Introduction

The digital shift in India’s insurance sector has transformed the way policyholders access, manage, and renew car insurance online. With more advanced online platforms, improved transparency, and faster processing, renewing car insurance online in 2025 has become the preferred choice for millions of vehicle owners. Whether you are looking to save time, compare policies, reduce paperwork, or secure better coverage, the online renewal process ensures unmatched convenience and efficiency for anyone planning to renew car insurance online.

1.

Instant and Hassle-Free Renewal Process

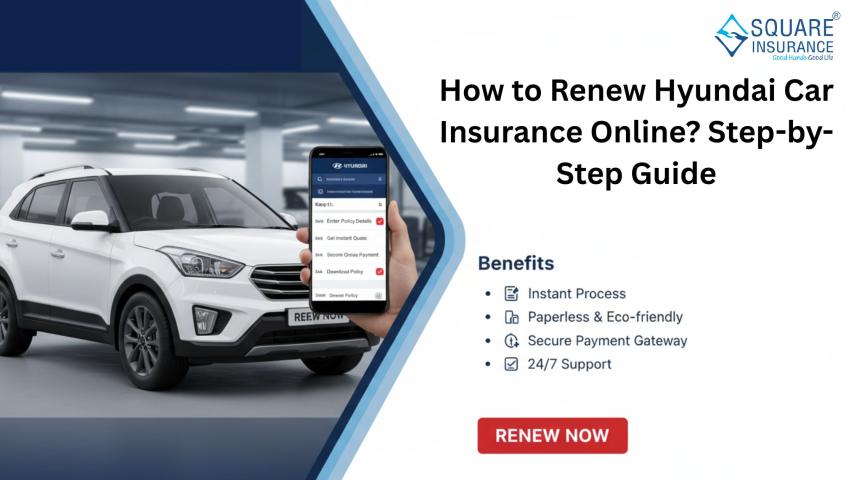

One of the biggest advantages of

renewing car insurance online is the speed. Traditional offline renewal

involves visiting an insurance office, filling out multiple forms, and waiting

for long verification processes. Online platforms eliminate these hurdles.

With just a few clicks, you can

enter your previous policy details, review the coverage, make changes if

needed, and instantly renew the policy. The entire process typically takes less

than 10 minutes. In 2025, advanced AI-driven systems further streamline the

steps, making car insurance renewal even more accurate and efficient.

2.

No Paperwork or Physical Documentation

Renewing car insurance online

removes the need for physical forms, photocopies, and manual signatures.

Digital KYC and automated policy verification have made the entire process

paperless. This reduces errors, saves time, and ensures your documents are

stored securely.

Additionally, you receive the

renewed policy instantly in your email and digital locker, giving you quick

access anytime you need it.

3.

Transparent Comparison of Plans

Before renewing your insurance, it’s

important to evaluate your existing coverage and check whether better options

are available. Online renewal platforms allow you to compare:

- Premium rates

- Add-on covers

- Claim settlement ratios

- Network garages

- Coverage features

This transparency ensures you renew

a policy that offers the best value. In 2025, comparison tools have become more

accurate, providing real-time premium calculations based on your car details

and driving history.

4.

Better Discounts and Premium Savings

Online car insurance renewal often

comes with exclusive discounts such as:

- No Claim Bonus (NCB) benefits

- Online-only discounts

- Seasonal promotions

- Long-term policy discounts

Digital platforms can also evaluate

your NCB automatically and adjust your premium accordingly, reducing the

chances of errors during offline renewals. Many insurers also waive inspection

requirements for policies renewed online within the grace period.

The result? More savings with better

coverage.

5.

Easy Customization and Add-On Selection

Life changes, and so do your

insurance needs. When renewing online, you can customize your policy by adding

or removing covers such as:

- Zero Depreciation

- Roadside Assistance

- Engine Protection

- Return to Invoice

- Consumables Cover

These add-ons enhance your protection

and can be chosen based on your car model, age, and usage. The online interface

clearly displays the premium impact of each add-on, helping you make informed

decisions without pressure.

6.

Immediate Policy Issuance

Once the payment is complete, your

renewed policy is generated instantly. You do not have to wait for days to

receive physical copies. This is particularly useful if your policy is close to

expiry or has already lapsed.

Digital policies are legally valid

and accepted during traffic checks, claims, and other motor-related procedures.

7.

Safe and Secure Online Payments

Online payment systems in 2025 are

more secure than ever. You can choose from UPI, credit/debit cards, net

banking, wallets, or auto-pay options. Encrypted payment gateways ensure secure

transactions, minimizing risks of fraud.

Most platforms also offer instant

payment confirmations and digital receipts for your records.

8.

Renewal Reminders to Avoid Policy Lapse

Forgetting renewal dates is common,

but a lapse in policy can lead to:

- Loss of NCB

- Mandatory inspection by the insurer

- Legal penalties

- Increased premiums

- Lack of financial protection

Online renewal systems send

automated reminders through SMS, email, and app notifications. These alerts

ensure that you renew your policy on time without risking coverage gaps.

9.

Enhanced Customer Support and Chat Assistance

In 2025, digital insurers offer 24/7

chat support, AI-based assistance, and quick customer service channels. Whether

you have questions about your coverage, NCB, or add-ons, the support team can

guide you instantly.

This quick access to expert advice

makes online renewal more reliable than visiting an offline branch.

10.

Environment-Friendly and Digital-First Approach

Online renewals reduce the need for

physical paperwork, office visits, and printed documents, contributing to a

greener and more sustainable environment. The shift towards digital policies

also supports India’s mission for a paperless insurance ecosystem.

Conclusion

Renewing car insurance online in

2025 is undoubtedly the smarter, faster, and more cost-effective choice for

every vehicle owner. With benefits like instant renewal, better discounts, easy

customizations, and secure payments, the online method ensures complete

convenience and enhanced protection. As insurance technology continues to

evolve, online renewal processes will only become more seamless and

user-friendly.

If you are planning to renew your

policy, opting for a trusted platform like Square Insurance can make the

entire experience smooth, transparent, and reliable.

Frequently

Asked Questions (FAQs)

1. Is renewing car insurance online

safe?

Yes, it is completely safe when done through a reputable insurance platform

that uses secure, encrypted payment gateways.

2. Can I renew my expired car

insurance policy online?

Yes, you can. However, some insurers may require an inspection if the policy

has been expired for a long period.

3. Will I get the No Claim Bonus

(NCB) on online renewal?

Absolutely. Your NCB is automatically applied during online renewal, provided

there were no claims made in the previous policy term.

4. Can I upgrade my coverage while

renewing online?

Yes, you can add or remove riders, increase coverage, and switch to

comprehensive or addon-rich policies easily during online renewal.

5. Do I need any documents for

online renewal?

In most cases, only basic details like previous policy number, vehicle

registration number, and personal information are required. It is a completely

paperless process.