The insurance industry in India is undergoing a rapid digital shift, and the Life Insurance Corporation of India (LIC) is at the forefront of this transformation. One of the most impactful digital tools introduced by LIC is the LIC Merchant Portal, specifically designed to support merchants, agents, and authorized partners in premium collection and transaction management.

The LIC Merchant Portal Login plays a crucial role in enabling seamless, secure, and efficient digital premium collection, reducing dependency on manual processes and improving service delivery. In this article, we explore the top benefits of using the LIC Merchant Portal and why it has become an essential platform for LIC merchants.

Understanding the LIC Merchant Portal

The LIC Merchant Portal is an official digital interface provided by LIC to authorized merchants and partners. It allows them to collect insurance premiums online, manage transactions, generate receipts, and track payment status in real time.

Unlike customer portals, the merchant portal is designed specifically for operational efficiency, high transaction volumes, and financial reconciliation. Access to these features begins with a secure LIC Merchant Portal Login.

Why Digital Premium Collection Matters Today

Traditional premium collection methods often involve cash handling, manual receipts, delayed updates, and reconciliation challenges. In contrast, digital premium collection ensures speed, accuracy, and transparency.

For LIC merchants, moving to digital platforms is no longer a convenience—it is a necessity to meet customer expectations, reduce errors, and comply with evolving regulatory standards.

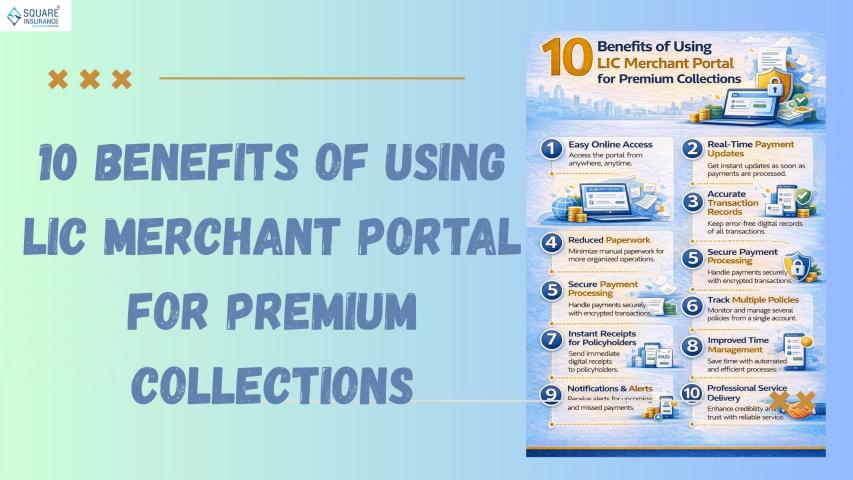

Top Benefits of LIC Merchant Portal Login for Digital Premium Collection

1. Faster and Hassle-Free Premium Collection

One of the biggest advantages of the LIC Merchant Portal Login is the ability to collect premiums instantly. Merchants can accept payments digitally without paperwork or manual intervention.

This significantly reduces transaction time, allowing merchants to serve more customers efficiently while eliminating delays associated with offline processing.

2. Real-Time Payment Confirmation

Once a premium payment is made through the merchant portal, confirmation is generated instantly. This real-time update ensures that:

- Customers receive immediate acknowledgment

- Policies remain active without delay

- Merchants avoid disputes related to payment status

Instant confirmation builds trust and enhances the overall customer experience.

3. Secure and Authorized Transactions

Security is critical when handling financial transactions. The LIC Merchant Portal uses secure authentication protocols, encrypted sessions, and role-based access to protect sensitive data.

Through LIC Merchant Portal Login, only authorized merchants can access the system, ensuring safe digital premium collection and minimizing the risk of fraud or data misuse.

4. Automated Receipt Generation

Manual receipt issuance is prone to errors and delays. The merchant portal automatically generates digital receipts after successful premium collection.

These receipts:

- Are instantly available for download or printing

- Serve as valid proof of payment

- Reduce paperwork and storage issues

This automation benefits both merchants and policyholders.

5. Improved Transaction Tracking and Transparency

The portal provides a complete record of all transactions carried out by the merchant. This includes:

- Date and time of payment

- Policy number

- Premium amount

- Payment status

Such transparency helps merchants track collections accurately and resolve customer queries quickly.

6. Simplified Reconciliation and Reporting

Reconciling daily or monthly premium collections can be challenging in offline systems. The LIC Merchant Portal simplifies reconciliation by offering detailed transaction reports.

Merchants can:

- View consolidated reports

- Match payments with bank settlements

- Identify discrepancies easily

This reduces administrative workload and improves financial accuracy.

7. Reduced Dependency on Physical Branches

With LIC Merchant Portal Login, merchants no longer need to visit LIC branches for routine premium-related activities. Digital premium collection and reporting can be handled entirely online.

This saves time, reduces operational costs, and allows merchants to focus more on customer service and business growth.

8. Better Customer Trust and Satisfaction

Customers today expect fast and transparent digital services. When premiums are collected digitally through an official LIC platform, customers feel more confident and secure.

Immediate receipts, real-time updates, and error-free transactions enhance customer satisfaction and strengthen long-term relationships.

9. Operational Efficiency for High Transaction Volumes

For merchants handling large numbers of policies, managing premiums manually can be overwhelming. The LIC Merchant Portal is designed to handle high transaction volumes efficiently without compromising speed or accuracy.

This scalability makes it ideal for both small and large merchants.

10. Compliance and Audit Readiness

Digital records maintained through the merchant portal help ensure compliance with LIC guidelines and regulatory requirements. Transaction histories and reports can be easily accessed during audits or reviews.

This reduces compliance risks and enhances accountability.

Who Can Use the LIC Merchant Portal?

The LIC Merchant Portal is typically accessible to:Authorized LIC merchants

- Approved agents and partners

- Institutions permitted by LIC for premium collection

Access credentials are issued after verification, ensuring controlled and secure usage.

Best Practices for Using LIC Merchant Portal Login

To maximize benefits:

- Always log out after each session

- Use strong passwords and update them periodically

- Verify transaction details before confirming payments

- Regularly download and review transaction reports

These practices help maintain security and operational efficiency.

Conclusion

The LIC Merchant Portal Login has transformed the way digital premium collection is handled by LIC merchants. From faster transactions and real-time confirmations to secure payments and simplified reconciliation, the portal offers multiple benefits that enhance efficiency and trust.

As digital insurance services continue to grow, merchants who adopt and effectively use this platform gain a significant operational advantage.

For merchants and insurance professionals seeking expert support, structured guidance, and technology-driven solutions, Square Insurance plays a key role. By empowering partners with digital tools, training, and operational assistance, Square Insurance complements LIC’s digital ecosystem and helps merchants deliver seamless premium collection services with confidence.

Frequently Asked Questions (FAQs)

Q1. What is the LIC Merchant Portal used for?

The LIC Merchant Portal is used by authorized merchants to collect insurance premiums digitally, generate receipts, and manage transactions.

Q2. Is LIC Merchant Portal Login secure?

Yes, the portal uses secure authentication and encrypted systems to ensure safe transactions and data protection.

Q3. Can merchants generate receipts through the portal?

Yes, digital receipts are automatically generated after every successful premium payment.

Q4. Does the portal support transaction reporting?

Yes, merchants can access detailed transaction and reconciliation reports for better financial management.

Q5. Can digital premium collection reduce errors?

Yes, automated processes significantly reduce manual errors, delays, and reconciliation issues.

Q6. Who provides support for LIC merchants using digital platforms?

In addition to LIC resources, organizations like Square Insurance offer guidance and support to merchants for efficient digital operations.

Also Read:-