Car insurance in India has evolved significantly over the years, giving vehicle owners more flexibility and control over their policies. One such evolution is the introduction of the Standalone Own Damage (OD) Cover. If you already have a valid third-party car insurance policy and are looking for additional protection for your own vehicle, ICICI Lombard Standalone Own Damage Car Insurance can be an ideal solution.

With over 15 years of experience writing insurance-focused content and having closely followed regulatory and product changes, I can confidently say that standalone OD cover is one of the most practical insurance options for informed car owners today.

What Is ICICI Lombard Standalone Own Damage Cover?

ICICI Lombard Standalone Own Damage Cover is a car insurance policy that covers damages to your own vehicle only, without including third-party liability.

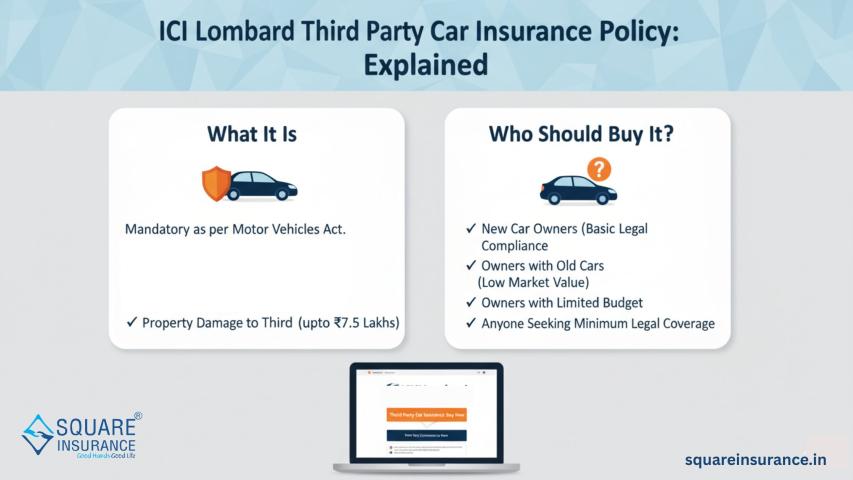

This policy can be purchased only if you already have an active third-party insurance policy, as third-party cover is mandatory under Indian law.

In simple terms:

- Third-party policy = Covers damage/injury caused to others

- Standalone OD policy = Covers damage/loss to your own car

Together, they offer the same protection as a comprehensive car insurance policy—but with greater flexibility.

Why Was Standalone Own Damage Cover Introduced?

The Insurance Regulatory and Development Authority of India (IRDAI) introduced standalone OD cover to:

- Give customers freedom to choose different insurers for third-party and own damage cover

- Increase competition and pricing transparency

- Allow policyholders to customize coverage based on their needs

ICICI Lombard was among the leading insurers to offer a robust standalone own damage policy with extensive coverage and digital convenience.

Coverage Offered Under ICICI Lombard Standalone Own Damage Policy

1. Accident-Related Damages

Covers repair or replacement costs if your car is damaged due to an accident, collision, or overturning.

2. Theft or Burglary

Provides financial compensation if your vehicle is stolen or damaged during an attempted theft.

3. Fire and Explosion

Covers losses arising from fire, self-ignition, lightning, or explosion.

4. Natural Calamities

Protection against floods, earthquakes, cyclones, storms, landslides, and other natural disasters.

5. Man-Made Disasters

Covers damages due to riots, strikes, vandalism, and malicious acts.

What Is Not Covered?

Like all insurance policies, ICICI Lombard Standalone Own Damage Cover has certain exclusions:

- Normal wear and tear

- Mechanical or electrical breakdown

- Driving without a valid license

- Driving under the influence of alcohol or drugs

- Consequential damages

- Usage outside policy terms

Understanding these exclusions helps avoid claim rejections and ensures realistic expectations.

Add-On Covers Available with ICICI Lombard Standalone OD Policy

One of the biggest advantages of ICICI Lombard Standalone Own Damage Cover is the availability of customizable add-ons, including:

- Zero Depreciation Cover – Reduces out-of-pocket expenses during claims

- Engine Protect Cover – Essential for flood-prone areas

- Return to Invoice Cover – Covers full invoice value in case of total loss

- Roadside Assistance – 24×7 emergency help

- Consumables Cover – Covers costs of nuts, bolts, engine oil, etc.

These add-ons significantly enhance the effectiveness of the policy.

Benefits of Buying ICICI Lombard Standalone Own Damage Cover

1. Flexibility

Choose ICICI Lombard for own damage while continuing your third-party policy with another insurer.

2. Cost Efficiency

You pay only for the coverage you need, avoiding bundled pricing.

3. High Claim Settlement Standards

ICICI Lombard is known for fast, transparent, and tech-driven claim settlement.

4. Cashless Garage Network

Access to 5,000+ cashless garages across India ensures smooth repairs.

5. Digital Policy Management

From purchase to claims, everything can be managed online with minimal paperwork.

How Is the Premium Calculated?

The premium for ICICI Lombard Standalone Own Damage Cover depends on:

- Vehicle make and model

- Age of the car

- Insured Declared Value (IDV)

- Location of registration

- Selected add-on covers

- Claim history

Since third-party premium is not included, OD policy premiums are often more transparent and customizable.

Standalone Own Damage vs Comprehensive Car Insurance

Standalone OD policy + Third-party policy together provide the same protection as a comprehensive policy. The difference lies in pricing flexibility, insurer choice, and renewal independence.

Standalone OD is especially beneficial if:

- You want to switch insurers without disturbing your third-party policy

- You already paid long-term third-party insurance

- You want better OD coverage or service

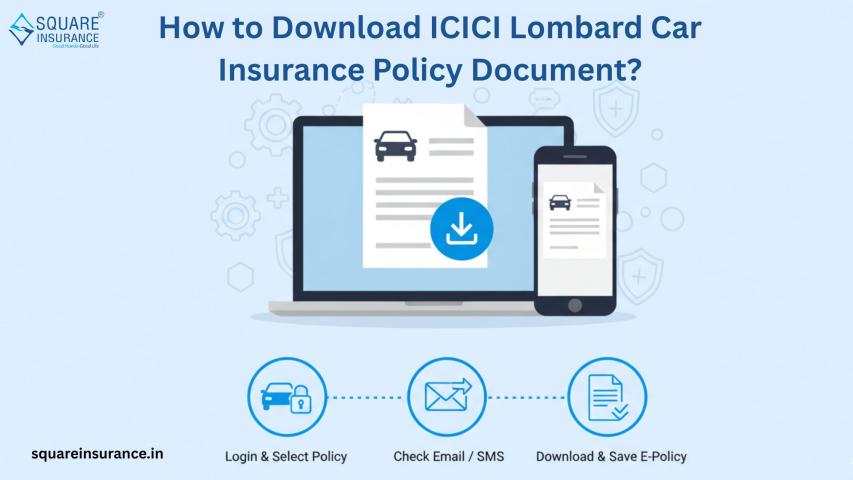

How to Buy ICICI Lombard Standalone Own Damage Cover Online?

The process is quick and simple:

- Enter your vehicle details

- Provide existing third-party policy details

- Select IDV and add-ons

- View premium instantly

- Make secure online payment

- Receive policy digitally

The entire process takes just a few minutes.

Claim Process for ICICI Lombard Standalone OD Policy

ICICI Lombard offers a digitally enabled claims experience:

- Intimate claim online or via app

- Upload photos/videos of damage

- Get surveyor approval digitally

- Repair at cashless garage

- Track claim status in real time

This reduces delays and improves transparency.

Frequently Asked Questions (FAQs)

Q1. Is standalone own damage cover mandatory?

No, it is optional. However, it is highly recommended to protect your vehicle financially.

Q2. Can I buy ICICI Lombard OD cover if my third-party policy is from another insurer?

Yes, as long as your third-party policy is active and valid.

Q3. How does squareinsurance help with standalone own damage insurance?

squareinsurance helps customers compare OD policies, understand coverage, and choose the most suitable ICICI Lombard Standalone Own Damage Cover based on their car and budget.

Q4. Is No Claim Bonus applicable in standalone OD policy?

Yes, NCB applies to the own damage portion and can reduce your premium significantly.

Conclusion

ICICI Lombard Standalone Own Damage Cover is a smart and flexible insurance solution for car owners who already comply with third-party insurance requirements and want focused protection for their own vehicle. With extensive coverage, strong digital infrastructure, and customizable add-ons, it offers both value and peace of mind.

Note: For easy policy management, comparisons, and a seamless insurance experience, you can explore Square Insurance POS – Apps on Google Play, designed to simplify insurance services for customers and POS professionals alike.