In today’s fast-paced world,

buying car insurance online has become the preferred choice for millions of car

owners. Among the leading insurers in India, ICICI Lombard General Insurance

stands out as a trusted and reliable option. Known for its strong financial

backing, quick claim settlements, and comprehensive digital services, ICICI Lombard online car insurance

has earned the trust of car owners across the country.

If

you own a vehicle—be it a compact hatchback, a sedan, an SUV, or an electric

car—choosing the right insurance provider is crucial. This guide explores why ICICI Lombard online car

insurance is a top choice, what makes it stand out in terms of

coverage, convenience, and cost, and how you can get the most out of your

policy in 2025.

Why ICICI Lombard

Online Car Insurance Stands Out

ICICI

Lombard has been a pioneer in providing digital-first insurance solutions, making it easier for

car owners to purchase, renew, and manage their insurance policies online.

Here’s why it is considered a top choice:

1.

Reputation and Trustworthiness: ICICI Lombard is part of the ICICI

Group, one of India’s largest financial institutions. Its financial stability

ensures reliability in claim settlements.

2.

Comprehensive Coverage: Offers plans that cover accidents,

theft, fire, natural disasters, third-party liabilities, and more.

3.

Quick Online Services: Policy purchase, renewal, and claim

filing can all be done online with minimal paperwork.

4.

Customer-Friendly Processes: Known for fast claim settlements

and strong support via phone, email, and online chat.

5.

Flexibility in Add-Ons: Offers multiple add-ons to enhance

coverage, including Zero Depreciation, Engine Protection, Roadside Assistance,

and Return to Invoice.

Types of ICICI

Lombard Online Car Insurance Plans

Understanding

the different types of car insurance offered by ICICI Lombard helps you make an

informed choice:

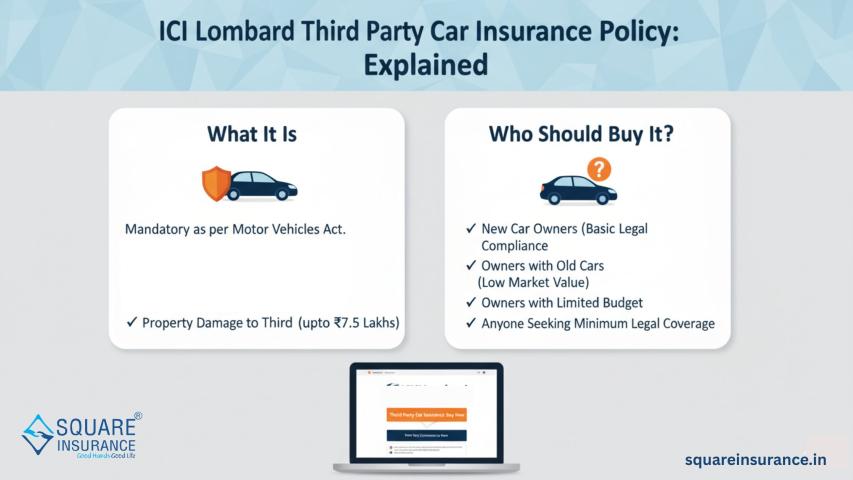

1.

Third-Party Liability Insurance

Mandatory

under Indian law, this insurance covers:

·

Injuries

or death to a third party

·

Damage

to third-party property

Limitation: Does not cover damages to your own

car.

2.

Own-Damage Insurance

Covers

damage to your car caused by:

·

Accidents

·

Fire

and explosion

·

Natural

calamities like floods, storms, earthquakes

·

Theft

3. Comprehensive Car Insurance

The

most recommended plan, it combines third-party liability and own-damage cover.

Features include:

·

Accidents

and repairs

·

Theft

and fire protection

·

Natural

disaster coverage

·

Optional

add-ons for extra protection

This

plan ensures your vehicle is fully protected under all circumstances.

Key Features That

Make ICICI Lombard Online Car Insurance a Top Choice

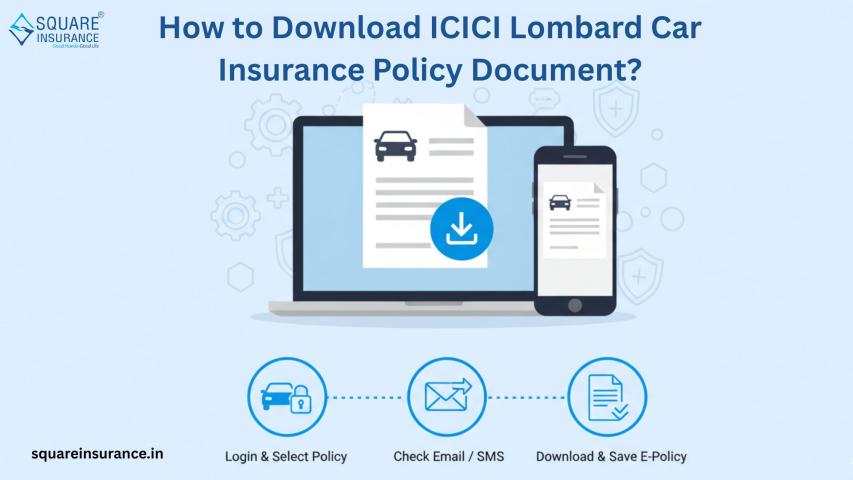

1.

Seamless Online Purchase and Renewal

ICICI

Lombard’s online platform allows car owners to:

·

Compare

premium quotes instantly

·

Customize

coverage and add-ons

·

Pay

securely online

·

Receive

an e-policy immediately

This

digital convenience saves time and reduces paperwork.

2.

Cashless Claim Network

ICICI

Lombard has a wide

network of cashless garages across India, ensuring that you

don’t have to pay upfront for repairs. Benefits include:

·

Hassle-free

claims

·

Authorized

service centers with genuine spare parts

·

Quick

and reliable repairs

3.

Multiple Add-On Options

Add-ons

enhance your coverage beyond the standard plan. Popular options include:

·

Zero Depreciation Cover: Full claim without depreciation

deductions.

·

Engine Protection Cover: Covers engine and gearbox repairs

due to water damage or mechanical failure.

·

Roadside Assistance: Immediate help during breakdowns or

accidents.

·

Return to Invoice (RTI): Ensures full invoice value in case

of total loss or theft.

·

Consumables Cover: Covers items like nuts, bolts,

engine oil, brake oil, and minor parts.

4. Transparent

Pricing

ICICI

Lombard offers clear,

competitive pricing. Premiums are calculated based on:

·

Car

model, age, and variant

·

Fuel

type

·

Insured

Declared Value (IDV)

·

Add-ons

selected

·

Driving

history and No Claim Bonus (NCB)

Online

calculators allow instant estimates, so you know exactly what you’re paying

for.

5. Quick and

Efficient Claim Settlement

One

of the strongest advantages of ICICI Lombard is its fast and hassle-free claim settlement process. Features include:

·

24/7

claim support

·

Easy

submission via mobile app or website

·

Direct

cashless repair at network garages

·

Transparent

claim status updates

This

efficiency reassures policyholders that they will not face unnecessary delays

during emergencies.

6. Flexible Payment

Options

ICICI

Lombard allows flexible premium payment methods:

·

Full

annual payment

·

Easy

monthly installments through credit/debit cards or EMI options

·

Multiple

online payment channels

Flexibility

in payments makes it convenient for all types of car owners.

Tips to Maximize

Benefits from ICICI Lombard Online Car Insurance

1.

Compare Policies Before Buying: Even though ICICI Lombard is

reliable, compare its plans with other insurers to ensure the best value.

2.

Choose Add-Ons Wisely: Only select add-ons that match your

driving needs and car type.

3.

Preserve Your No Claim Bonus (NCB): Avoid minor claims to maintain NCB

and reduce future premiums.

4.

Check IDV Accuracy: Ensure the Insured Declared Value

(IDV) reflects your car’s current market value.

5.

Buy or Renew Online: Save time, reduce paperwork, and

avail online discounts.

Why Customers

Prefer ICICI Lombard Online Car Insurance

·

Digital Convenience: Purchase, renewal, and claims are

completely online.

·

Comprehensive Protection: Covers all major risks with

optional add-ons.

·

Financial Reliability: Backed by ICICI Bank and strong

claim settlement history.

·

Customer Satisfaction: High ratings in claim settlement

and customer support.

·

Transparency: Clear premium calculation and

policy terms.

These

features make ICICI Lombard a top choice for car insurance in India.

Conclusion

ICICI

Lombard online car insurance offers convenience, reliability, comprehensive coverage, and customer-friendly

services, making it a preferred option for car owners across

India. Whether you own a hatchback, sedan, SUV, or an electric vehicle, their

online platform allows you to purchase or renew policies effortlessly, choose

relevant add-ons, and get cashless claim benefits at authorized garages.

With

ICICI Lombard, car owners can enjoy peace of mind on the road, knowing their vehicles and

finances are well protected. If you’re looking for a top-notch online car insurance solution in 2025, ICICI Lombard is a choice you can

trust.

Frequently Asked Questions

Q.1. Why is ICICI Lombard online car insurance popular among car owners?

ICICI

Lombard is popular due to its comprehensive coverage, fast claim settlement, digital convenience, and

strong financial backing.

It allows car owners to buy, renew, and manage policies online without hassle.

Q.2. What is the No Claim Bonus (NCB) in ICICI Lombard car insurance?

NCB

is a reward for claim-free years, offering discounts up to 50% on your

own-damage premium. Maintaining NCB reduces future premiums significantly.

Q.3. Are cashless garages available for ICICI Lombard car insurance?

Yes.

ICICI Lombard has an extensive network of cashless garages nationwide,

including authorized service centers, ensuring you don’t pay upfront for

repairs.

Q.4. Can I renew my ICICI Lombard car insurance online?

Absolutely.

Online renewal is fast, convenient, and often comes with discounts. Early

renewal ensures continuity of coverage and preservation of your NCB.

Q.5. How can I save money on ICICI Lombard car insurance?

You

can save by:

·

Comparing

online quotes

·

Choosing

only necessary add-ons

·

Maintaining

a clean driving record

·

Preserving

your NCB

·

Opting

for online payments to avail discounts