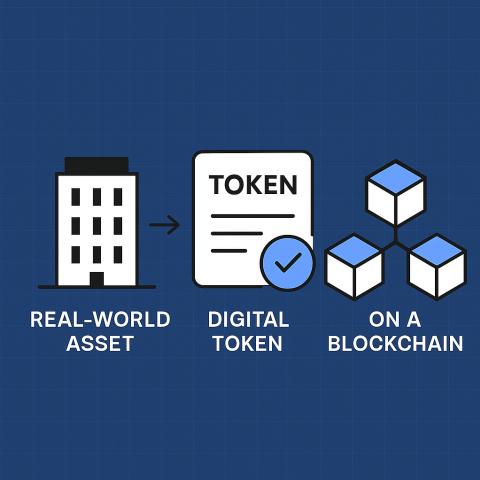

What Is a Crypto Wallet? (Quick Refresher)

A crypto wallet is like your digital bank vault. It stores your private keys — the secret code that proves you own your crypto. Whether you're building a fintech product or launching a Web3 app, a wallet becomes the heart of your user experience.

And guess what? Choosing the right wallet type can boost trust, security & conversions for your business.

Major Types of Crypto Wallets in 2026 You Must Know

Different users. Different risk levels. Different use cases.

Here are the wallet categories ruling the market:

1️⃣ Custodial Crypto Wallets

These wallets are managed by a service provider on behalf of users.

✅ Super beginner-friendly

✅ Easy recovery options

✅ Best suited for crypto exchanges and Web3 apps

Perfect for businesses who want control, security tracking & faster onboarding.

Want to launch a branded custodial wallet fast? Try a "White Label Crypto Wallet Software"

2️⃣ Non-Custodial Crypto Wallets

Users control their own private keys.

No middlemen. No gatekeepers. Full ownership.

Ideal for:

- Hardcore crypto users

- DeFi & staking platforms

- Web3 gamers

If your users love freedom and self-custody, this is their go-to.

Looking for higher authority & maximum trust? Explore the Types of Crypto Wallets solution to match your business need.

3️⃣ Hot Wallets (Internet-Connected)

Fast. Flexible. Perfect for daily usage.

Examples:

- Browser extensions

- Mobile wallets

- Exchange wallets

Designed for quick trades & payments — think of it like your main debit card.

Pro Tip: SMBs & SaaS startups prefer this type for user growth and transaction volume.

4️⃣ Cold Wallets (Offline Storage)

No internet = No hacking risk 😎

Often used for institutional assets and long-term storage.

Common options:

- Hardware wallets

- Paper wallets

If your business targets institutional investors, this is the security-first choice.

5️⃣ Multi-Signature (Multi-Sig) Wallets

Imagine a vault that needs multiple keys to unlock.

Excellent for:

- DAOs

- Web3 startups

- Cross-border teams

- Secure treasury operations

It’s teamwork + security. Nobody runs off with the funds alone!

6️⃣ HD (Hierarchical Deterministic) Wallets

One seed phrase = unlimited keys generated.

Perfect for apps managing multiple accounts or NFT wallets.

HD wallets offer:

- Better key organization

- Easy recovery

- Future-proof integrations

If scaling is your vision, this is your backbone.

7️⃣ Smart Contract Wallets

These wallets are programmable.

You can automate:

✅ Transaction approvals

✅ Spending limits

✅ Multi-factor authentication

They are trending big in DeFi, Web3 gaming, and enterprise blockchain.

Brands launching next-gen platforms rely heavily on smart contract wallet architecture.

Why 2026 Is the Year to Launch Your Crypto Wallet Product?

Mass adoption is closer than ever.

Global crypto users could hit 1.5+ billion, giving startups a goldmine opportunity.

With the right white label crypto wallet software, you can:

✨ Launch faster with reduced cost

✨ Build a loyal user base

✨ Generate multiple revenue streams

✨ Stay ahead of competitors