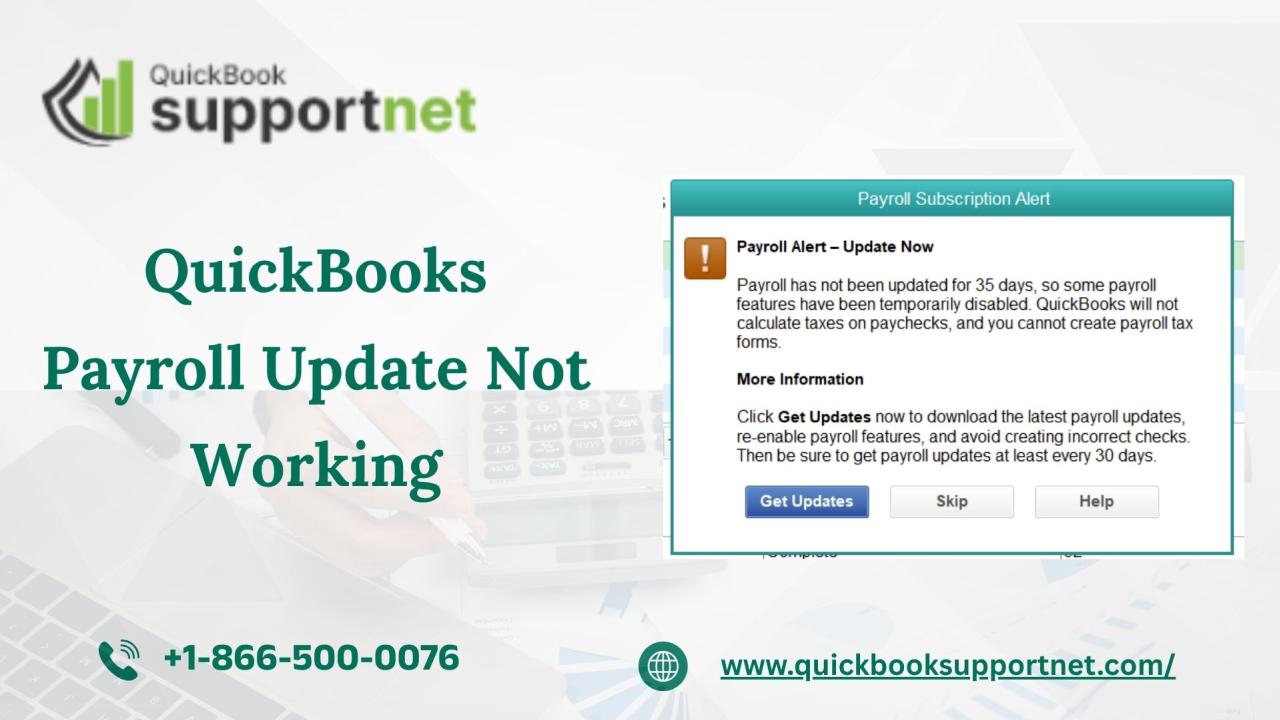

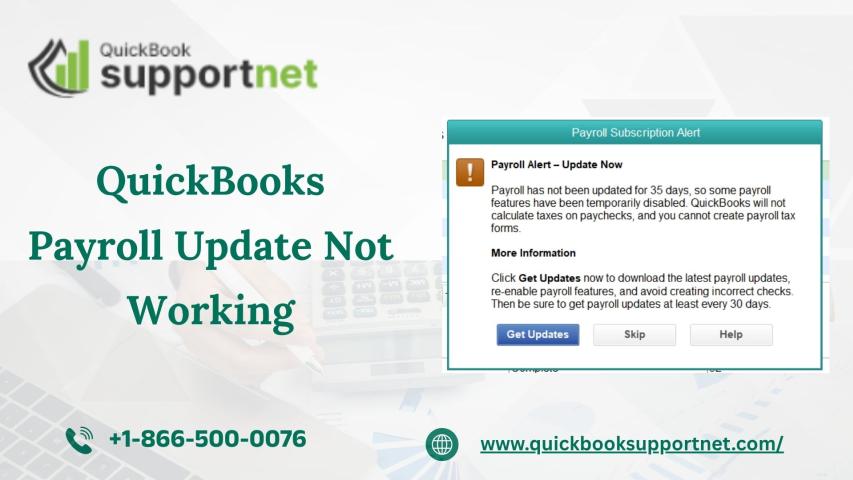

QuickBooks Desktop remains one of the most trusted accounting solutions for small and mid-sized businesses. However, users often encounter update issues—especially related to payroll. Understanding why QuickBooks Payroll Update Not Working occurs and how to fix it is essential for smooth payroll processing, accurate tax calculations, and compliance.

When your payroll update fails, it may halt paycheck creation, prevent tax table downloads, or generate unexpected error codes. If you’re facing this issue and need immediate help, contacting +1-866-500-0076 can connect you with experts who can assist.

This comprehensive guide explains everything you need to know about the QuickBooks Payroll Updates Not Working problem, its causes, troubleshooting steps, and when to seek advanced support.

Fix QuickBooks Payroll Update Not Working issues with expert tips, causes, and solutions. Call +1-866-500-0076 for instant payroll update support.

What Does “QuickBooks Payroll Update Not Working” Mean?

When QuickBooks Desktop fails to download or install the latest payroll updates, it triggers this issue. QuickBooks uses payroll updates to keep tax rates, deductions, and forms compliant with federal and state laws.

A failed payroll update may prevent users from:

- Calculating payroll taxes accurately

- Creating paychecks

- Filing tax forms

- Updating tax tables

- Running payroll reports

For businesses that process payroll regularly, resolving this issue quickly is crucial. If the problem persists, you can always call +1-866-500-0076 for step-by-step assistance.

Common Signs of QuickBooks Desktop Payroll Updates Not Working

Users typically encounter the following symptoms:

- QuickBooks freezes during the payroll update

- Error messages appear, such as PSXXX series (e.g., PS036, PS038)

- Tax table does not update to the latest version

- Update gets stuck at 0% or 100%

- Payroll subscription shows as inactive

- Incomplete or corrupted payroll downloads

These symptoms highlight that QuickBooks Desktop Payroll Updates Not Working can disrupt daily operations unless addressed properly.

Primary Causes Behind QuickBooks Payroll Update Failures

Several factors contribute to payroll update issues. Understanding these root causes helps in applying the right solution.

3.1 Internet or Network Issues

QuickBooks requires a stable internet connection to download updates. Weak or unstable connectivity can interrupt the process.

3.2 Incorrect Payroll Subscription Status

If your payroll subscription is inactive, expired, or incorrectly recognized in QuickBooks, updates will fail.

3.3 Outdated QuickBooks Desktop Version

QuickBooks Desktop must be updated to the latest release before applying payroll updates.

3.4 Incorrect System Date and Time

Mismatched system time can lead to update server disconnection.

3.5 Antivirus or Firewall Blocking Updates

Security software may block QuickBooks from connecting to the payroll update server.

3.6 Damaged QuickBooks Program Files

Corrupted installation files can cause update interruptions.

3.7 Incorrect Service Key or EIN

Service key or Employer Identification Number mismatch also prevents payroll updates.

When the cause isn’t clear, technicians at +1-866-500-0076 can diagnose and fix the issue quickly.

Read This Blog: Write Off Bad Debt in QuickBooks Desktop

How to Fix QuickBooks Payroll Update Not Working

Below are the most effective troubleshooting methods to resolve payroll update failures. Follow them in the given order.

Step 1: Verify Your Payroll Subscription

An inactive or incorrectly recognized payroll subscription is one of the most common reasons for update failure.

- Open QuickBooks Desktop

- Go to Employees

- Select My Payroll Service

- Choose Account/Billing Information

- Verify your subscription status

If inactive, renew it or contact support for verification. For subscription syncing issues, calling +1-866-500-0076 is recommended.

Step 2: Confirm Your QuickBooks Desktop Version

- Open QuickBooks

- Press F2

- Check the version and release

If outdated, update QuickBooks:

- Go to Help

- Select Update QuickBooks Desktop

- Install available updates

Step 3: Restore Correct System Date & Time

- Open Control Panel

- Select Date and Time

- Verify accuracy

- Correct if needed

QuickBooks servers may reject requests from systems with incorrect time.

Step 4: Configure Internet Connection Settings

- Go to Help

- Select Internet Connection Setup

- Choose Use my computer’s internet connection settings

- Click Next

- Press Done

Try downloading payroll updates again.

Step 5: Turn Off Security Software Temporarily

Firewall or antivirus may block payroll update downloads.

- Temporarily disable your antivirus

- Add QuickBooks as a trusted program

- Retry payroll update

Always re-enable security settings afterward.

Step 6: Run QuickBooks as Administrator

- Right-click the QuickBooks Desktop icon

- Select Run as administrator

- Attempt payroll update

Administrator access ensures proper update installation.

Step 7: Verify Your Payroll Service Key

- Go to Employees

- Select My Payroll Service

- Click Manage Service Keys

- Verify correct service key

- Re-enter if incorrect

Step 8: Repair QuickBooks Desktop Installation

If program files are damaged:

- Open Control Panel

- Go to Programs & Features

- Select QuickBooks Desktop

- Click Repair

After repair, restart QuickBooks and retry the payroll update.

Step 9: Reset QuickBooks Update Settings

- Go to Help → Update QuickBooks Desktop

- Select Options

- Click Mark All

- Go to Update Now

- Check Reset Update

- Click Get Updates

This resets all update settings and clears corrupted files.

Step 10: Use Quick Fix My Program (Tool Hub)

- Install QuickBooks Tool Hub

- Go to Program Problems

- Select Quick Fix My Program

Reload QuickBooks and attempt payroll updates again.

Advanced Causes & Solutions

Some payroll update issues require deeper analysis.

5.1 Database Errors

Network-damaged company files can corrupt payroll calculations.

5.2 PS Series Payroll Errors

Errors like PS036 or PS038 need subscription re-verification or stuck payroll data troubleshooting.

5.3 Damaged Company File Components

Using QuickBooks File Doctor can help repair them.

If these issues persist, expert guidance at +1-866-500-0076 can help prevent data loss.

Preventing Payroll Update Errors in the Future

Here are best practices to avoid future update failures:

- Keep QuickBooks Desktop updated regularly

- Maintain a stable and secure internet connection

- Ensure sufficient system resources

- Create regular backups of your company file

- Keep payroll subscription active

- Avoid third-party software conflicts

- Update Windows and security software regularly

Proactive maintenance reduces 90% of payroll update errors.

Conclusion

Experiencing QuickBooks Payroll Updates Not Working or QuickBooks Desktop Payroll Updates Not Working can interrupt your daily payroll tasks and lead to tax discrepancies. However, with the right approach—verifying subscriptions, updating QuickBooks, fixing internet settings, and repairing installation files—you can resolve the issue efficiently. If the problem persists or becomes too complex to handle on your own, expert help is just a call away at +1-866-500-0076.

Read More: How to Use QuickBooks File Doctor to Fix Company Files