In today’s fast-paced world, efficiency and convenience are key when it comes to managing financial transactions. The Life Insurance Corporation of India (LIC) recognizes this need and provides a dedicated Merchant Portal to streamline services for agents, merchants, and policyholders. The LIC Merchant Portal is designed to simplify business processes, reduce paperwork, and provide easy access to essential services. If you are associated with LIC or planning to engage with it, understanding the features and benefits of the merchant portal of LIC can make your work more efficient and organized.

What is the LIC Merchant Portal?

The LIC Merchant Portal is an online platform created by LIC for merchants, agents, and distributors to manage their transactions digitally. Traditionally, many insurance-related transactions required paperwork, visits to LIC offices, and manual follow-ups. With the Merchant Portal, LIC has shifted these processes online, allowing users to manage operations securely from anywhere. The portal is accessible through computers, tablets, and smartphones, making it convenient for users on the go.

The portal’s primary aim is to reduce administrative burdens, provide transparency, and improve efficiency in handling LIC-related business. From payment collection to policy management, the LIC Merchant Portal serves as a one-stop digital solution.

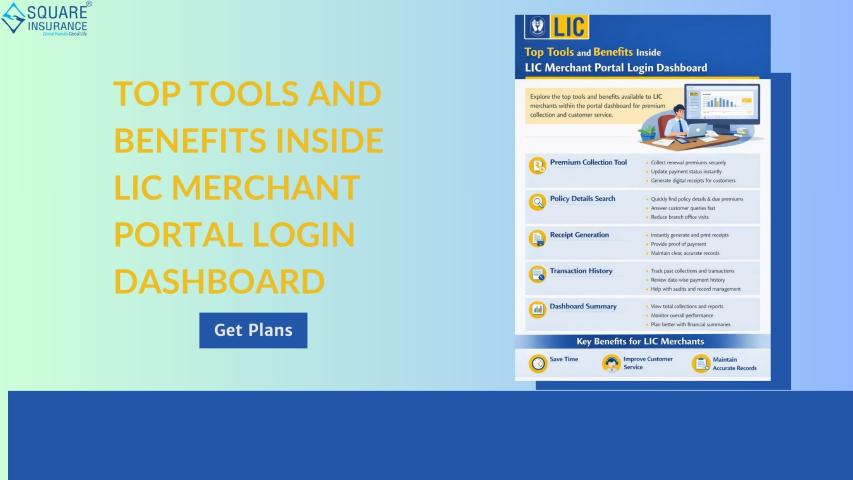

Key Features of LIC Merchant Portal

The LIC Merchant Portal comes with a wide range of features that help merchants and agents carry out their operations smoothly. Below are some of the key features:

1. Easy Transaction Management

The portal allows users to process payments and manage transactions efficiently. Whether it’s premium payments, commission tracking, or collections, everything can be done digitally. This lowers the possibility of errors and does away with the requirement for manual entries.

2. Real-Time Policy Updates

Merchants and agents can access real-time information about policies, premiums, and renewals. This helps in staying up-to-date with the latest policy status and ensures timely follow-ups with clients.

3. Secure Login and Access

Security is a top priority for LIC. The Merchant Portal provides a secure login system that ensures only authorized users can access sensitive information. All data is protected with encryption, keeping financial and personal details safe.

4. Comprehensive Dashboard

The portal features a user-friendly dashboard that provides a clear overview of transactions, pending tasks, and updates. This allows users to manage multiple activities from a single interface without confusion.

5. Easy Commission Tracking

Agents and merchants can track their earned commissions through the portal. This transparent tracking system allows users to know exactly how much commission has been earned, processed, or pending, reducing disputes and delays.

6. Digital Receipts and Reports

All transactions are recorded digitally, and the portal generates receipts and reports instantly. This not only saves time but also helps in maintaining accurate records for accounting and auditing purposes.

7. Customer Management Tools

The LIC Merchant Portal offers features to manage client information efficiently. Merchants can view customer policy details, payment history, and reminders for renewals. This helps improve customer service and ensures clients stay informed.

8. Notifications and Alerts

The portal sends automated notifications and alerts for important activities, such as pending payments or upcoming renewals. These reminders reduce the chances of missed deadlines and help in timely follow-ups.

9. 24/7 Accessibility

Being an online platform, the LIC Merchant Portal can be accessed anytime and from anywhere. This flexibility is particularly beneficial for agents and merchants who operate in different locations or have clients across regions.

Benefits of Using the LIC Merchant Portal

Using the LIC Merchant Portal comes with several advantages that make it an essential tool for anyone associated with LIC.

1. Time-Saving

By digitizing transactions and automating routine tasks, the portal saves considerable time. Merchants no longer need to visit LIC offices for routine work, reducing the time spent on administrative tasks.

2. Enhanced Accuracy

Manual record-keeping can often lead to errors, such as miscalculations or missing payments. The LIC Merchant Portal automates processes and ensures that all records are accurate, reliable, and up-to-date.

3. Improved Customer Service

With access to real-time policy information and automated notifications, agents and merchants can provide better service to clients. Prompt reminders, quick access to payment records, and clear communication help build trust and satisfaction among customers.

4. Transparency

The portal offers transparency in all transactions. Merchants and agents can view detailed records of payments, commissions, and renewals. This transparency reduces confusion, prevents disputes, and strengthens accountability.

5. Convenience and Flexibility

The ability to access the portal from any device with internet connectivity provides unmatched convenience. Merchants can perform tasks while traveling or outside office hours, offering flexibility in managing their work.

6. Cost-Effective

By reducing paperwork, office visits, and manual processes, the portal indirectly saves costs associated with administrative work. Digital records also minimize the need for physical storage and related expenses.

7. Better Record Keeping

All transactions, receipts, and reports are stored digitally on the portal. This ensures easy retrieval whenever required and simplifies record-keeping for audits, taxation, or business analysis.

Who Can Benefit from the LIC Merchant Portal?

The LIC Merchant Portal is primarily designed for LIC agents and merchants who handle policy transactions and client interactions. However, policyholders also indirectly benefit from the portal as it ensures faster, more accurate, and transparent processing of premiums, renewals, and other services.

Agents, in particular, find it helpful as it allows them to manage multiple clients efficiently, track commissions, and reduce the administrative burden that typically comes with managing insurance policies. Merchants handling payments for groups of clients also find the portal indispensable for smooth and secure transaction management.

Conclusion

The LIC Merchant Portal is a modern solution for managing LIC-related transactions efficiently. Its features like secure login, real-time updates, transaction tracking, commission management, and automated notifications provide significant benefits to both agents and merchants. By leveraging the portal, users save time, improve accuracy, enhance customer service, and enjoy greater convenience and transparency in their operations.

In a world where digital solutions are increasingly important, the LIC Merchant Portal stands out as a tool that simplifies the business of insurance management. Understanding its features and benefits ensures that users can make the most of this platform, ultimately improving efficiency and professionalism in handling LIC services.