A real world asset tokenization company creates intelligent asset solutions that connect traditional finance with advanced digital systems. It converts physical and financial assets such as real estate, bonds, and commodities into secure blockchain-based tokens. These tokens represent verified ownership and can be traded easily, giving investors greater flexibility and transparency. Tokenization simplifies asset management by combining security, accessibility, and automation in one structure.

What Is Real World Asset Tokenization

Real world asset tokenization means converting real assets into digital tokens recorded on a blockchain. These tokens stand for fractions of ownership, allowing multiple investors to participate in high-value assets. Each token carries real legal meaning backed by asset verification and smart contracts. This approach increases liquidity, lowers entry limits for investors, and improves accountability through traceable digital records.

How Intelligent Asset Solutions Work

Intelligent asset solutions use blockchain and smart technologies to improve how assets are managed, verified, and traded. They automate everyday processes and maintain real-time visibility across transactions. This system is programmed to keep records transparent, reducing the risks of fraud or human error. Asset owners can see their holdings clearly, while investors can verify ownership through open, secure blockchain data.

Steps Followed by a Real World Asset Tokenization Company

-

Asset identification and valuation.

-

Verification of ownership and asset authenticity.

-

Legal documentation to define investor rights.

-

Token creation recorded on blockchain.

-

Smart contract integration for investor control.

-

Asset-backed token distribution to investors.

-

Ongoing monitoring and transparent tracking.

This structured process ensures each token accurately represents a legitimate, legally recognized real-world asset.

Benefits of Real World Asset Tokenization

Tokenization helps both investors and businesses in meaningful ways:

-

Liquidity: Turning assets into tradeable tokens simplifies buying and selling.

-

Transparency: Blockchain records make all transactions visible and traceable.

-

Accessibility: Investors can own portions of assets with smaller amounts.

-

Efficiency: Transactions settle faster without complex manual processes.

-

Security: Smart contracts protect the validity of each transaction.

These points show why companies and investors are moving toward tokenized platforms for asset management.

Blockchain Technology in Asset Tokenization

Blockchain forms the foundation of tokenization. The decentralized ledger keeps public, verifiable data about every transaction, preventing alteration or tampering. This structure builds investor trust by offering clear proof of ownership. It connects digital tokens to legally recognized assets while keeping transfers seamless across borders.

Smart contracts further automate ownership transfers, rental payments, or dividends linked to tokenized assets. They eliminate the need for intermediaries, which cuts costs and improves operational speed.

Real World Asset Tokenization for Businesses

For businesses, tokenization provides flexible funding and sustainable growth opportunities. Organizations can convert property, company shares, or equipment into blockchain-based tokens and use them for capital generation. This gives both startups and established firms direct access to a larger pool of investors without heavy administrative procedures.

Fractional ownership opens new markets and encourages collective investment in commercial projects, real estate developments, or renewable energy assets. Businesses benefit from faster fund allocation and transparent communication with investors.

Role of a Blockchain-Based Tokenization Company

A blockchain-based tokenization company builds the digital framework that keeps tokenized assets secure and reliable. Its core functions include blockchain network integration, ownership verification, and compliance with regulatory standards.

Such companies apply advanced encryption methods, multi-layer verification, and ongoing audits to protect investor interests and asset integrity. They combine blockchain’s transparency with professional legal structures, ensuring every token has real asset backing.

Intelligent Asset Tokenization Solutions

Intelligent asset tokenization solutions improve how digital ownership is managed. These systems connect asset valuation tools, blockchain ledgers, and user dashboards in one environment. This integration supports investors, developers, and compliance teams by providing smooth management and instant reporting updates.

Features of intelligent tokenization systems include:

-

Real-time valuation and tracking.

-

Secure digital custody for tokens.

-

Regulatory compliance and KYC modules.

-

Automated profit distribution and asset rebalancing.

These digital systems simplify investment management and create safer conditions for global trading.

Building Investor Trust through Transparency

Trust is a central element of asset tokenization. Every legitimate tokenization company uses open documentation, verified audits, and regulated frameworks to guarantee asset legitimacy. Investors can view complete transaction history, ownership transfers, and contract execution records on the blockchain.

This transparency makes tokenization reliable and promotes confidence among both retail and institutional investors, helping the market grow steadily.

Real World Asset Tokenization Platforms

A real world asset tokenization platform is where investors and asset owners meet digitally. The platform connects token issuance, trading, and reporting through user-friendly systems. It allows instant trades without traditional delays and facilitates fractional investment participation.

Such platforms may support a wide range of assets, including commercial buildings, art, business shares, and commodities, offering global availability under verified conditions.

Regulatory Framework and Compliance

Compliance is vital to maintaining accountability in tokenized asset systems. Reputed companies follow financial and digital asset laws across regions, applying identity verification and anti-money-laundering standards.

They align blockchain activity with local license requirements, keeping asset ownership safe under recognized laws. Transparent governance policies strengthen both credibility and stability, encouraging long-term adoption of tokenized finance.

Asset Tokenization in Decentralized Finance

Decentralized finance adds another layer of utility for tokenized assets. Tokens representing verified real-world value can be used in lending, borrowing, or staking programs run on blockchain networks.

This allows investors to put their tokens to productive use without losing ownership. Tokenized real assets bring real value into decentralized systems, creating stable growth options within digital markets.

Intelligent Asset Solutions for Global Investors

Global investors gain broad advantages through tokenization. They can diversify across multiple assets such as real estate, metals, and corporate bonds without facing cross-border restrictions. Intelligent platforms provide 24/7 access, real-time data visibility, and transparent reporting.

Investors can manage holdings through digital wallets, trade tokens globally, and monitor performance data instantly through integrated web or mobile applications.

Blockchain-Based Real Asset Management

Blockchain-based management streamlines how real assets are tracked and reported. Every ownership detail, valuation update, and contractual term is stored securely. The technology ensures that once data is recorded, it cannot be changed without the consent of network participants.

This gives asset owners long-term control, reduces dispute risks, and improves accountability throughout the asset’s lifecycle.

The Future of Tokenized Finance

Real world asset tokenization marks a shift toward smarter, fairer finance. It encourages open participation, accelerates settlements, and supports sustainable development models. In the coming years, tokenization will continue expanding across property, supply chain assets, insurance products, and environmental credits.

Intelligent asset solutions will keep advancing through integration with artificial intelligence, allowing automated valuations and predictive analytics. With regulatory clarity growing, tokenized systems will play a major role in shaping future economic infrastructure.

How Tokenization Promotes Financial Inclusion

Tokenization gives small investors access to markets that were once limited to large organizations. By offering smaller investment units, people worldwide can now hold fractions of premium assets. This inclusion contributes to wealth distribution and creates opportunities for community-driven investments.

Financial inclusion through digital systems promotes economic participation among populations previously excluded from global markets.

Security and Data Integrity

Security remains a top focus for any real world asset tokenization company. Encryption, private key authentication, and multi-signature protocols protect investor data and asset ownership.

Regular audits and 24/7 system monitoring prevent tampering or unauthorized access. These measures maintain digital trust, which is vital for long-term investor participation and market growth.

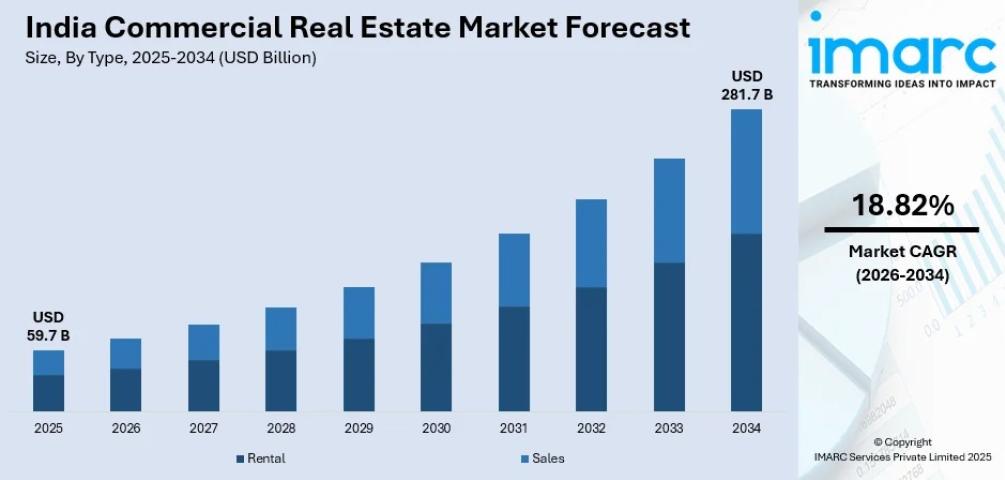

The Growing Adoption of Tokenized Assets

Industries such as banking, real estate, and commodities trading have started to adopt tokenization to reduce delays and improve liquidity. Governments and institutions are exploring models that connect regulated financial frameworks with blockchain-based asset systems.

This trend signals a steady shift toward transparency, efficiency, and inclusion at a global scale.

Conclusion

A real world asset tokenization company delivering intelligent asset solutions connects physical and digital finance through secure and transparent systems. Asset-backed tokens empower investors and organizations by simplifying ownership, trading, and compliance.

Tokenization stands at the center of financial evolution, providing clarity and inclusivity in global investment markets. As trust and regulation mature, intelligent asset solutions will redefine how value is stored, transferred, and grown across the financial spectrum. Partner With a Leading Real World Asset Tokenization Company Today.